What next for Solana’s BOME price after 2,200% gains in March?

Book of Meme (BOME) price has closed March 2024 at $0.15, with remarkable gains in excess of 2,265%, recent social media trends suggest more bullish action could follow in April.

Since the turn of the year, Solana memecoin ecosystem has been on a remarkable run with the likes of Dogwifhat (WIF) and BONK leading the charts. However, newly-launched Book of Meme (BOME) has been at the forefront of the rally in recent weeks.

Book of Meme social media trends hint at April rally

Book of Meme (BOME) is a Solana (SOL) memecoin launched on March 14. The token made giant strides, claiming unicorn status within its first week of trading to become the 3rd largest meme project on the Solana ecosystem.

Interestingly, Book of Meme price action has flattened since March 19, consolidating within the narrow $0.1 to $0.15 channel, while the likes WIF and BONK have surged to new peaks amid massive media traction.

However, after two weeks in consolidation, away from the major headlines, current media trends suggest BOME has now reached a potential turning point.

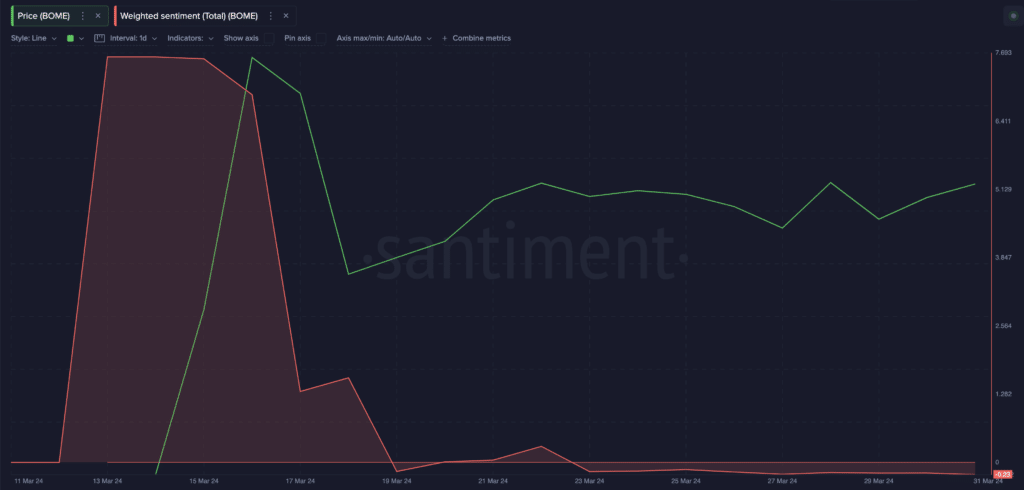

Santiment’s weighted sentiment metric pulls data from relevant crypto media platforms to compare the ratio of negative mentions surrounding a project, to the positives.

Following the euphoria that greeted BOME’ remarkable 2,000% price rally in the week it was launched, the media buzz surrounding the project has waned.

BOME currently has a negative weighted social sentiment score of -0.23%, at the time of writing on April 1. This implies that negative and pessimistic comments surrounding BOME now outnumber the positive and euphoric discourse.

Typically, strategic new entrants who missed out on the 2,200% rally in March 2024 maybe looking to buy when market hype cools off. With media comments now dominantly negative, these strategic traders could now consider it perfect timing to enter the fray.

If this scenario plays out, that influx of new capital could send BOME price into another parabolic breakout in April.

BOME maintains high liquidity, despite flat price action

Despite Book of Meme’s flat price action since March 18, critical market metric show that investors have not shown any signs of throwing in the towel. While WIF and BONK have attracted most of the media traction, market liquidity, and investor interest in BOME have remained steady at healthy levels over the past two weeks.

In concrete terms, the Trading Volume to Market Cap (TVMC) ratio, is a financial metric used to assess the liquidity and trading activity of a particular crypto asset. It is calculated by dividing the total trading volume of an asset over a specific period by its market capitalization.

Since inception on March 14, BOME has maintained an average daily trading volume of $1.1 billion according to Coingecko starts. When compared to the current market cap of $840 million, the it gives a TVMC ratio of 1.3.

An asset is regarded as undervalued when its TVMC ratio (Trading volume/ Market Cap) is greater than 1. And as observed in the BOME markets, trading volume has consistently exceeded market cap by approximately 30%.

This puts BOME is position for positive price action in the near term for two main reasons. the combination of a A high TVMC ratio and consistently high trading volume, suggests strong liquidity and active investor interest in the BOME despite the two-week long price consolidation phase.

Also, the trading volume surpassing market cap indicates favorable conditions for BOME’s price growth in the near term as new investors may view BOME as undervalued relative to its trading activity.

In summary, the low media hype and high TVMC ratio presents an opportunity for BOME to attract fresh capital inflows, potentially kickstarting another rally towards the next milestone price of $0.02 in the days ahead.

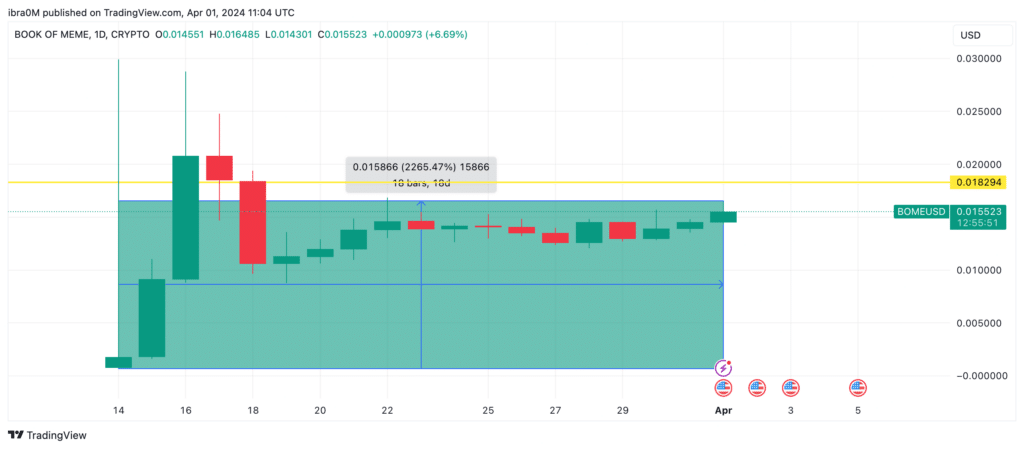

Forecast: BOME price heading straight to $0.02 in April?

At the time of writing on April 1, Book of Meme price is hovering just above the $0.015 area. But low media hype and the 130% TVMC ratio presents an opportunity for BOME to attract fresh capital inflows, potentially kickstarting another rally towards the next milestone price of $0.02 in the days ahead.

However, the $0.18 territory poses significant short-term resistance. As seen below, BOME investors who exited early had sold off majority of their holdings around that price level.

But if the Book of Meme bulls can scale that historically significant sell-zone, a decisive breakout above $0.02 could be on the cards as predicted.

On the flip side, BOME could slip into a prolonged downtrend if the critical support level $0.10 caves. But this currently seems unlikely, given the brimming market liquidity and overall positive sentiment surrounding the broader Solana memecoin ecosystem.