US govt sent $594m Silk Road Bitcoin to Coinbase

More Silk Road Bitcoin moved again after a U.S. government wallet sent 10,000 BTC to Coinbase.

The U.S. government transferred Bitcoin (BTC) worth $593.5 million to its preferred crypto brokerage platform, Coinbase Prime, on Aug. 14, according to Arkham Intel. U.S. authorities sent this 10,000 Bitcoin tranche to the wallet “bc1ql” two weeks ago.

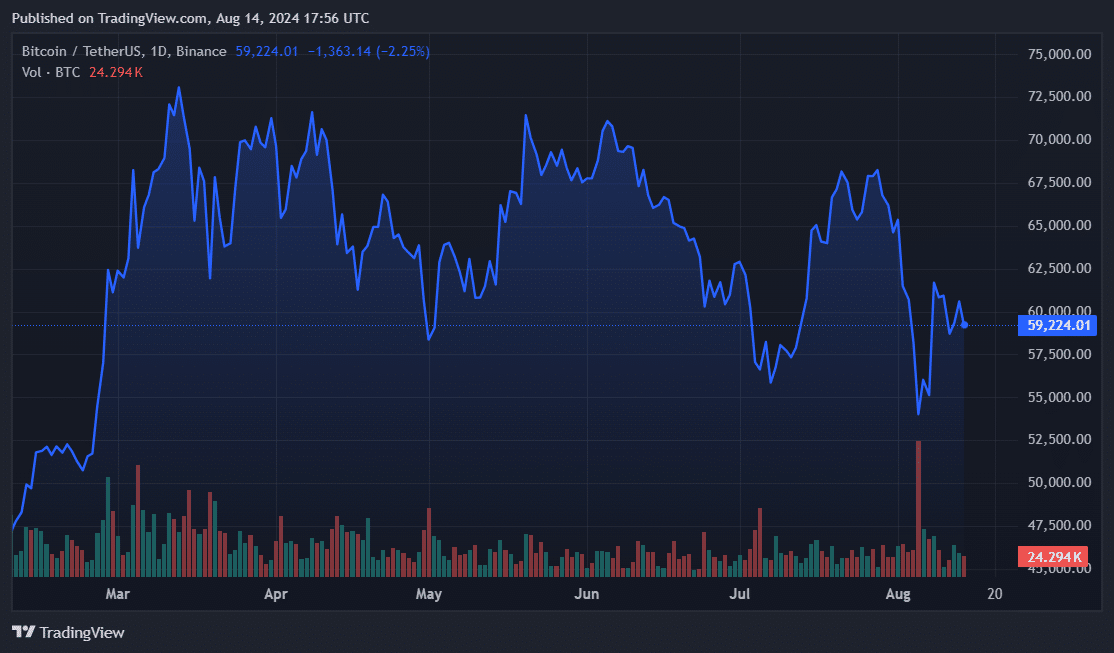

BTC dropped 3.6% following the news, although the price dip began before Coinbase Prime received the seized Silk Road funds. One BTC cost around $59,100 after an initial market spike due to positive CPI data.

Is America reducing its Bitcoin war chest ahead of elections?

In late July, the U.S. government also sent $2 billion in BTC, with the recipient believed to be Coinbase. As reported by crypto.news, citing remarks from Gemini co-founder Tyler Winklevoss, authorities moved the BTC trove shortly after former president Donald Trump pledged to create a strategic Bitcoin reserve.

Speculation abounds about whether the current administration intends to offload some or most of its BTC holdings before the winter elections. Despite the latest transfers, America remains the largest sovereign BTC holder, with more than $11 billion in Bitcoin.

Meanwhile, U.S. Senator Ted Cruz has joined the pro-BTC chorus. Speaking at the Texas Blockchain Council, Cruz called the cryptocurrency a “reservoir of power” for power grid systems in Texas.

More sell pressure

Sell pressure and added volatility may arise in the BTC market, partly due to the possibility of U.S. government liquidations on Coinbase.

In addition to the cumulative $2.5 billion transferred by American authorities, Mt. Gox customer repayments are also ongoing. Crypto exchange BitGo received $2 billion in BTC from the Mt. Gox Trustee, and some claimants may take profits.

How BTC might handle this sell demand remains to be seen, but spot BTC exchange-traded fund inflows may offset market dips.