Vanguard, other tradfi giants boycott spot Bitcoin ETFs

Financial institutions like Vanguard have no plans to allow spot Bitcoin ETF trading despite approval from the U.S. SEC.

While trading for spot Bitcoin ETFs opened on Jan. 11 across major U.S. exchanges like the Nasdaq and platforms such as Robinhood plan to swiftly add support for these products, some firms have reportedly blocked users from trading them.

Vanguard, the second-largest asset manager after BlackRock, reportedly said spot Bitcoin ETFs do not align with the company’s investment philosophy.

In addition to not enabling trading for the newly approved products, Vanguard disabled the buying of Grayscale’s GBTC shares on its platform, according to several users on X.

A spokesperson for the firm said Vanguard also has zero plans to offer a Vanguard Bitcoin ETF or other crypto-based products. The Tradfi heavyweight views crypto volatility as a risk to its long-term positive return strategy for customers, per comments from the representative.

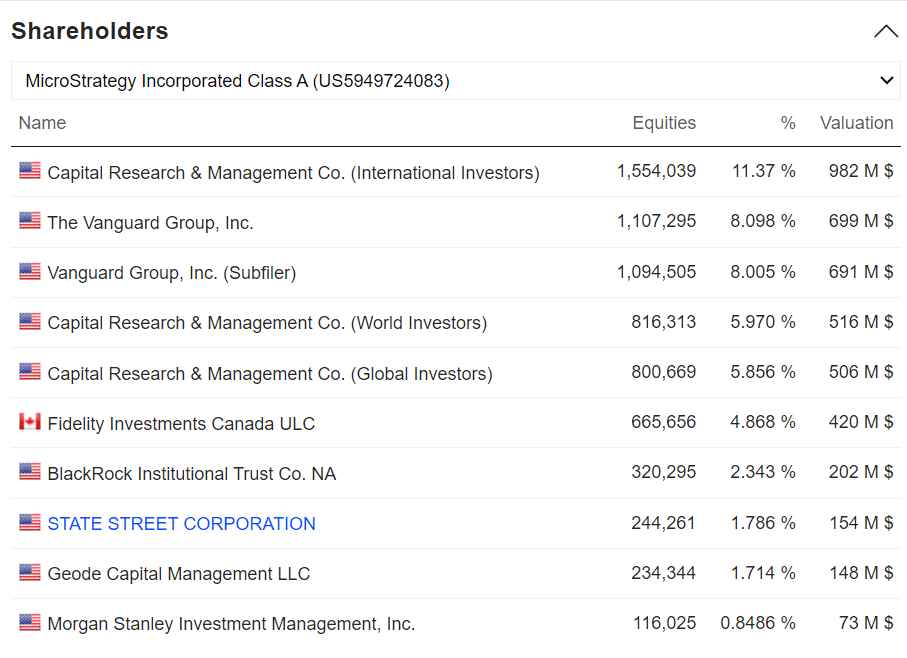

Vanguard is notably one of the largest owners of MicroStrategy shares, the Michael Saylor company, which holds over $8 billion in Bitcoin (BTC).

Furthermore, there are reports that other legacy institutions like Merrill Lynch, Citi Bank, UBS, Wells Fargo Advisors, and Raymond James will also boycott spot BTC ETFs — Merrill Lynch, in particular, plans to assess how the ETFs perform and possibly reevaluate its decision.

Meanwhile, Bloomberg’s James Seyffart confirmed over $1.2 billion in volume for spot Bitcoin ETFs in the first 30 minutes of trading. BTC itself briefly touched $49,000 shortly after trading opened but has since declined slightly in price to around $46,300, per CoinMarketCap.

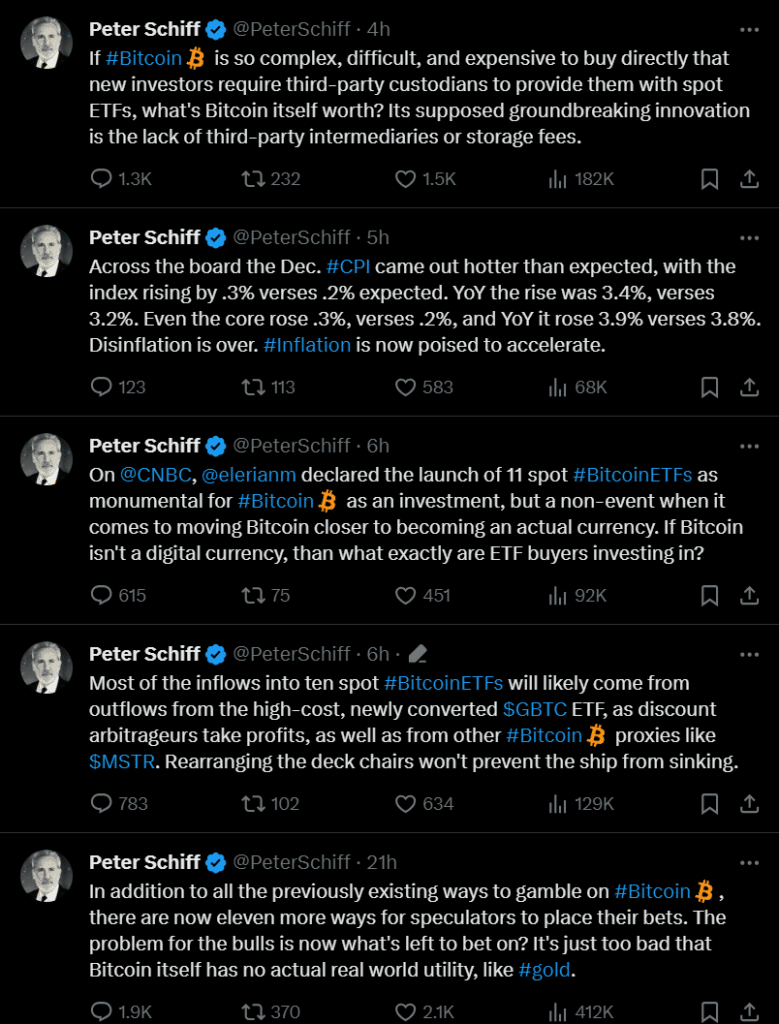

Despite confirmation from the Securities and Exchange Commission for BTC ETFs, long-standing Bitcoin skeptic Peter Schiff continued championing anti-crypto rhetoric. Schiff scrutinized mainstream media channels for their coverage of these products and questioned the liquidity following spot BTC ETFs.