UK parliament to pass crypto bill against financial crimes

The UK parliament is close to passing a new bill to protect investors from financial crimes involving cryptocurrencies.

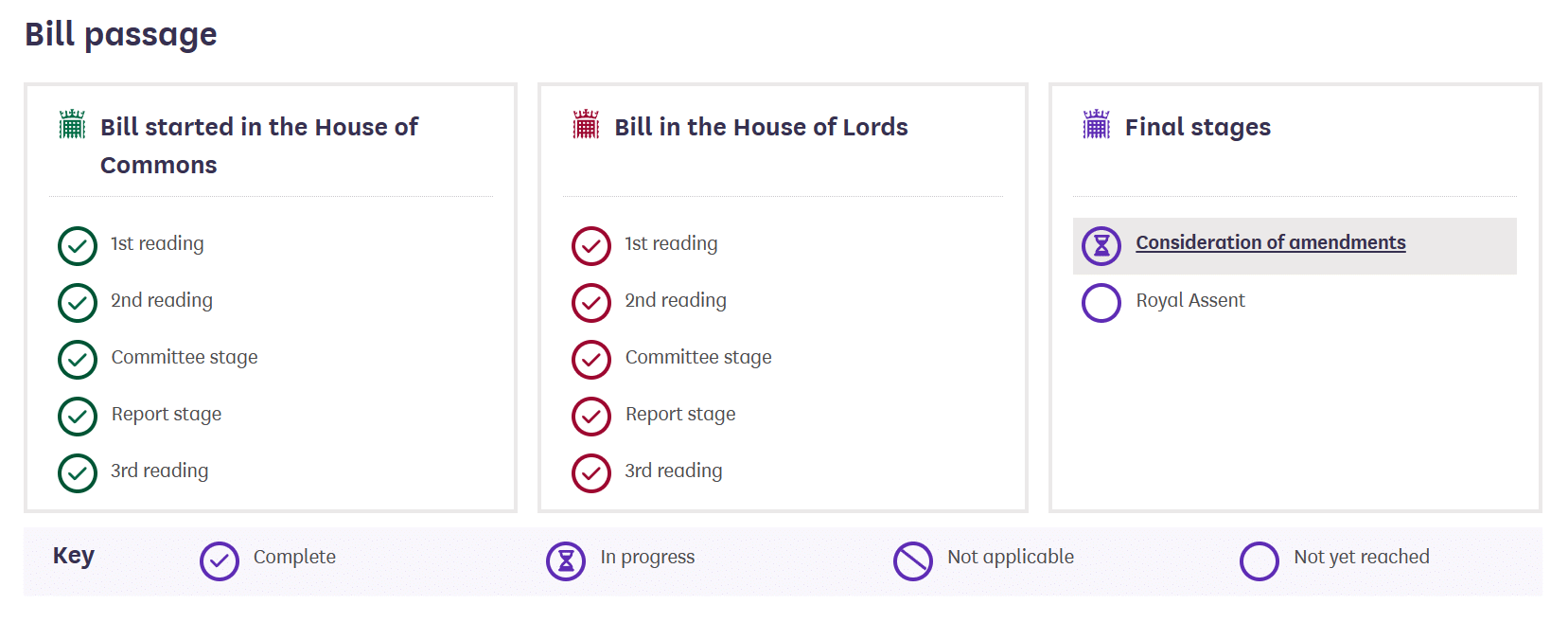

The UK’s House of Lords has advanced the Economic Crime and Corporate Transparency Bill, which addresses illicit cryptocurrency activities. Initiated in September 2022, this bill has passed through legislative houses and is now nearing its final approval phase.

While primarily focused on combating crypto financial crimes, the bill also touches upon corporate transparency and foreign business registrations. As the House of Commons prepares to review the bill’s latest amendments, the final step before it becomes law will be the royal assent, marking the monarch’s formal endorsement.

The Economic Crime and Corporate Transparency bill was first proposed in September 2022. Its main objective is to combat crypto-related financial crimes such as money laundering and fraud.

The bill will require crypto businesses to register with the Financial Conduct Authority (FCA) and comply with anti-money laundering and counter-terrorism financing rules. The bill will also empower the FCA to impose sanctions on crypto businesses that violate the regulations.

UK’s crypto progress

The UK has been making significant progress in the crypto sector, especially after leaving the European Union. Brexit has created new opportunities for the crypto industry in the UK, reducing the regulatory barriers and increasing the flexibility for innovation. This has attracted professionals and experts who believe cryptocurrencies are here to stay and can benefit the country’s economy.

The UK government has shown a positive attitude towards cryptocurrencies, with officials and authorities expressing optimism about the role of crypto in the country’s economic growth. They recognize the potential of cryptocurrencies and are keen on developing a regulatory framework that balances innovation and consumer protection. This approach contrasts with the EU, which has imposed strict regulations on crypto transfers.

However, there are still challenges to overcome. A study commissioned by British lawmakers compared the cryptocurrency industry to gambling, highlighting the inconsistent stance taken by the country towards the sector. This inconsistency, uncertain regulations, and a lack of clarity can deter businesses and investors from participating in crypto, potentially hindering its growth and development in the UK.