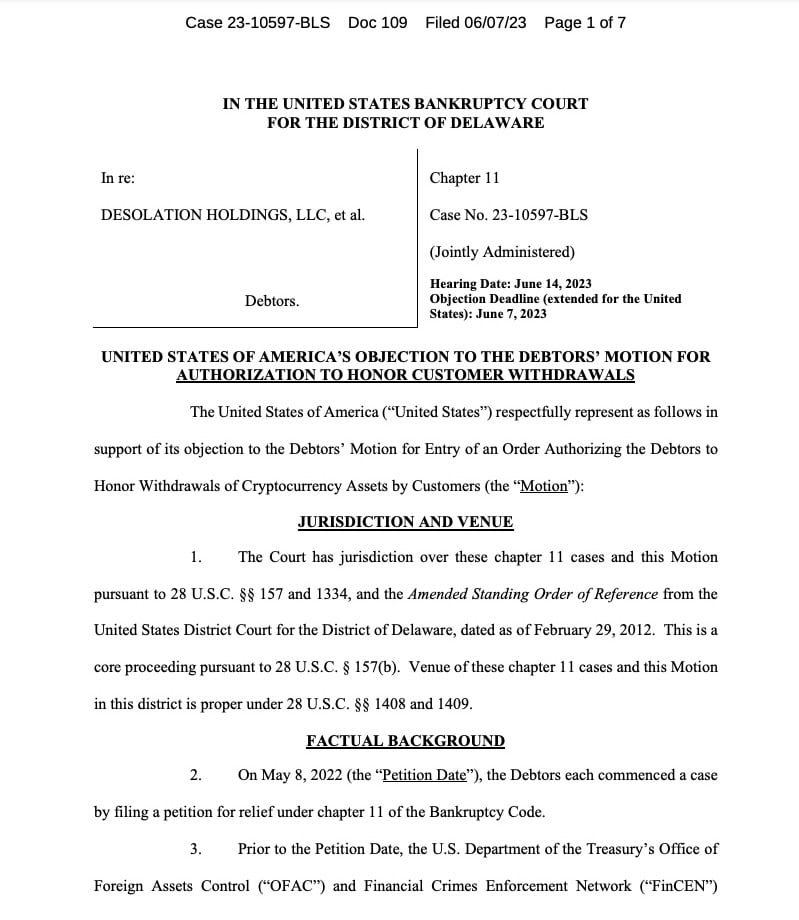

US Government challenges Bittrex US’s motion to return customer crypto assets

Amid the unfolding bankruptcy case of crypto exchange Bittrex US, the US government has opposed the platform’s motion to authorize customer withdrawals of their crypto assets.

The US government has countered a request by Bittrex US, the now-bankrupt cryptocurrency exchange, to authorize the release of customer funds. The motion, which was set in response to Bittrex US’s intent to enable customer withdrawals of cryptocurrency assets, has met with opposition from the government which has scheduled a hearing for June 14.

The government argues that Bittrex’s proposition is premature and tries to unfairly prioritize creditors outside an approved plan. This contention has been influenced by the fact that Bittrex US currently holds a debt of $5 million to the Financial Crimes Enforcement Network (FinCEN).

Government’s demand and controversy

Bittrex US’s original motion proposed categorizing creditors in order of significance for repayment. However, the government disputes the necessity of such categorization, contending that issues surrounding the ownership of cryptocurrency assets should be resolved prior to confirming the Plan.

Government’s stand on plan confirmation

The government maintains that segmenting creditors into subordinate classes outside the confirmation hearing is not proper. As such, it insists that the issues in question should be discussed post-establishment and confirmation of a plan.

The government’s legal team further explains, “Whether the customers possess in rem interests or claims against the Debtors is not a matter that needs resolution now. Customers, at present, could be allowed to withdraw their cryptocurrency assets, but should be subjected to potential avoidance actions at confirmation should all creditors not be fully compensated.”

Bittrex US declared bankruptcy following charges from the SEC for operating an unregistered securities exchange. The ongoing developments underline the complexity of bankruptcy cases involving cryptocurrencies and potentially set precedents for similar instances in the future.