Why Latin America’s biggest crypto news outlets struggle to keep readers

Latin America’s largest crypto publisher, CriptoNoticias, drew 1.35 million visits in the second quarter of 2025, yet the average reader stayed for just 54 seconds. Across the region, crypto-related coverage across both mainstream and crypto-native sites totaled about 271 million visits, but typical sessions still ran under a minute, with bounce rates often topping 50%.

- LATAM crypto interest is surging, but attention isn’t: sessions are sub-1 minute and bounce rates >50%, even as total crypto coverage hit ~271M visits.

- CriptoNoticias is the lone top-tier holdout by reach; most outlets saw declines as readers shift to aggregators and AI summaries.

- Discovery volatility + AI referrals + regulation are reshaping traffic; winning playbooks focus on loyal direct audiences and engagement quality over raw clicks.

In short, the Latin American audience exists, but their attention isn’t, and that imbalance is what we set out to understand.

What those numbers don’t show is how quickly reading habits are changing across the region, and how crypto media is struggling to keep up. It’s not just fewer clicks; it’s shorter sessions, faster exits, and a growing preference for quick-scan content. Most readers stayed for less than a minute, and more than half left after a single page.

At the same time, the broader picture points in the opposite direction. Our previous analysis of second-quarter data shows that crypto adoption in LATAM is booming, with unique users up 18.3% quarter-over-quarter. But crypto-native media traffic fell by more than 54%, signaling that visibility and loyalty are now pulling apart.

We at Outset PR have monitored these trends through the first half of 2025, and the pattern is only deepening. In the first quarter, six LATAM crypto publications each attracted over 400,000 monthly visits — a competitive top tier by any measure. By the end of Q2, that top tier had collapsed to just one outlet: CriptoNoticias, averaging 448,000 monthly visits and 1.35 million in total for the quarter.

