VELO price outlook: big moves expected as DEX volumes drop

Velodrome Finance’s token consolidation continued, reflecting the broader price action seen in Bitcoin and other altcoins.

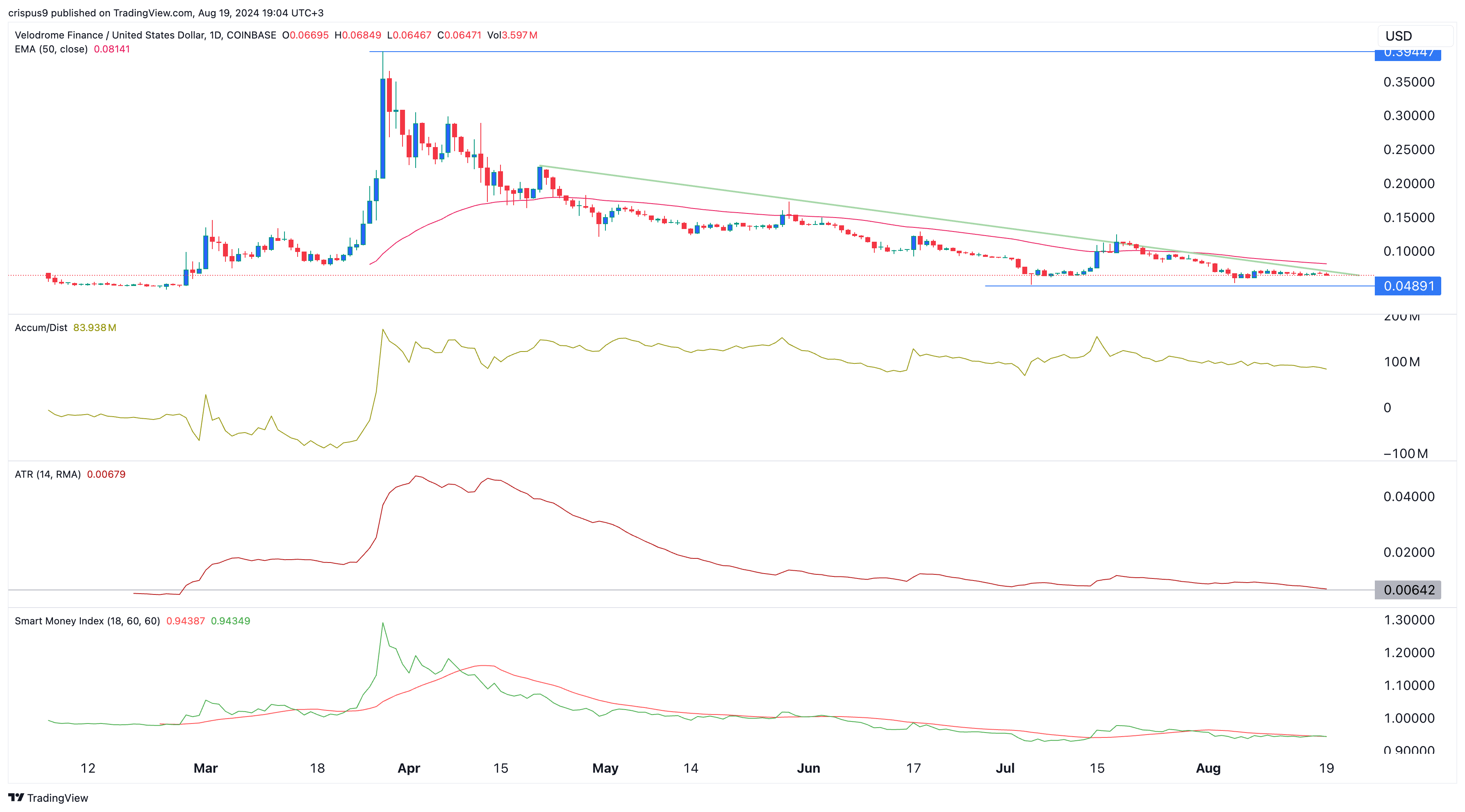

Velodrome (VELO) was trading at $0.065, a level it has maintained since Aug. 6, giving it a market cap of over $90 million. At its peak in March, Velodrome had a valuation of over $200 million.

Velodrome, the third-largest decentralized exchange on the Optimism (OP) network, has faced significant challenges in recent months. Data shows that the total value locked in its ecosystem has dropped from $322 million in April 2023 to $85 million. Additionlly, according to DeFi Llama, its total volume in the past seven days has decreased by over 34% to $197 million.

This decline in volume aligns with trends seen across other DEX protocols, which have experienced reduced activity following the crypto Black Monday on Aug. 5. The total volume handled by DEX protocols in August was $111 billion, down from $190 billion in July.

Typically, DEX and centralized platforms see increased volume when cryptocurrencies are rising, as rallies attract more investors and traders. For instance, Coinbase’s revenue surged by 72% in Q1, reaching $1.6 billion as Bitcoin hit record highs.

VELO price forecast

The price of Velodrome Finance’s token has seen a sharp decline in recent months. After peaking at $0.3945 in March, it has dropped by over 83% to $0.065, meaning that a $10,000 investment would now be worth just $1,647.

VELO found strong support at $0.048, where it formed a double-bottom chart pattern. The token has remained below the 50-day moving average indicator.

It has also moved below the descending trendline that connects the highest swings since April 21. As a result, it has formed a descending triangle pattern, which often leads to a bearish breakout. This triangle is nearing its confluence, suggesting that significant price movements could be imminent.

The accumulation/distribution and smart money index indicators have also pointed downward. Additionally, the average true range (ATR), a popular measure of volatility, has retreated to its February lows.

Therefore, the path of least resistance for the token appears to be downward, with the next level to watch being $0.048. A break below this level could lead to further downside. An alternative scenario could see the token bounce back if Bitcoin (BTC) bounces back.