Why is Bitcoin price crashing right after Federal Reserve rate cuts?

Bitcoin price crashed for the fourth consecutive day, reaching its lowest level since Oct. 23 after the Federal Reserve delivered its second consecutive interest rate cuts and Donald Trump reached a trade deal with Xi Jinping.

- Bitcoin price crashed after the Federal Reserve slashed interest rates.

- The interest rate decision was more hawkish than expected.

- It also dropped as bullish liquidations rose and a death cross neared.

Bitcoin price crashed as investors sold the news

There are two main reasons why the Bitcoin (BTC) price crashed after the Federal Reserve slashed interest rates by 0.25%. First, the rate cut was not a surprise as most analysts and traders were expecting it. Odds of the rate cut stood at over 98% before it happened.

Similarly, traders were expecting Donald Trump to reach a deal with Xi Jinping, especially after the recent statements by Scott Bessent and his Chinese counterpart.

Therefore, Bitcoin price is falling as investors sell the news. This is a situation where investors buy an asset before a major even happens and then sell it when it happens.

Second, Bitcoin price crashed because the Fed cut was more hawkish than what analysts were expecting. In his statement, Jerome Powell noted that a December rate cut was not guaranteed. As a result, odds of a December cut dropped from over 90% to 65%. This also explains why the stock market dropped after the cut.

Rising Bitcoin liquidations

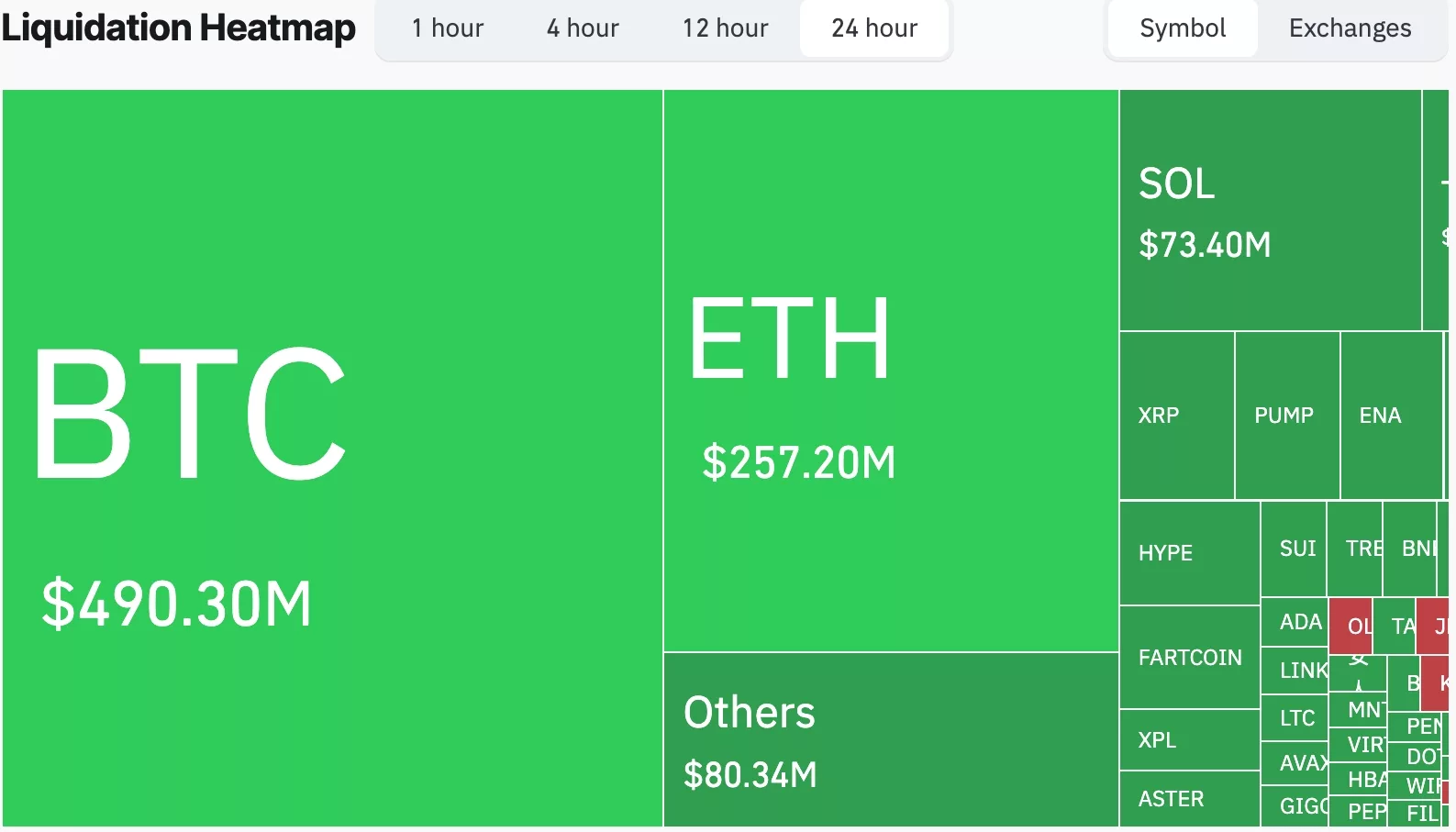

Bitcoin price also crashed after the Federal Reserve cut interest rates because of the rising liquidations.

Data shows the 24–hour Bitcoin liquidations jumped to over $483 million, representing a big share of the combined liquidations in the crypto industry. One trader on Hyperliquid suffered a $21.4 million wipeout.

A liquidation happens when an exchange closes leveraged trades when they hit the margin call area.

The rising liquidations coincided with the ongoing deleveraging among investors as Bitcoin’s open interest in the futures market dropped to $73 billion from this month’s high of $94 billion.

Spot Bitcoin ETF outflows

Meanwhile, the Bitcoin price crash happened as spot Bitcoin ETFs lost assets. Data compiled by SoSoValue shows that spot BTC ETFs shed over $470 million on Wednesday, bringing the net outflows this week to $118 million.

Most of the outflows happened on Fidelity’s FBTC, which shed assets worth over $164 million. Ark Invest’s ARKB lost assets worth over $143 million, while BlackRock’s IBIT lost $88 million.

Bitcoin price nears death cross pattern

Technicals have also contributed to the ongoing Bitcoin price crash. The daily timeframe chart shows that the coin found rejection at $116,370 earlier this week.

It is now about to form a death cross pattern, which happens when the 50-day and 200-day Weighted Moving Averages cross each other. Forming that pattern will point to more downside, potentially to $100,000 and below.