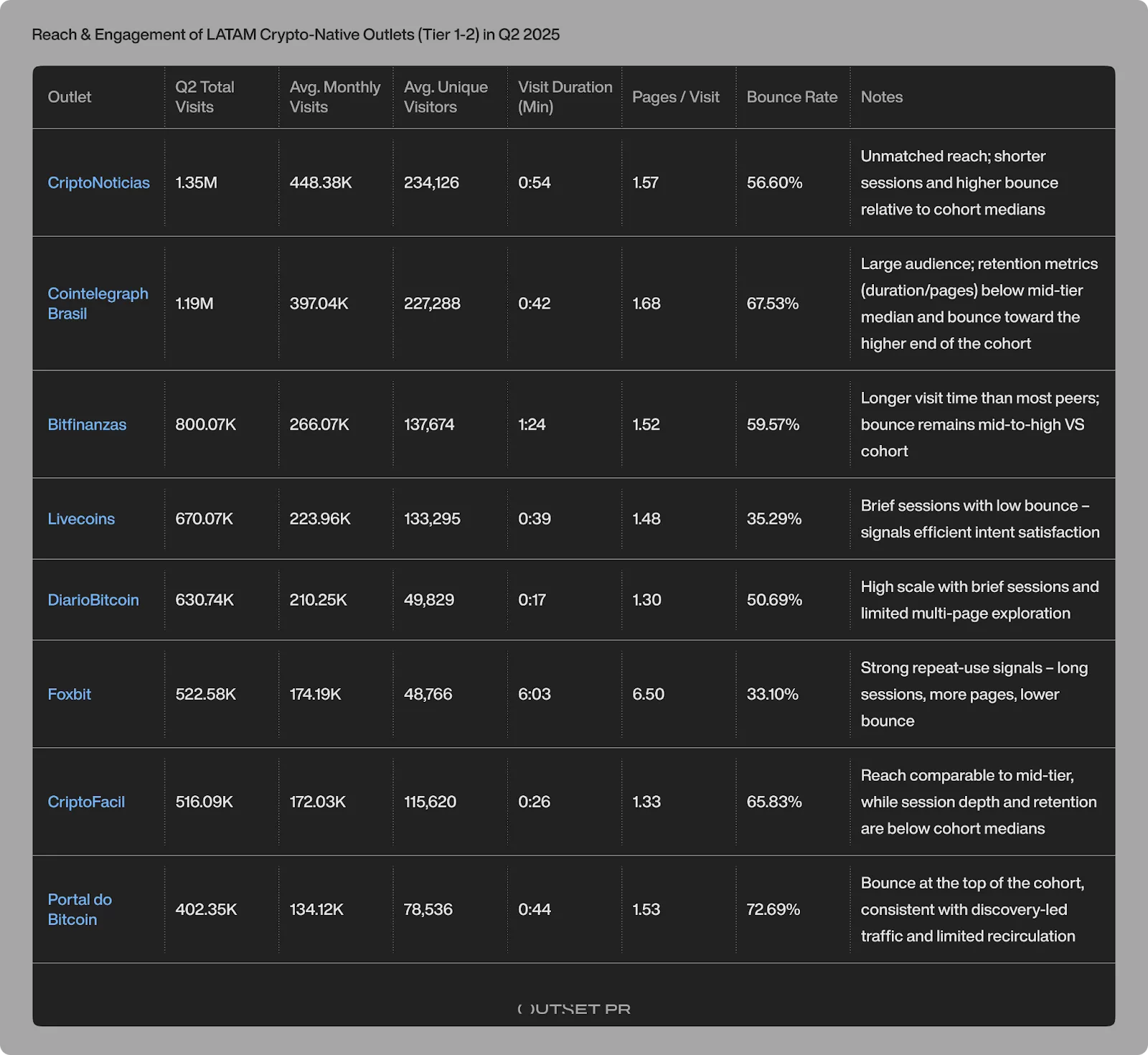

Previously at the top of the field, Cointelegraph Brasil fell into the mid-tier category, alongside others such as Foxbit, Bitfinanzas, Livecoins, DiarioBitcoin, CriptoFácil, and Portal do Bitcoin — underscoring that even depth-strong players don’t command massive reach in Q2. Together, these eight outlets captured roughly 74% of LATAM’s crypto-native traffic, forming a stable base for comparing reach and engagement across the region.

Outset PR visualization of reach and engagement metrics across LATAM’s crypto outlets in Q2 2025

Traffic vs. reader depth

After mapping the region’s traffic trends, we turned to behavior — what readers do once they land on a page. The data tracks how long sessions last, how many pages are viewed, and how often readers leave after a single click.

The differences across outlets were striking. Within the core cohort, Foxbit ranked highest on our engagement index, with readers spending about 6 minutes and 3 seconds per session, viewing 6.5 pages, and bouncing just 33% of the time.

Livecoins, at the other end of the spectrum, clocked 39-second sessions but only a 35% bounce rate, suggesting quick intent satisfaction. Bitfinanzas struck a middle ground with 1 minute 24 seconds per session, 1.5 pages per visit, and a 59% bounce rate.

Meanwhile, CriptoNoticias and Cointelegraph Brasil led on volume but lagged in retention, averaging under a minute per visit and bounce rates of 56% and 68%, respectively. At the thinner end, DiarioBitcoin, CriptoFácil, and Portal do Bitcoin had shorter sessions and higher bounce rates, though they play a crucial discovery role.

