Burning crypto tokens: What does burning crypto mean?

Burning crypto means intentionally destroying digital tokens or coins. Once burnt, these tokens are gone. This might seem counterintuitive to some investors. Why would a blockchain project deliberately destroy its own tokens? In this article, we’ll examine why these burns are carried out, their impact on the projects and their investors, and offer insights into how investors can navigate this complex landscape. We’ll also delve into the world of burning crypto and explore some of the most significant burning events in recent history.

Table of Contents

What is crypto burning?

Simply put, burning crypto is the process of permanently removing cryptocurrency from circulation. This can be done by sending the coins to an unspendable address, also known as a “burn address,” where they can never be accessed again.

But why would anyone want to burn their cryptocurrency? The answer lies in the concept of scarcity.

Reducing the overall supply of a cryptocurrency can become more valuable, similar to how a limited edition item can fetch a higher price. This is because fewer coins are available for purchase, which can create a sense of urgency among investors looking to acquire the asset.

Understanding the reasons behind cryptocurrency burns

There are several reasons why burning takes place:

Increasing token value with scarcity

Cryptocurrency burns are a strategic move to stoke the value of a particular token by reducing its circulating supply. When tokens are deliberately removed from circulation, scarcity is created, typically driving up demand for the remaining tokens. This leads to an uptick in token value, thanks to the age-old dance of supply and demand.

Breathing new life into lackluster projects

Occasionally, crypto burns emerge as a lifeline for projects that have lost their spark or stalled. A well-executed token burn can whip up a frenzy of excitement, catching the eye of investors and amplifying trading volume.

With fresh interest and support, projects can harness the momentum to push forward and realize their ambitions.

Reducing inflation and safeguarding stability

Cryptocurrency burns are vital in curbing inflation by shrinking the overall token supply. Left unchecked, inflation can gnaw away at token value and destabilize prices.

Periodic token burns are like a well-timed jab, keeping inflation in check and preserving the project’s and its investors’ long-term prospects.

Leveling the playing field for distribution and governance

Token burns can also be a great equalizer, ensuring a more equitable distribution and governance within a decentralized project.

When a project accumulates tokens through fees or other means, incinerating those tokens stops the project’s team from hoarding the lion’s share. This leads to a decentralization safeguard that hinders manipulation or control by any single party.

Impact of token burns on crypto

Let’s delve into the real-world implications of token burns and how they can shape cryptocurrency projects’ and investors’ trajectories.

Boosting investor confidence

Token burns show a project’s commitment to maintaining value, supporting growth, increasing investor trust, and attracting new supporters. Projects actively managing token supply and combating inflation demonstrate their dedication to preserving investor value and bolstering investor confidence.

Improving market perception

When a project conducts a token burn, it often catches the attention of traders and investors, increasing trading volume and liquidity and ultimately helping the project regain its competitive edge.

Unlocking new opportunities

As the token value and market perception improve, other projects or organizations may take notice, opening doors for growth and expansion through collaboration or integration.

Encouraging long-term investment

Increased token value due to token burns may motivate investors to hold onto their tokens, fostering a healthier ecosystem.

Moreover, investors are more likely to contribute to a project’s growth through participation in governance or community activities, creating a more stable investor base and sustainable ecosystem.

Reinforcing good tokenomics practices

Token burns promote healthy tokenomics practices, contributing to a more robust and well-regulated cryptocurrency market. As projects recognize the benefits of token burns, they may adopt similar strategies, fostering a more sustainable and successful future for the entire industry.

Proof-of-burn: a greener consensus algorithm

Proof-of-burn (POB) is an environmentally friendly consensus algorithm in some cryptocurrencies. Miners showcase their “proof of work” by burning or destroying some coins.

The more coins a miner burns, the higher their chances of being selected to validate a block of transactions. This method contrasts proof-of-work (POW) and proof-of-stake (PoS), which prioritize mining power and stake in the network, respectively.

In the broader context of token burns, POB provides an energy-efficient alternative to POW without the need for massive energy consumption during the mining process.

