Valkyrie Alumnus-founded Canary bids for spot Litecoin ETF

Canary Capital filed with the U.S. Securities and Exchange Commission to list an exchange-traded fund underpinned by the Bitcoin-inspired cryptocurrency, Litecoin.

Crypto-focused investment startup Canary Capital filed paperwork with the Securities and Exchange Commission to bring a spot Litecoin (LTC) ETF to Wall Street trading terminals. The new wealth manager, launched by Valkyrie founder Steven McClurg, submitted documents, including a Form S-1, signaling the formal registration of securities for its spot LTC ETF.

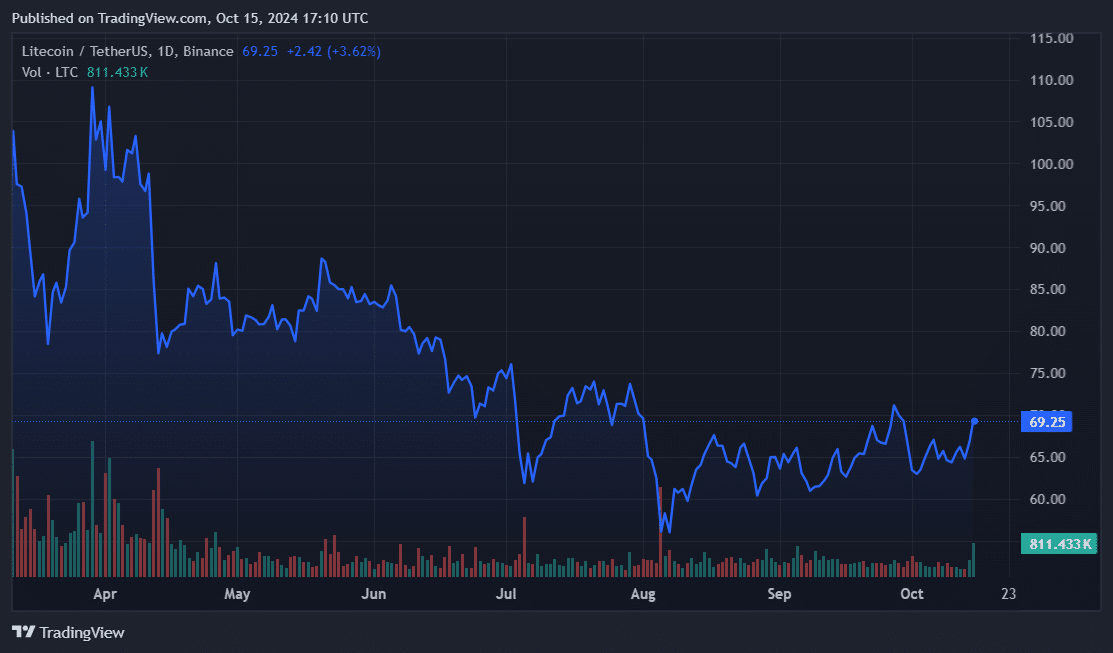

Litecoin is one of the oldest blockchain assets and is often considered an offshoot of Bitcoin (BTC). However, LTC was built in 2011 as a lighter version of BTC rather than an actual Bitcoin fork. Thirteen years later, LTC traded at almost $70 per coin and had a market cap of over $5.25 billion. The token ranked 27th among the top 100 cryptocurrencies by valuation.

Canary Capital has jumped head-first into the crypto ETF bidding scene. Last week, the investment firm joined Bitwise to bid for a spot (XRP) ETF. On Oct. 1, Canaray unveiled its inaugural private fund focused on Hedera (HBAR) and called the Canary HBAR Trust.

Crypto ETF filings have become a regular theme at the SEC since some 11 issuers secured approval for spot Bitcoin funds in January. Spot Ethereum (ETH) ETFs followed in late July, sparking a mountain of speculation over which crypto would don the institutional ETF wrapper next.

Solana (SOL) and Ripple’s native token have featured as leading contenders for a crypto ETF after BTC and ETH. However, the SEC’s regulatory approach and perception of which tokens fall under securities laws leaves looming uncertainty.

Per Fortune, SEC chair Gary Gensler told hedge funds that Ethereum and Litecoin were not securities in 2018. This assertion and LTC’s similarities with Bitcoin could improve the chances of a spot LTC ETF. However, SEC leadership under Gensler remains largely skeptical of the crypto economy, and the product may receive pushback from agency staff.