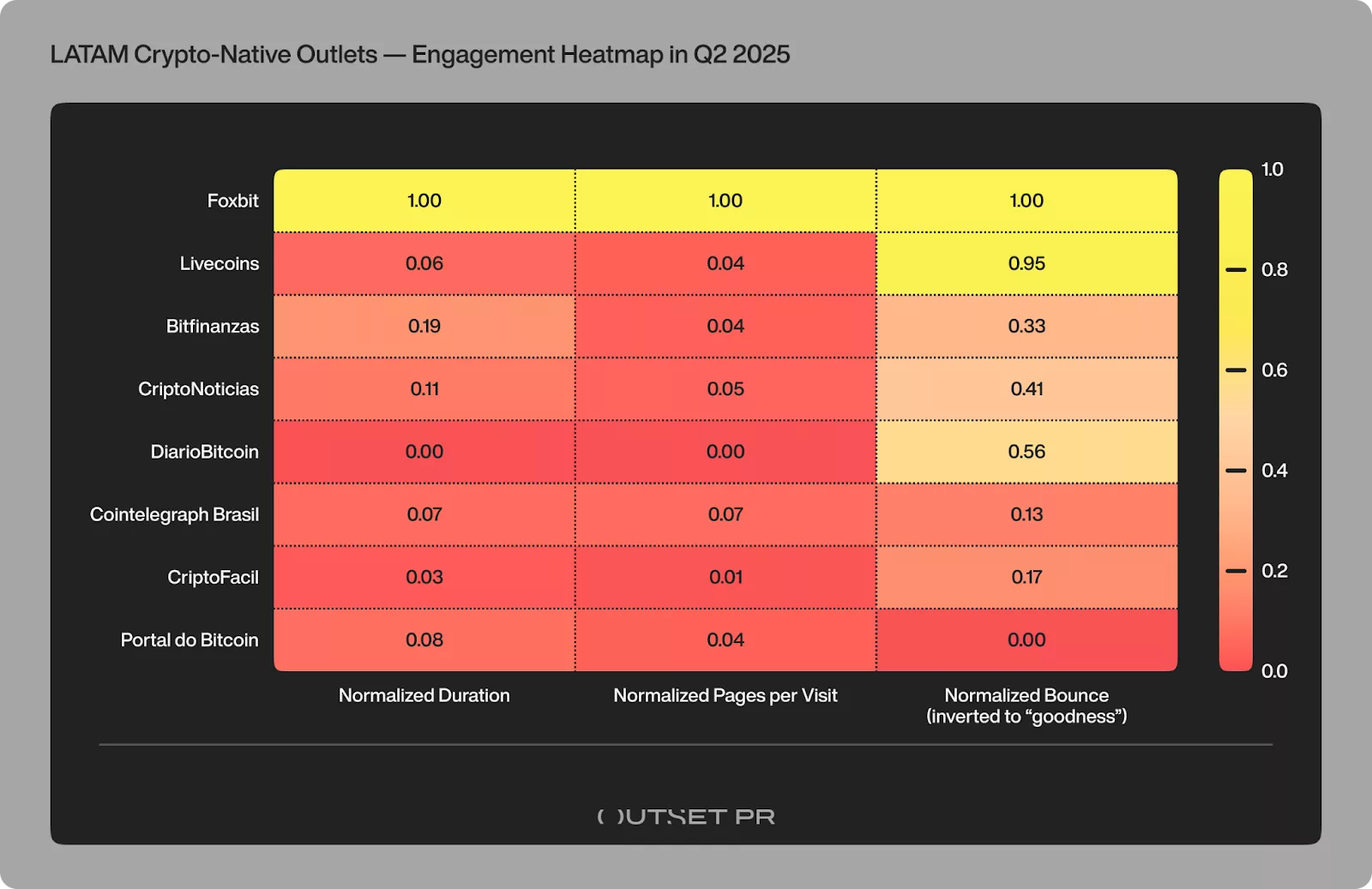

Outset PR’s engagement heatmap comparing reader depth across LATAM crypto media

Across the board, we see a mismatch between reach and retention: several crypto portals managed to attract eyes in Q2, but few convinced those eyes to stick around. Even CriptoNoticias, with its record-high visits, experienced this shallow engagement pattern. High bounce rates and sub-1-minute sessions have become the norm, signaling that LATAM readers are often skimming and exiting rather than engaging deeply with crypto content.

Why are readers so quick to leave? The data suggests it’s not the content quality per se, but a broader shift in how people consume information.

Many Latin American crypto enthusiasts now get their news from aggregator platforms and one-click summaries. This reduces the need to linger on any single site. When headlines and snippets in a feed already answer the basic who/what/when/how/why, readers feel little incentive to click through and read a full article.

Aggregators and AI are driving the new skim culture

We reached out to LATAM crypto editors, and their consensus was clear: audience behavior has changed. Readers are increasingly relying on aggregator surfaces and AI-generated summaries instead of traditional news websites.

Indeed, our survey found that many outlets saw Google referral visits shrink in Q2 as readers used ChatGPT, Perplexity, and other AI tools and aggregators for instant information.

These AI-driven platforms scrape facts and headlines from across the web, delivering bite-sized responses that often satisfy casual curiosity. The result is that fewer clicks and shorter sessions occur on the source sites.

AI referrals during Q2 accounted for roughly 0.97% of crypto-native visits and 1.41% of mainstream traffic. For most outlets, that’s a small share but a fast-growing one. A few sites saw over 40% of their referral traffic come from AI aggregators, while others saw none at all, underscoring the uneven impact.

Whether through AI chatbots or curated news apps, LATAM readers are getting crypto updates in frictionless ways that often bypass the publishers entirely. This skim-first, clickless consumption habit leaves crypto outlets competing not just against each other, but against an ecosystem of feeds and algorithms that siphon attention.

Final thoughts: attention is the new challenge

It might seem confusing that Latin America, one of the world’s most crypto-enthusiastic regions, is seeing its crypto news outlets struggle to retain an audience. But this trend aligns with what we found in other markets, especially across Europe and Asia. The problem isn’t interest itself; rather, it’s how that interest is being met.

In LATAM, with only one top-tier crypto outlet left standing and even it is experiencing brief visits, the balance of power has shifted toward large generalist platforms and alternative content channels. Crypto adoption can climb double digits and on-chain activity can surge, yet crypto-native media infrastructure isn’t able to keep up.

As our prior reports have noted, this challenge is structural. It’s no longer enough to be visible; the real battle is to hold readers’ attention.

For crypto publishers, this means rethinking strategies. Success going forward will require adapting to AI-driven discovery, diversifying traffic sources, and building loyal direct audiences (for example, via newsletters, communities, or exclusive content).

The outlets that act early, including optimizing content for new discovery channels and prioritizing engagement quality over raw click counts, could define how crypto information is delivered as LATAM continues to embrace crypto.

The takeaway from Q2 2025 is sobering but clear: visibility isn’t the metric that matters anymore — attention is.