Notable projects employing POB include Slimcoin (SLM), Counterparty (XCP), and Factom (FCT), while some coins use a combination of PoS and POB for token issuance and maintenance.

Although POB doesn’t destroy coins permanently, it effectively removes them from circulation, creating scarcity and combating inflation. The impact of coin burns on price is generally long-term, as burns have limited short-term influence.

How can you burn tokens?

Projects use smart contracts to burn tokens. This is a technical process, but it essentially entails telling the smart contract the number of coins they want to burn. The smart contract will then verify that they have enough coins in their wallets and subsequently executes the burn. The smart contract will send tokens to a randomly generated address that’s inaccessible.

Now let’s take a look at an example of a coin burn, where we burn an NFT (ERC-721 token) on Etherscan.

Here are the steps:

- Click the contract address of your NFT. This address should be available on the platform you minted the NFT. The address will open on Etherscan, a block explorer for Ethereum-based tokens.

- Next, go to the contract tab.

- Click “Write Contract.”

- Scroll down and go to the “Burn” option.

- Enter the address of the wallet holding the NFT in the first field.

- Copy the token ID from the NFT platform and paste it into the second field.

- Indicate the number of tokens you want to burn in the last field.

- Click “Write” to execute the burn transaction.

A coin burn is recorded as a transaction on the blockchain and is visible to everyone. It is also permanent and irreversible. So if you are going to try this, don’t do it with your favorite NFT.

Examples of coin burns

The following are some of the most notable burn events in the cryptocurrency world:

Serum DEX burned $1.3 million worth of SRM to increase token scarcity

Serum, a popular decentralized exchange (DEX) on the Solana (SOL) blockchain, conducted a notable burn event in May 2021 in which 84,538 SRM ($1.03 million) were destroyed, and 21,134 SRM ($257k) were dropped to stakes.

This action followed previous burns in September 2020 and April 2021, which destroyed $400k and $600k worth of SRM, respectively.

The Serum team aims to maintain low token circulation to increase SRM’s scarcity through continuous coin burns, which boost prices in the long run.

Binance completed the 21st BNB burn in 2022

Binance completed its 21st BNB burn in October 2022, which includes the auto-burn feature, pioneer burn program, and a portion of gas fees burned in every transaction.

The burn saw 2,065,152.42 BNB removed, valued at approximately $574,800,583.92. The pioneer burn program contributed to the burning of 4,833.25 BNB.

Since BNB and Binance’s launch in 2017, the company has committed to removing 100 million BNB, or half of the total supply, from circulation through a burning process.

The auto-burn formula automatically calculates the number of tokens to be removed, ensuring an independently auditable and objective process separate from the Binance centralized exchange. Additionally, BNB Chain continues to burn some of BNB Chain’s gas fees in real-time.

