US CPI data adds bullish pressure to Bitcoin price action

Bitcoin price soared to a 20-month peak of $48,965.41 after the U.S. Consumer Price Index report for December 2023 was released on Jan 11.

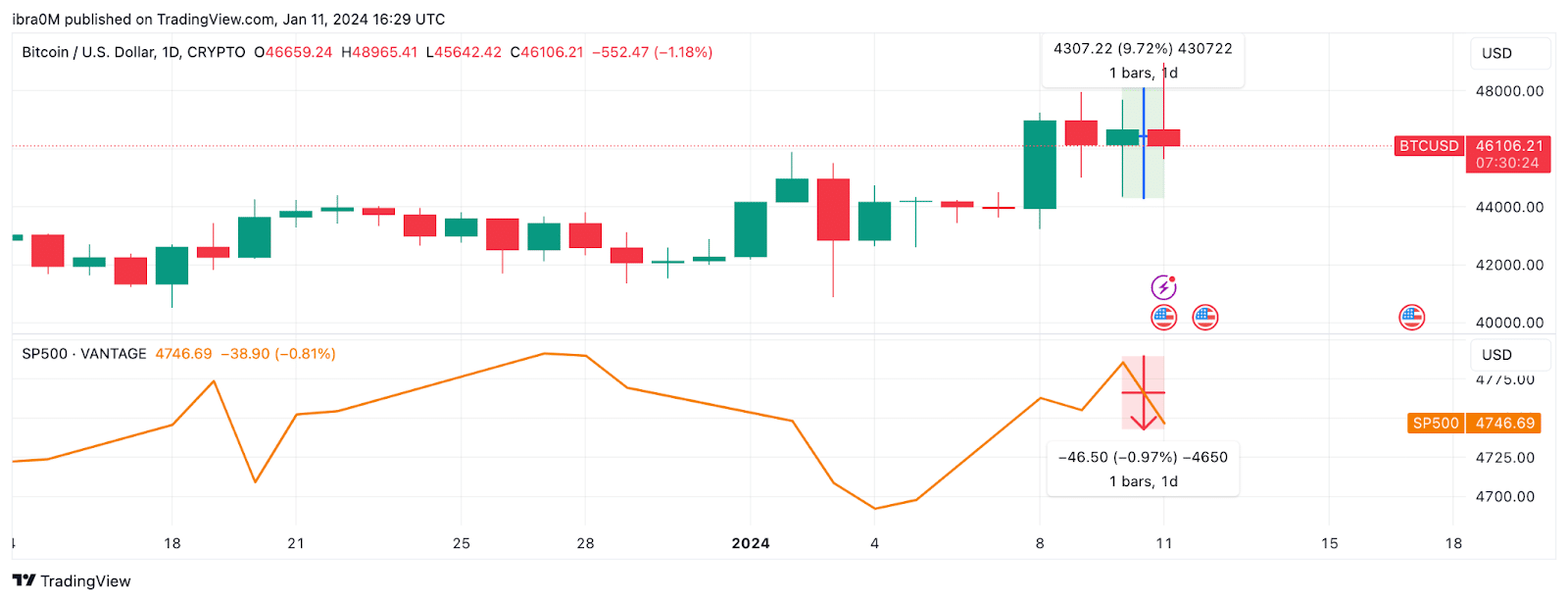

The U.S. Bureau of Labor Statistics released the U.S. Consumer Price Index (CPI) report on Jan. 11, showing higher-than-expected inflation figures. Early market reactions saw U.S. stocks stumble as the S&P 500 dropped 1% within five hours of the report.

On the flip side, cryptocurrency markets received a massive boost as Bitcoin (BTC) retested the $49,000 area for the first time since May 2022.

U.S. CPI data posts higher-than-expected inflation rate

The U.S. CPI report is a vital focal point for financial markets due to its significant implications for Federal Reserve monetary policy and treasury yields. The latest report released on Jan. 11 appears to have added bullish pressure to Bitcoin price action due to two key factors.

