Widespread negative crypto sentiment ‘evident’ across regions, CoinShares says

Digital asset investment products experienced multi-million outflows last week, driven by reduced expectations of a U.S. interest rate cut following stronger economic data.

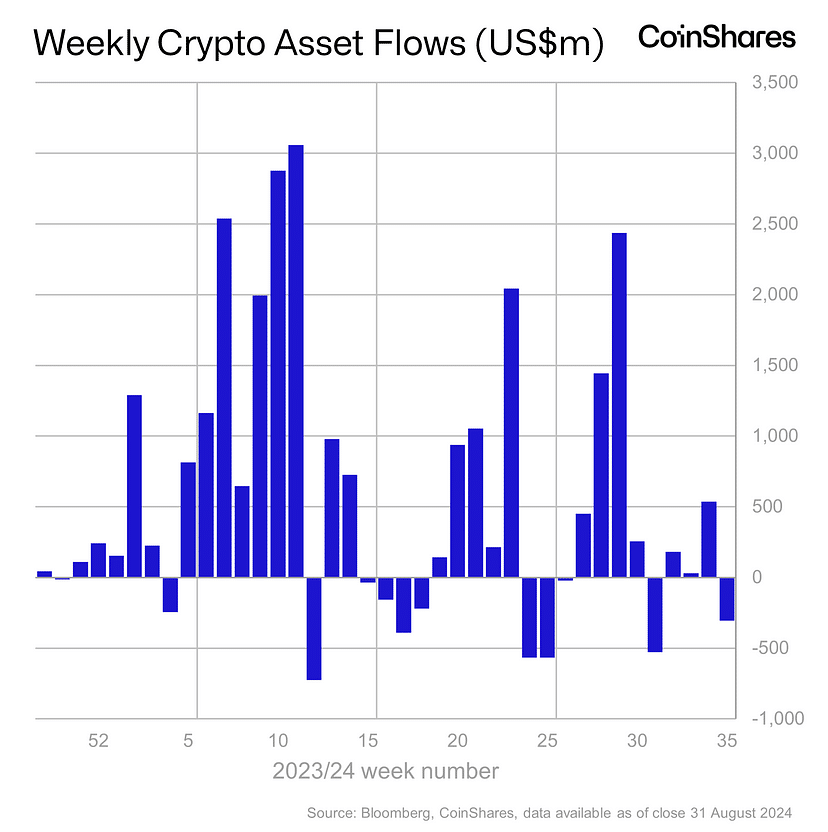

The crypto market is seemingly gripped by widespread negative sentiment “across various providers and regions,” as digital asset investment products saw outflows totaling $305 million last week, according to CoinShares.

In a Sept. 2 blog post, CoinShares head of research James Butterfill said the outflows appear to have been driven by stronger-than-expected U.S. economic data, which has reduced the likelihood of a 50-basis point interest rate cut by the Federal Reserve.

“We continue to expect the asset class to become increasingly sensitive to interest rate expectations as the FED gets closer to a pivot.”

CoinShares head of research James Butterfill

The U.S. led the outflows, with $318 million withdrawn, while Germany and Sweden also saw outflows of $7.3 million and $4.3 million, respectively, data shows. In contrast, Switzerland and Canada recorded minor inflows of $5.5 million and $13 million.

Bitcoin (BTC) bore the brunt of the outflows, shedding nearly $320 million. However, short Bitcoin investment products saw their largest inflows since March, attracting $4.4 million for the second consecutive week. Ethereum (ETH) also faced outflows of $5.7 million, with trading volumes stagnating at just 15% of the levels seen during the U.S. ETF launch week.

Solana (SOL) defied the overall trend, attracting $7.6 million in inflows. Butterfill noted that blockchain equities also experienced positive momentum, with $11 million flowing in, particularly into investment products focused on Bitcoin miners.

As crypto.news reported earlier, Bitcoin dropped by almost 10% in August, while the Nasdaq 100 index rose by over 2% and gold peaked at an all-time high of $2,530. The performance occurred despite the U.S. dollar index plunging to $100.1, down by over 6% from its highest point this year. Analysts at French blockchain firm Kaiko suggested that the likely reason for the sell-off was that investors are concerned about the falling liquidity in the Bitcoin market and rising worries that governments will start selling their holdings.