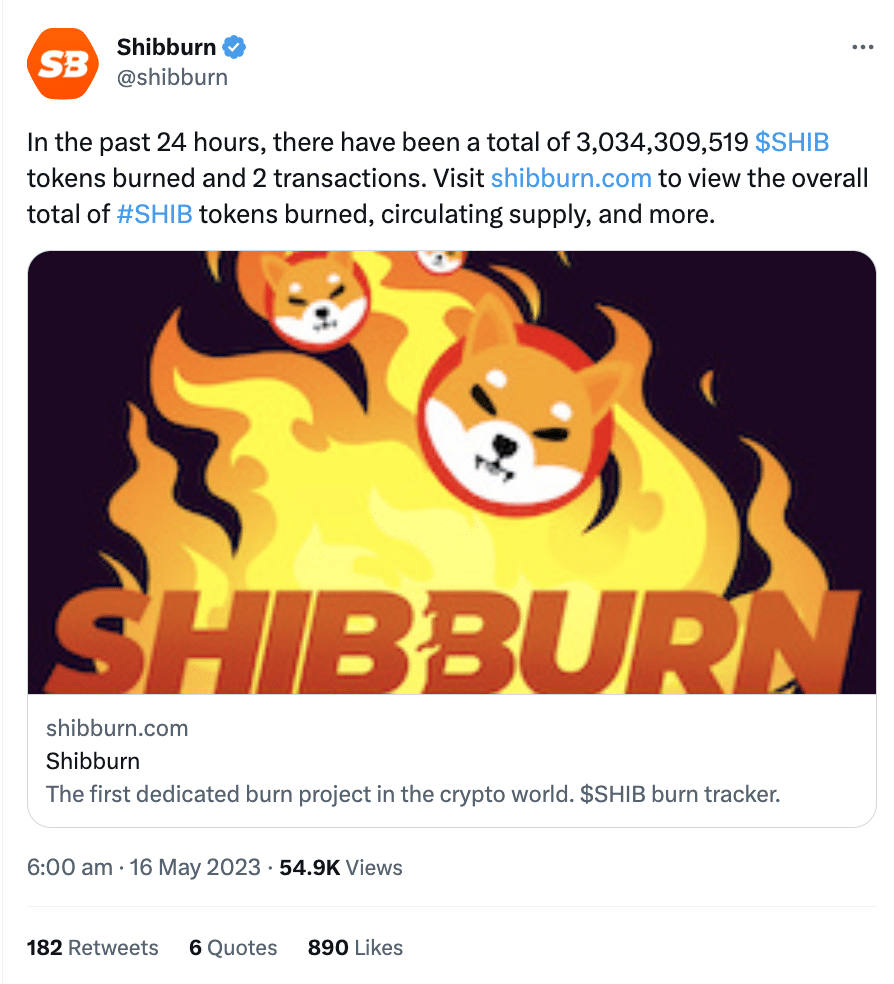

SHIB community reduced circulating tokens

In May 2023, the Shiba Inu community significantly reduced the number of SHIB meme tokens in circulation by burning 3.03 billion SHIB in a single day.

The token burn event contributed to the increased scarcity of SHIB and its potential for a significant price increase in the future.

Conclusion

In conclusion, crypto burning has the potential to shape the future of the cryptocurrency world. Its effects can be far-reaching and significantly impact the projects and investors involved. Understanding token burns’ motivations and real-world implications is crucial for navigating this ever-evolving landscape.

FAQs

Are coin burns good or bad?

Generally speaking, restricting the supply of a cryptocurrency should lead to an increase in the value of the existing tokens as they become scarcer. As such, coin burns are typically considered positive and welcomed by token holders. However, not every coin burn leads to a price increase for the burned token.

What are the risks of coin burns?

Coin burns could lead to centralized control when the development team uses burn wallets to hide large token holders referred to as whales. Also, projects can use coin burning to implement scams known as rug pulls. They do this by claiming they have burned a particular amount of tokens while, in reality, the “burned” tokens remain in a wallet they can control.

How can you protect yourself from coin burn scams?

Always conduct thorough research before buying any crypto tokens. Look out for red flags like anonymous founders, unclear project objectives, no real token use case, and a non-existent project roadmap.

Also, never reveal your wallet’s private keys if you are asked to as part of a project’s token burn. If someone is asking for your private keys or recovery phrase, they are trying to scam you.

Does burning crypto increase its value?

Burning crypto can increase its value as it reduces the overall supply of the cryptocurrency, creating scarcity and driving up demand for the remaining tokens. This can increase token value due to the basic economic principle of supply and demand.

Do you lose money when crypto is burned?

If you own the tokens that are being burned, then yes, you would lose the value of those tokens. However, suppose the burn is successful and leads to an increase in the overall value of the cryptocurrency. In that case, it could offset the loss and result in a net gain.

What does shiba inu burn mean?

Shiba Inu is a meme-inspired cryptocurrency that saw a significant reduction in the number of tokens in circulation in May 2023, when 3,034,309,519 SHIB were removed from circulation in a single day. This token burn event contributed to the increased scarcity of the cryptocurrency and its potential for a significant price increase in the future.

Can burned crypto be recovered?

No, burned crypto cannot be recovered. It is permanently removed from circulation by sending the coins to an unspendable address, also known as a “burn address,” where they cannot be accessed again.