Why was Bitcoin price down overnight?

Bitcoin price has pulled back over the past three days as the recent rally paused ahead of next week’s election.

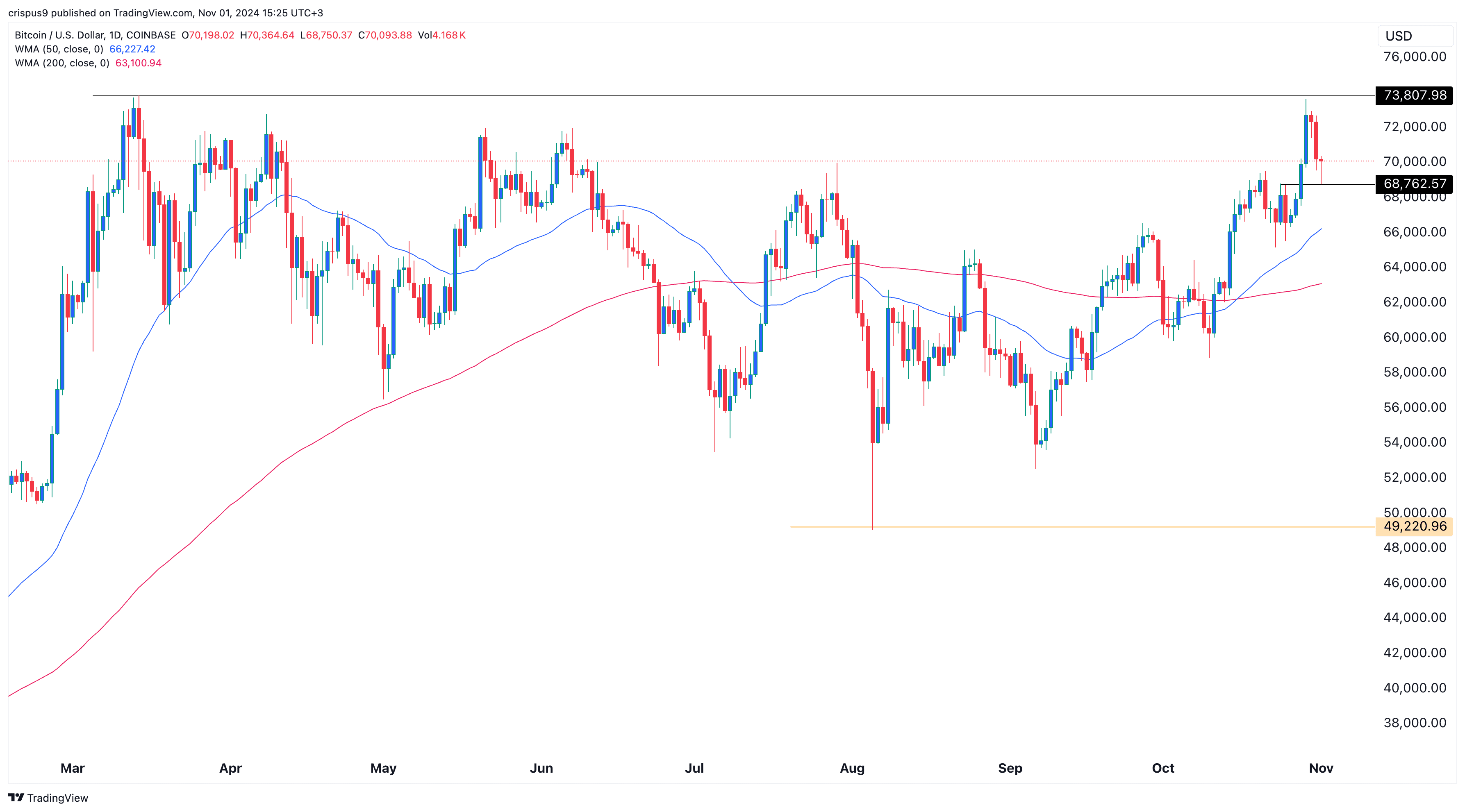

Bitcoin (BTC) retreated to $68,762, down 6.60% from its highest level this year. This decline has also triggered further sell-offs among altcoins, with the Mask Network (MASK), Immutable X (IMX), Doland Tremp, and Moo Deng being some of the worst performers.

Bitcoin and these altcoins have declined partly due to the reduced odds of Donald Trump winning the general election next week. According to Polymarket, his odds have dropped to 63% from a high of 67% earlier this week.

Trump’s odds have also fallen in other prediction markets, such as Kalshi and PredictIt. This shift likely reflects that all official polls in swing states remain close, suggesting an unpredictable outcome.

Historical polling inaccuracy also contributes to investor caution. In 2016, most polls predicted a Hillary Clinton win, and in the last midterm election, many polls pointed to a clear Republican sweep in Congress, neither of which materialized.

These concerns explain why most Trump-themed assets have pulled back in recent days. Trump Media & Technology stock has dropped by 35% from its highest level this year, and most Trump meme coins, such as Trumpcoin, MAGA, and TRUMP, have also declined.

Trump is widely regarded as the most pro-crypto president in recent years. According to Arkham, his crypto portfolio is worth over $6 million. He has also pledged to make the U.S. a global crypto hub by reducing regulations and has committed to pardoning Ross Ulbricht, the founder of Silk Road.

Meanwhile, odds of Bitcoin rising to a record high have retreated in the past few days. Data by Polymarket places these odds at 83%, down from this week’s high of $94.

Bitcoin price has favorable technicals

Technical indicators suggest that Bitcoin may have further upside. The recent pullback occurred after Bitcoin neared the significant resistance level of $73,777, a common point where assets pause after testing key resistance.

Bitcoin has formed a golden cross pattern, with the 200-day and 50-day moving averages crossing.

It has also formed an inverse head and shoulders pattern, a bullish technical signal. Additionally, ETF inflows have surged to over $24 billion. Given these factors, Bitcoin is likely to bounce back and potentially surpass its all-time high this week.