Uniswap token climbs to 26-month high, community backs token reward scheme

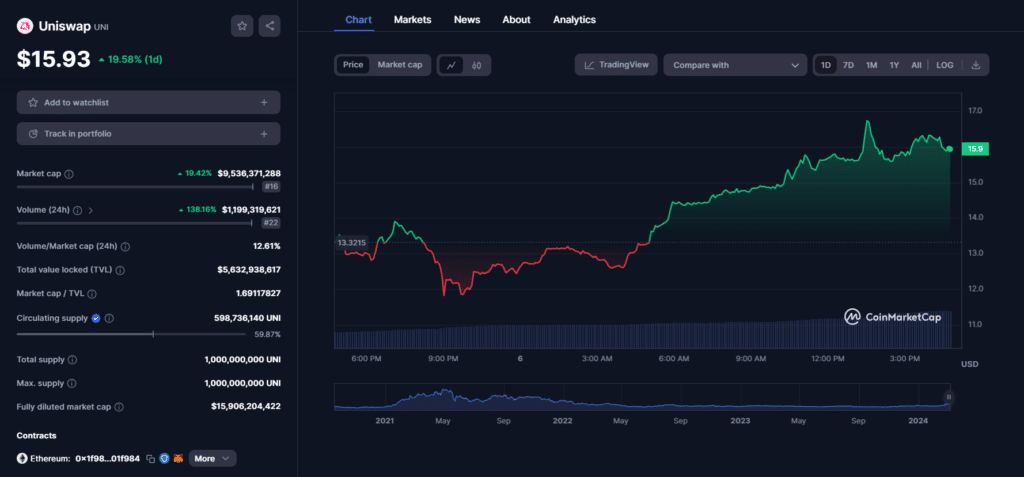

Uniswap’s governance token rose to its highest level in two years on Mar. 6 as the total altcoin market cap exceeded $310 billion for the first time since April 2022.

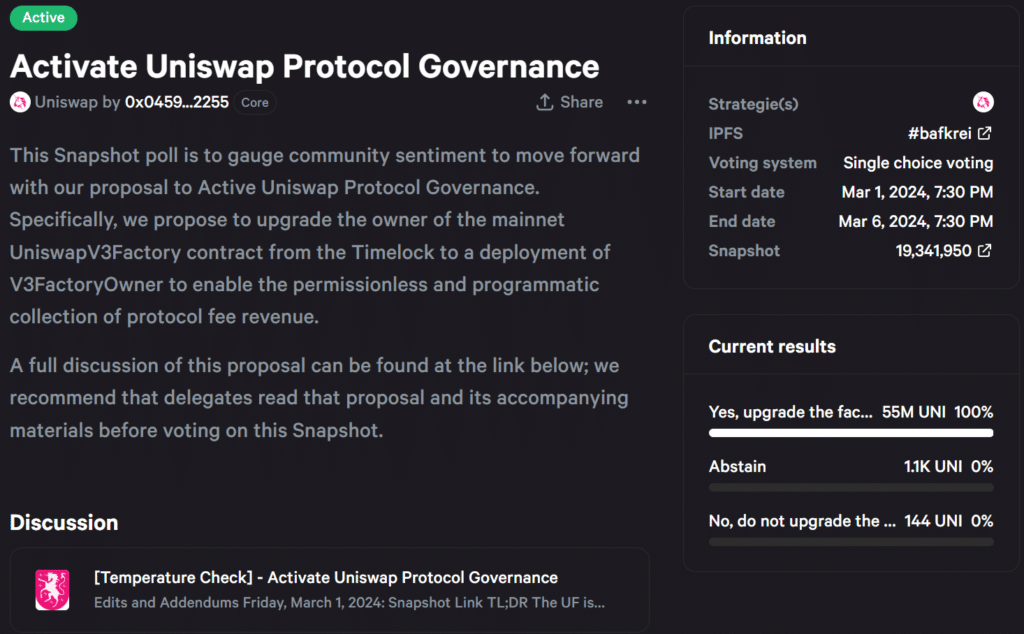

Uniswap (UNI) surged 20% in 24 hours and traded for over $15.60 as a proposal to initiate protocol rewards for token holders passed a temperature check ahead of an on-chain vote slated for Mar. 8.

The last time UNI exchanged hands around this price was in the early second quarter of 2022, shortly before the digital asset market nosedived in the wake of Terraform’s collapse and a slew of crypto bankruptcies.

Decentralized protocols use temperature checks to assess a community’s viewpoint toward a proposed change or idea. The Snapshot vote on Uniswap’s DAO forum showed total support for distributing token rewards to UNI holders.

If passed after the primary on-chain vote, blockchain proponent Colin Wu estimates that UNI holders, who delegate and stake their tokens, could receive a share of $62 million to $156 million in annual income. This is based on Uniswap’s yearly protocol earnings.

Should the UNI community back the proposal, other defi juggernauts like Frax Finance could follow in Uniswap’s footsteps and implement a revenue-sharing scheme. However, 21Shares analysts surmised that such programs could attract regulatory crackdowns since crypto assets may meet the security requirements postulated by the Howey test.

LookOnChain said a large UNI holder sold 41,000 tokens as the crypto jumped to a 26-month high. The on-chain observer said the wallet may be a Uniswap team member, an investor, or an advisor.

The UNI holder made $608,000 from their latest sale and still holds over 358,326 tokens per Etherscan data.