USDC and DAI more susceptible to de-pegging, say analysts

Stablecoins from Circle and MakerDAO have been less stable than those from Tether and Binance in the last couple of years, states a new S&P Global report.

Analysts at S&P Global have noted that while all dollar-pegged stablecoins are susceptible to fluctuations, certain ones, like Circle’s USD Coin (USDC) and MakerDAO’s Dai (DAI), have exhibited a greater tendency to depeg compared to others.

A comprehensive study conducted in September by Dr. Cristina Polizu, Anoop Garg, and Miguel de la Mata analyzed the valuation and depegging trends of five prominent stablecoins: USDT, BUSD, Paxos (USDP), USDC, and DAI.

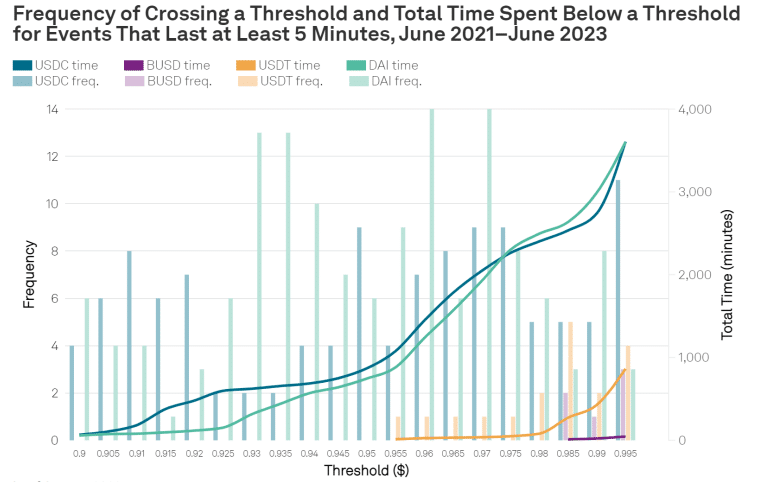

The findings highlighted that USDC and DAI have experienced more frequent depegging incidents than their counterparts, USDT and BUSD, over the past two years.

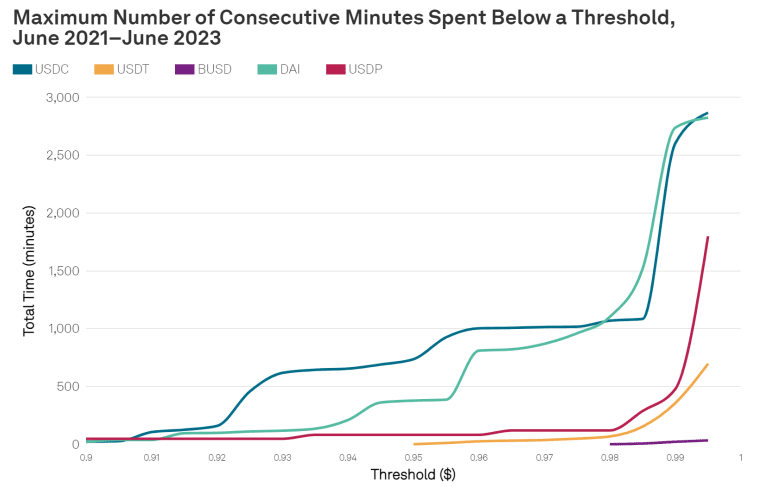

Notably, USDC’s value plummeted below $0.90 for 23 minutes, and DAI’s value dipped for 20 minutes in the most significant depegging event recorded during the study period. In contrast, USDT’s value fell below $0.95 for a solitary minute, and BUSD consistently maintained a value above $0.975 from June 2021 to June 2023.

Furthermore, the study revealed that the occurrences of depegging were considerably higher for USDC and DAI than for USDT and BUSD throughout the analyzed timeframe.

The researchers pointed out that brief depegging events lasting for a minute could be disregarded as noise, mainly when the deviations were near the $1 mark. However, extended depegging durations were perceived as more significant, with the data favoring USDT over USDC.

A significant event that contributed to USDC’s devaluation was the collapse of the Silicon Valley Bank in March 2023. At that juncture, Circle, the issuer of USDC, had parked $3.3 billion of its $40 billion USDC reserves with the bank. Concurrently, MakerDAO held over 3.1 billion USDC in reserves, which were utilized as collateral for DAI, thereby leading to its depegging.

The researchers accentuated the necessity of robust governance, sufficient collateral, and reserves, alongside market confidence and adoption, to maintain the peg and a stable mechanism. They concluded that these factors are pivotal in ensuring the stability of a stablecoin.

Furthermore, the market dynamics have shifted, with USDT expanding its supply by 25% since the onset of the year, thereby commanding a dominant market share of 67%. This growth seems to have occurred at the expense of Circle, which observed a 41.5% reduction in USDC supply and a decline in market share to 21% during the same timeframe.