US CBDC debate heats up amid elections. Does the country need a digital dollar?

During the 2024 presidential race, the discussion on a U.S. CBDC becomes more intense. Candidates’ contrasting views mirror wider concerns about privacy and government control.

As of Jan. 2024, the situation regarding central bank digital currencies (CBDCs) in the U.S. is characterized by caution and gradual progression, especially when compared to the advancements made by other countries.

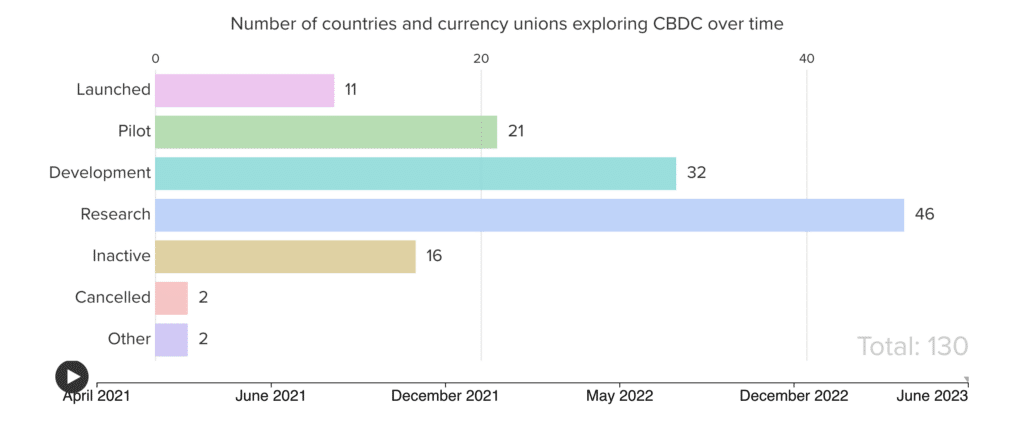

Currently, 11 countries have fully implemented digital currencies, while China, India, and several other countries are in the pilot phase.

In the U.S., the development of a retail CBDC (direct-to-consumer) has seen little progress. However, there is forward movement on a wholesale CBDC, which focuses on bank-to-bank transactions.

Amid this, the Federal Reserve is approaching the idea of a digital dollar with a degree of caution. Fed Chair Jerome Powell expressed interest in a digital dollar in 2022 but also recognized the need for careful consideration due to the global significance of the dollar.

Currently, the U.S. is emphasizing research and development in this area, with projects like the joint effort between the Bank of Boston and the MIT Digital Currency Initiative’s Project Hamilton, and the Bank of New York’s Project Cedar, exploring the technical aspects of CBDCs.

Meanwhile, the U.S. stance on CBDCs has also become a topic of interest in the political arena, particularly in the context of the 2024 presidential election.

Concerns have arisen regarding privacy and the potential for a CBDC to serve as a tool for government surveillance, leading to opposition from some political figures.

To delve deeper into this topic, it is important to understand the perspectives of the presidential candidates on CBDCs and whether the U.S. even needs a CBDC.

US presidential candidates’ stance on CBDCs

The issue of CBDCs has emerged as a significant topic among U.S. presidential candidates in the 2024 election cycle. There is a clear division in views, especially among prominent figures in the Republican Party.

Former President Donald Trump has taken a strong stance against CBDCs. During his campaign, he vowed to prevent the creation of a U.S. CBDC if reelected, labeling it a “dangerous threat to freedom.”

Trump’s concerns are centered around the potential for a CBDC to give the federal government extensive control over citizens’ finances, including the ability to monitor and possibly seize funds without individuals’ knowledge.

This perspective aligns with other Republican candidates, including Florida Governor Ron DeSantis. DeSantis has proposed legislation in Florida to ban the use of CBDCs, framing it as an attempt by the federal government to increase surveillance and control over financial transactions.

Another significant voice in the Democratic field, Robert F. Kennedy Jr., has also expressed reservations about CBDCs. He warns of the potential for CBDCs to become social surveillance and control tools, citing the lack of anonymity associated with such digital currencies.

Kennedy raises concerns about the government’s ability to monitor private financial affairs and enforce transaction restrictions, suggesting that CBDCs could lead to greater government intrusion into individual lives.

On the other hand, President Joe Biden showed a cautious but forward-looking approach towards CBDCs during his term.

In April 2022, he signed Executive Order #14067, which authorized the Fed to begin a formal process of assessing the risks and opportunities of the U.S. CBDC.

However, no formal design for a U.S. CBDC has been released, nor has a release date been announced under Biden’s administration.

Does the US need a CBDC model?

Economically, the introduction of a CBDC in the U.S. could have far-reaching implications. It could streamline payment systems, reduce transaction costs, and transform monetary policy implementation.

For instance, in times of economic crisis, CBDCs could enable quicker and more direct implementation of measures such as stimulus payments. This was evidenced during the COVID-19 pandemic when stimulus payments were delayed due to logistical issues in distributing funds.

However, it also raises questions about the role of commercial banks and the dynamics of money supply and demand.

The potential for a CBDC to bypass traditional banking intermediaries could disrupt current financial models, impacting bank deposits and lending activities.

Moreover, the global financial landscape, where the U.S. dollar holds a dominant position, could be influenced by the introduction of a U.S. CBDC.

There’s a debate on how it could affect the dollar’s role as the world’s reserve currency, especially in the face of competition from digital currencies like China’s digital yuan.

Some experts argue that a well-designed U.S. CBDC could reinforce the dollar’s global standing, while others caution against potential risks to its long-established position.

The ongoing research and exploration by the Fed and other institutions are crucial in determining the most appropriate course of action for the U.S. as it directly impacts the world economy and the global state of affairs.