Why the U.S. doesn’t need a tax on mining: Senator Lummis explains

Senator Cynthia Lummis released a report opposing the proposed 30% energy excise tax on miners.

The politician published a report entitled “Powering Down Progress: Why A Bitcoin Mining Tax Hurts America,” which examines the Administration of U.S. President Joe Biden’s proposal to introduce a 30 percent excise tax on the energy consumed by Bitcoin (BTC) miners.

Table of Contents

What the report says?

However, according to Lummis, this move by the Biden administration could destroy the booming American Bitcoin mining industry, which began to develop after China banned mining.

Senator believes the tax could push industry out of the country and into the arms of other countries. She also noted that the Treasury’s reasons for introducing the tax are based on outdated views about energy use and technology.

Lummis cited the Bitcoin Energy Sustainability and Emissions Tracker as evidence that Bitcoin mining is cleaner than commonly thought, noting that up to 52.6% of BTC mining could be emissions-free.

“In terms of the amount of energy used, Bitcoin mining uses approximately as much energy as standard household appliances. For example, a recent KPMG report found that the total energy used by bitcoin miners is roughly the same as the total energy used by tumble dryers.”

Bitcoin mining paper

The politician also drew attention to the growing role of Bitcoin mining facilities in ensuring the security of the energy system. Mining operations present large, dynamic electrical loads that can be used to balance and redistribute energy across electrical networks as needed.

Lummis also called the proposal a poorly conceived policy that could harm the very goals it is intended to achieve. Thus, the Administration claims that Bitcoin mining threatens the operation of local energy systems but does not provide any evidence. However, research shows that Bitcoin mining strengthens energy networks.

Finally, the senator explained that imposing a 30% excise tax on miners would disincentivize them from finding sustainable forms of energy and new methods of processing energy.

Bitcoin mining tax

In March, the U.S. Presidential Administration proposed a 30% excise tax on electricity used for mining cryptocurrencies like Bitcoin.

The document justified increasing energy consumption to extract digital assets by stating that it harms the environment and increases energy prices.

The tax is expected to be introduced gradually: in 2025, the rate will be 10%; next year, it will be 20%, and then it will reach 30%. The taxable base will be the electricity consumed for mining, even if it is produced from sources not connected to the network.

Lummis criticized the initiative. In her opinion, this tax will deprive the crypto industry of “any foothold” in the United States.

The first attempt to introduce a tax on mining

In May 2023, the Council of Economic Advisers under the Biden administration already proposed including a 30% tax on the electricity used by miners in the federal budget. The proposal called for a 10% tax on miners’ electricity use starting in 2024, gradually increasing to 30% by 2026.

Politicians have pointed to miners’ significant electricity consumption and criticized its negative environmental impact. According to the presidential Administration’s calculations, DAME could generate revenue of $3.5 billion within ten years. The initiative caused a backlash from sizeable American mining companies, which assessed it as an attempt to marginalize the cryptocurrency community and push crypto businesses out of the country.

Politicians also said that crypto mining pollutes the environment and consumes a lot of electricity during rising energy prices. This tax would allow companies to consider better the harm they cause to society, according to the White House.

The White House emphasized that intensive electricity consumption by miners can also increase electricity prices for the population and lead to unstable power grid operation —equipment overloads and service interruptions are possible.

Another reason for introducing such a tax is that mining crypto assets does not bring local and national economic benefits.