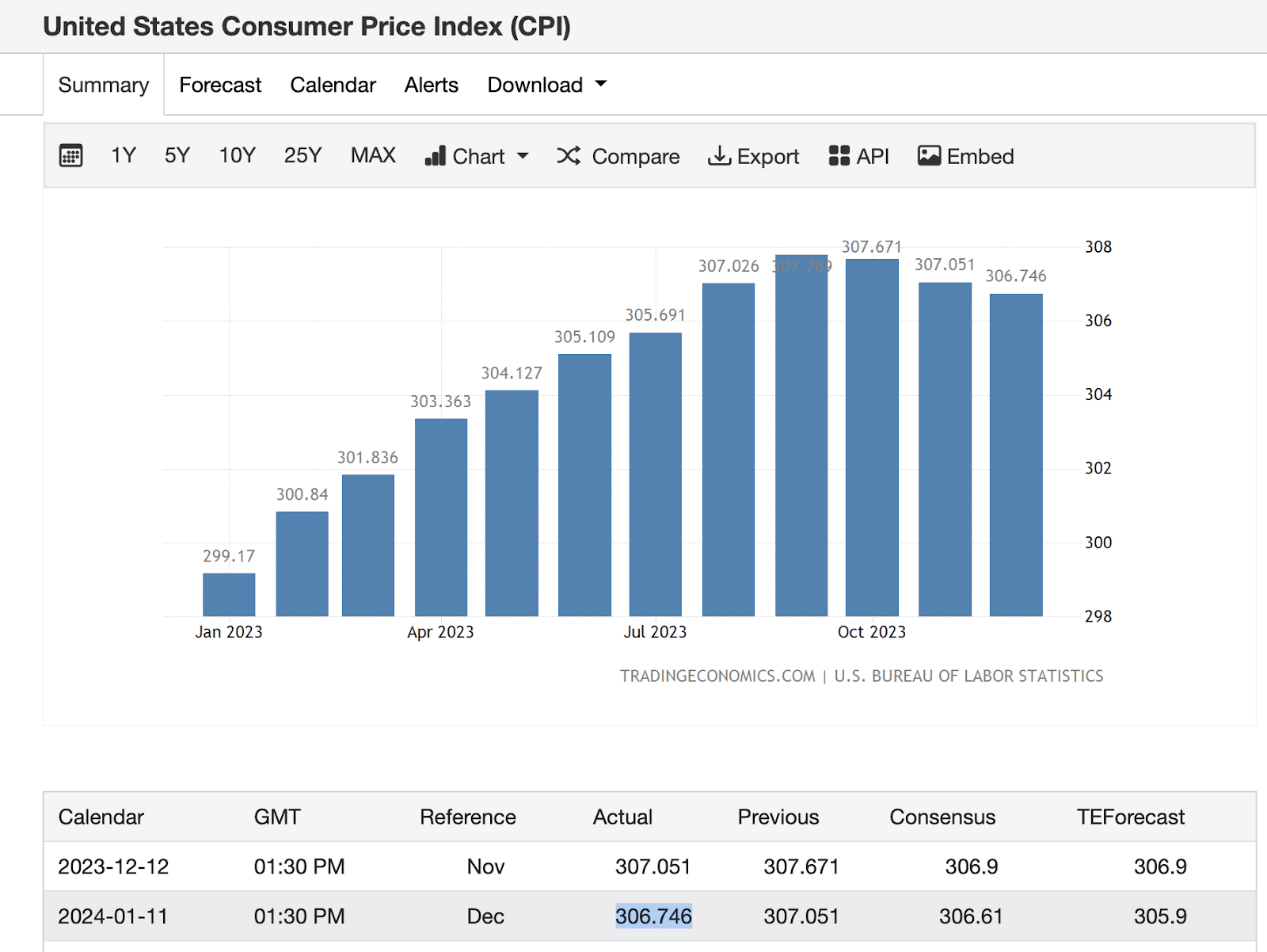

Firstly, the data released on Jan. 10 shows that the CPI saw a 0.3% increase for December 2023. The year-on-year perspective shows a 3.4% climb in the all-items index, a notable increase compared to the 3.1% in the previous year.

More importantly, the TradingEconomics’ chart below shows that markets had priced in consensus expected inflation index of 306.61. But notably, the official figure read 306.746, marginally higher than the expected inflation rate.

A higher-than-expected inflation figure often triggers bullish price movements in non-cyclical risk assets like Bitcoin.

When the actual CPI readings come in higher than the consensus forecasts, it suggests a higher inflationary economic environment than anticipated. This scenario could lead the Federal Reserve to reassess its monetary policy, potentially cutting down on interest rates.

Higher inflation often triggers volatility in the stock markets as investors anticipate negative impacts on corporate earnings and economic growth. In such scenarios, investors often seek to redirect funds toward non-cyclical risk assets like Bitcoin.

