Why is ChainOpera AI (COAI) price up over 300% this week?

ChainOpera AI stood as one of the best-performing cryptocurrencies over the past week, defying the broader market downturn fueled by macroeconomic concerns.

- COAI price rose 350% in the past 7 days.

- Strong derivatives market activity and the broader resurgence of the AI sector has helped support the rally.

- Technical indicators were mostly leaning bullish for the token at the time of writing.

According to data from crypto.news, ChainOpera AI (COAI) skyrocketed from $5.24 on Oct. 9 to a record high of $43.81 by Monday. But the rally was short-lived with the token crashing nearly 90% to $5.47 the very next day before staging a sharp recovery. As of this writing, it’s trading around $23, still holding onto a 350% gain over the past week and a staggering 6,100% since launch.

COAI has recorded impressive trading activity throughout the past 7 days, reflecting robust demand among investors that has pushed its market cap from around $1 billion on Oct. 9 to over $4.5 billion at press time.

In the past 24 hours alone, the token’s daily trading volume climbed 17% to $243.5 million, which shows that market participants still remain actively involved with the asset despite its recent volatility.

Why is COAI price going up?

A number of reasons may be supporting COAI’s parabolic rally over the past trading sessions.

First, ChainOpera AI positions itself as an “AI infrastructure token,” and the token’s gains were supported by the broader resurgence of the AI token market in recent weeks, following chip-making giant AMD’s partnership with OpenAI, just a few weeks after rival chip maker Nvidia announced plans to commit $100 billion in the artificial intelligence company.

Such partnerships highlight the growing demand for intelligent compute networks, the very niche ChainOpera is focused on. With its range of AI-powered tools built on the BNB Smart Chain, the project stands out as a well-positioned player in the space.

Notably, the total market cap of all AI crypto tokens combined rose over 5% to nearly $32 billion over the past week, and COAI is currently leading the recovery as the top performer.

Second, strong derivatives market activity has played a major role in amplifying COAI’s recent price moves.

COAI’s open interest has surged 5% in the past 24 hours. When open interest rises alongside price and trading volume, it is considered a sign that new money is entering the market. This influx of capital and participation typically confirms that the uptrend remains strong and is likely to continue.

Third, liquidation data shows a total of $15.68 million was wiped out in the past 24 hours, with short positions accounting for nearly $11.16 million of that figure. This sharp skew suggests that the rally caught bearish traders off guard, forcing mass liquidations that only added more fuel to the upward momentum.

COAI price analysis

On the 4-hour chart, COAI price has printed back-to-back green candles after rebounding from its sharp dip to $14.48 seen yesterday. The Supertrend indicator also flipped green, with the trend line now sitting below the current price level, a setup often read by traders as a fresh buy signal.

Momentum indicators are echoing that sentiment as the MACD is trending upward with a widening distance between the MACD line and signal line, which typically suggests strengthening bullish momentum. In technical terms, this structure indicates that buying pressure has been gradually building.

Even the RSI climbed above the 70 mark, entering the overbought zone. While that usually hints at a potential short-term cooldown, it does not necessarily signal a full reversal, especially in strong uptrends where momentum often stays elevated for extended periods.

For now, $28.4 serves as the key resistance level to watch. A decisive break above this could pave the way for a retest of COAI’s all-time high near $44. On the flip side, if price fails to hold above $17.6, the structure could shift bearish, possibly triggering a larger pullback.

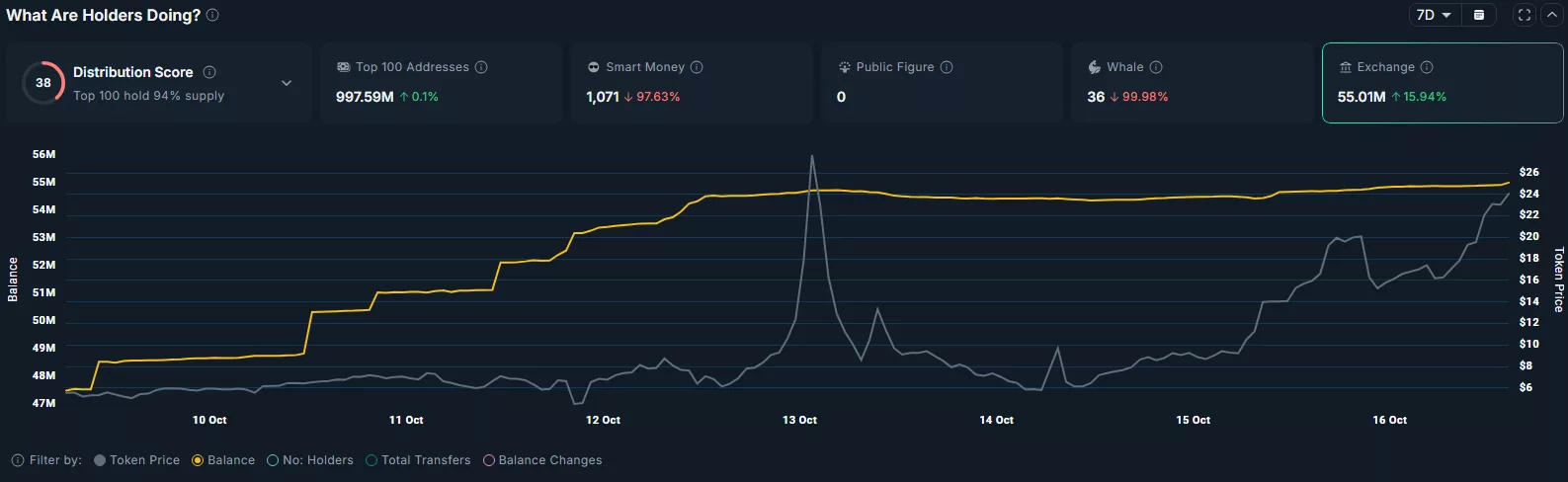

However, on-chain data from Nansen presents a layer of caution for traders. Notably, the number of COAI tokens held on centralized exchanges has increased from 47.48 million to 55 million over the past seven days. This inflow could mean that a subset of traders may be looking to sell or rotate into other altcoins.

While this is typical after strong rallies as investors move to lock in gains, if selling accelerates beyond current levels, especially near key resistance, COAI may face a period of consolidation or even a deeper retracement before attempting another leg up.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.