American miners consume electricity as much as an entire state

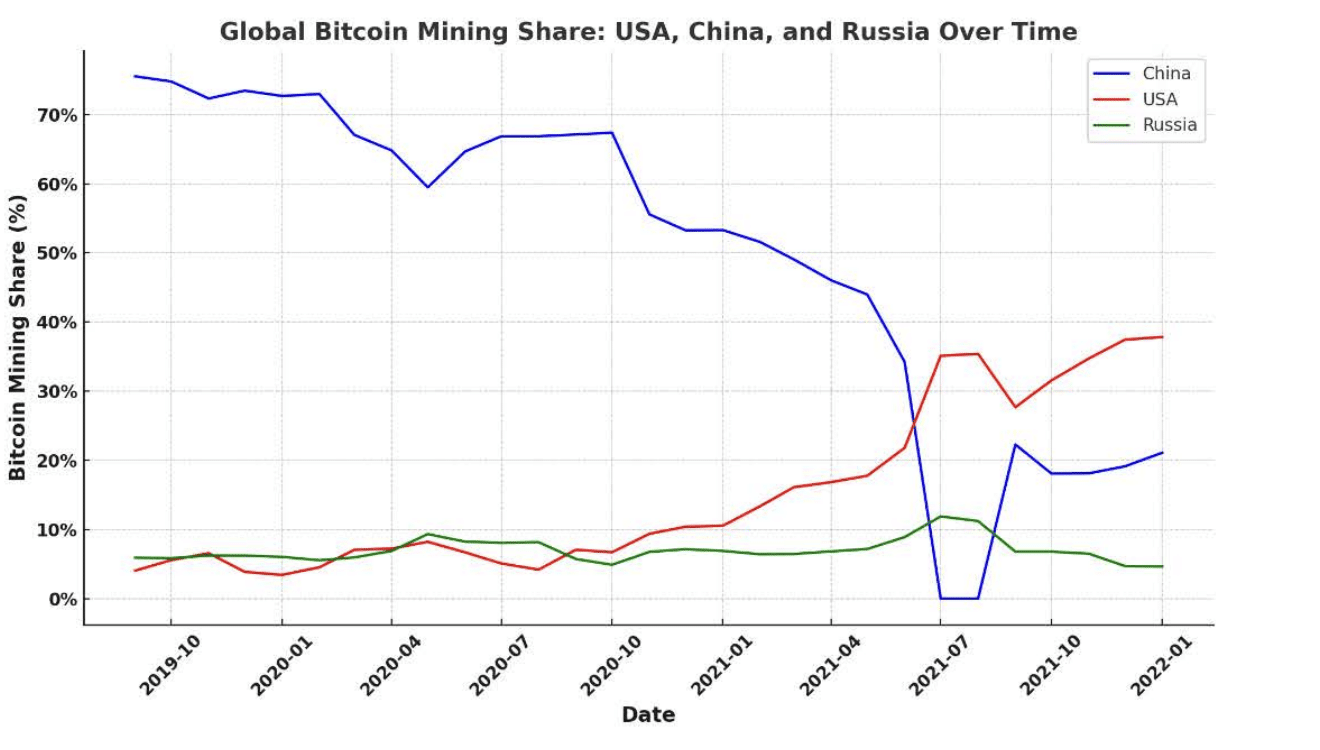

Although Americans started mining about a decade ago, the industry has grown significantly since 2019. According to analysts, the recent rise is mainly due to the movement of cryptocurrency mining operations to the United States from China after the republic introduced a crackdown on miners in 2021.

Last year, crypto miners accounted for 0.6% and 2.3% of all U.S. energy consumption. According to figures from the Energy Information Agency (EIA), the entire state of Utah spent about the same amount of electricity.

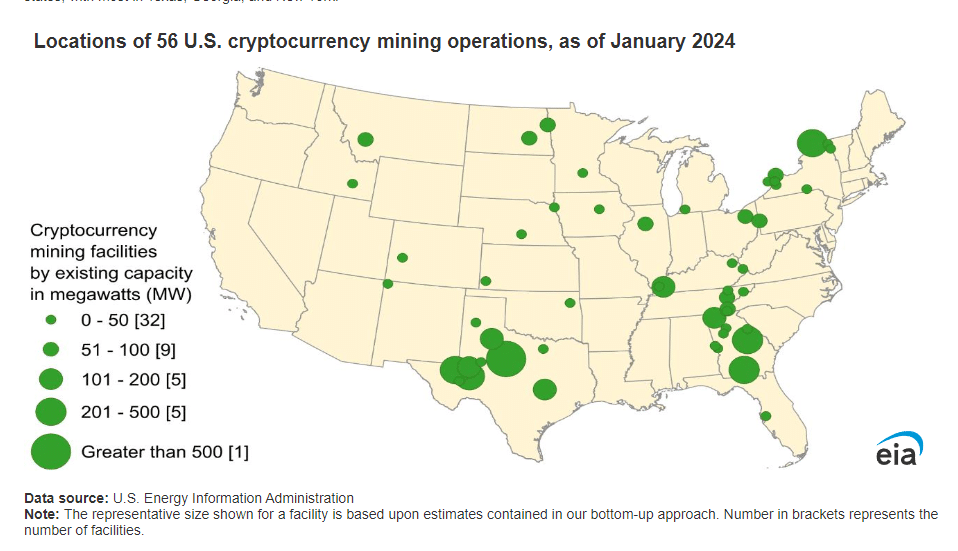

At the end of last year, about 137 farms in the country belonged to cryptocurrency mining companies. The equipment is spread across 21 states, including the most active in Texas, New York, and Georgia. In 2023, Bitcoin mining energy consumption reached between 0.2% and 0.9% of global energy consumption.

How will the law affect mining in the U.S.?

Last year, the U.S. ultimately abandoned imposing an additional 30% tax on industrial crypto-mining businesses. If the law is abandoned again, the mining industry in the United States will kick-start the development.

This can become strategic for the United States, allowing it to maintain a leading position in the digital economy and attract high-tech investment on the world stage. Therefore, it is likely that the proposed restrictions and increases in tax rates for miners will not be accepted and implemented.