The chart above captures the initial Bitcoin price reaction to CPI data compared to the S&P 500, the flagship stock markets index. S&P 500 slid 1% to 4,777.94. Meanwhile, BTC prices moved as high as $48,890 on Jan. 11, up 10% within 24 hours.

This negative divergence affirms the outlook that this higher-than-expected inflation data could increase the appeal of BTC to investors.

Bitcoin investors place early bets on potential rate cuts

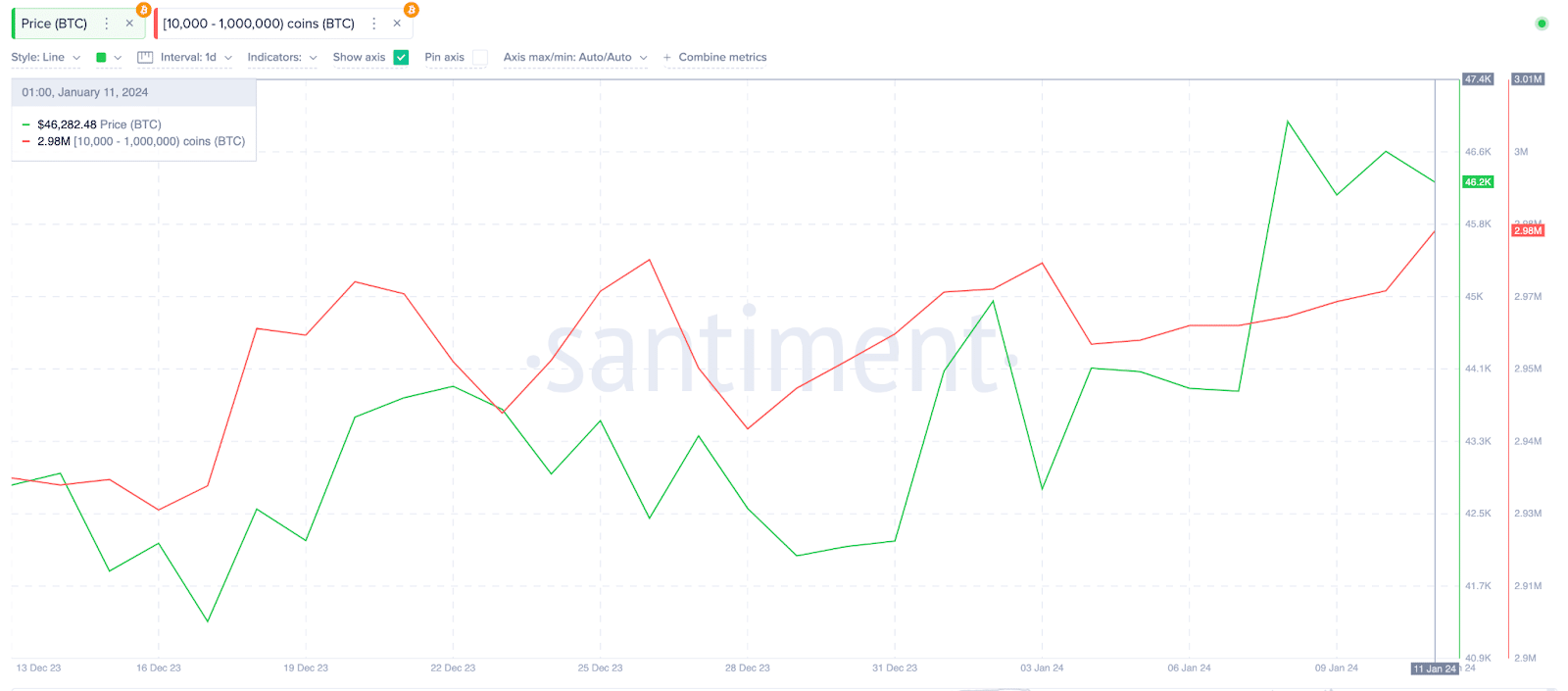

Looking beyond the price charts, the instant reaction among Bitcoin institutional investors is another vital factor that affirms this bullish CPI narrative for BTC price. Santiment’s supply by address metric tracks corporate entities’ Bitcoin holdings by aggregating balances held in wallets with at least $100,000 worth of BTC.

Bitcoin’s largest whale investor cohort — wallets with 1,000 to 1 million BTC — held a total balance of 2.97 million BTC at close on Jan. 10. But, following the higher-than-expected inflation data, the whales rapidly increased their balances to 2.98 million BTC.

The chart above illustrates that Bitcoin institutional investors have increased their holdings by 10,000 BTC on Jan. 11. With BTC currently trading at $46,003 apiece, the newly acquired coins are worth approximately $460 million at the time of writing.

This movement reaffirms that institutional investors could increase exposure to Bitcoin in an early bid to front-run gains from potential rate cuts.

Corporate investors are highly influential in any cryptocurrency ecosystem. Hence, there’s a chance that strategic retail investors and speculative traders could mirror the whales’ stance and take on bullish positions as well.

In summary, the timing of the CPI data release, less than 24 hours after the much-anticipated spot ETF approval, appears to have intensified the bullish pressure on Bitcoin price.

Positive CPI data impact to push Bitcoin price to $50,000?

Based on the aforementioned data points, whale investors have been scooping up BTC after CPI data and spot ETF approval. If sustained, the bullish pressure from these critical factors could drive Bitcoin price to $50,000 in the days ahead.

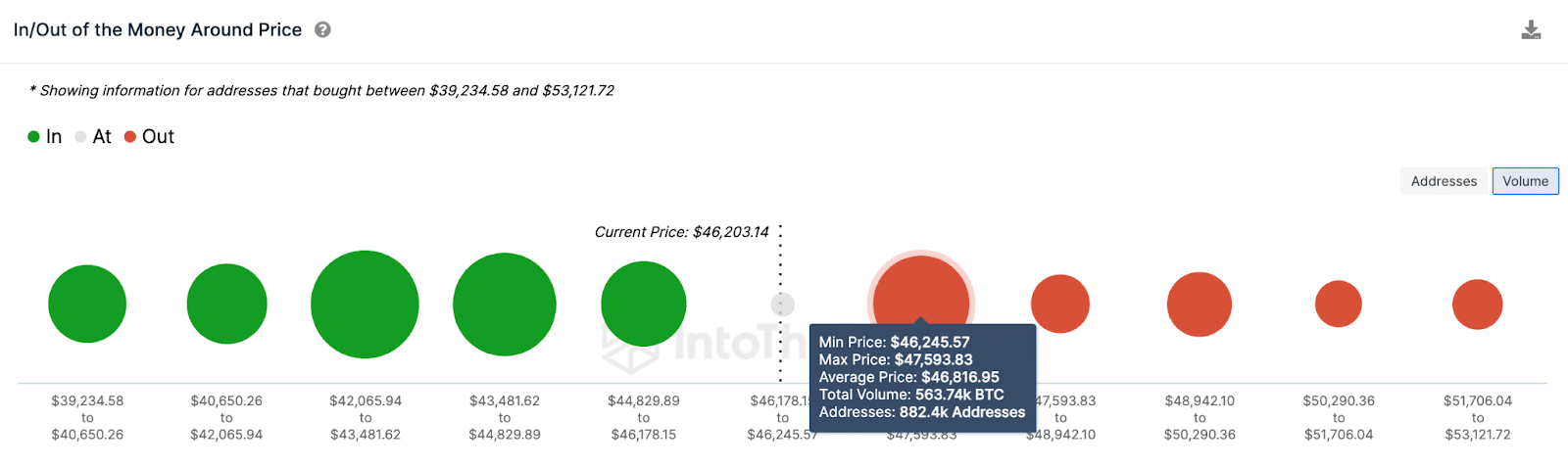

However, the $47,590 resistance is the main obstacle for the bulls to actualize this target. IntoTheBlock’s in/out of the money around price data shows key resistance and support levels by grouping current holders according to their historical entry points. As depicted below, 882,400 addresses had acquired 563,740 BTC at an average price of $47,593.

BTC could continue consolidating just above the $45,000 area if these major clusters of investors keep booking profits.

But if the bulls can orchestrate a decisive breakout above the $47,600 resistance, the $50,000 retest could be on the cards.

Conversely, BTC could experience major downside, the bears force an unexpected reversal below $43,500. In that case, the chart above also shows that 1.48 million BTC holders had acquired 690,980 BTC at an average price of $43,950.

To avoid slipping into a net-loss position, this cluster of investors could make short-covering purchases and possibly trigger an early rebound.