Will Bitcoin price rebound as the Fear and Greed Index crashes?

Bitcoin price stabilized today, Nov. 18, as investors bought the dip and waited for the upcoming FOMC minutes and Nvidia earnings.

- Bitcoin price has crashed to its lowest level since April.

- The Crypto Fear and Greed Index has moved to the extreme fear zone.

- Technical analysis suggests that Bitcoin is about to bottom.

Bitcoin (BTC) rose to $93,700, up modestly from this week’s low of $88,790. It remains in a deep bear market, down ~26% from its year-high.

Crypto Fear and Greed Index

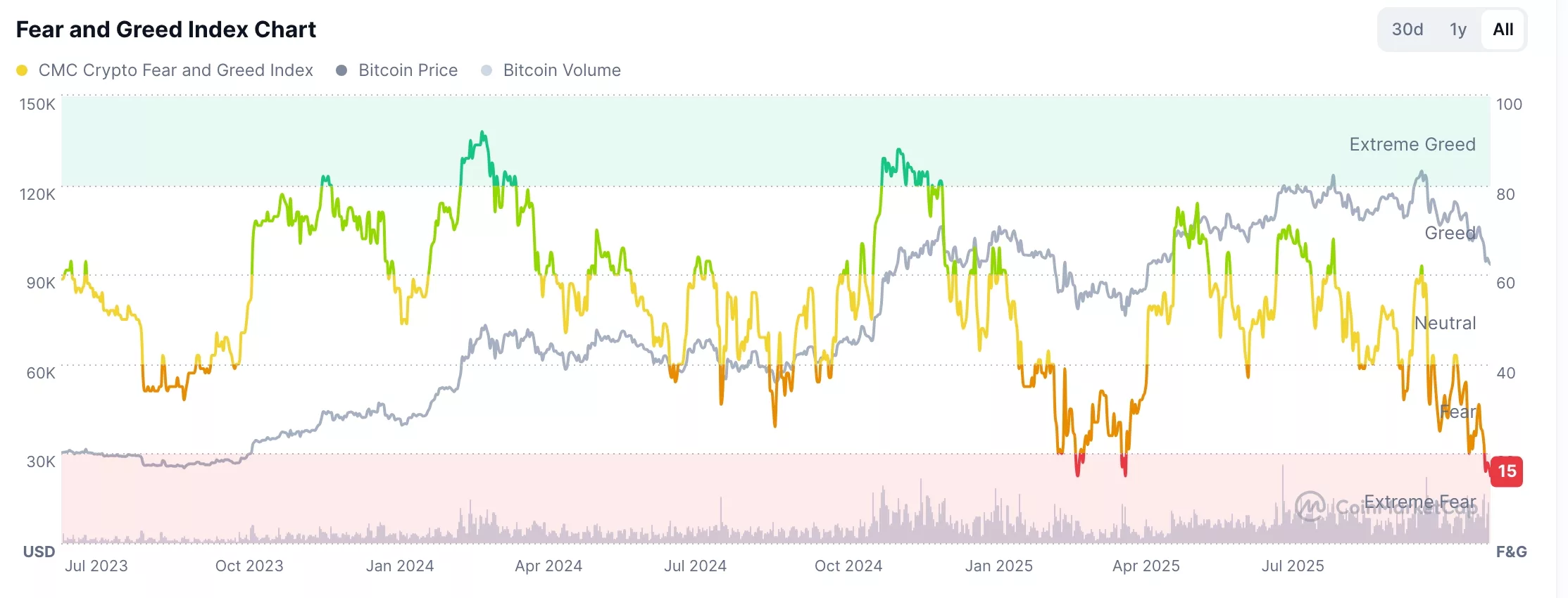

A potential catalyst for BTC’s price is the ongoing crash, which has driven market fear. Data compiled by CoinMarketCap shows that the Crypto Fear and Greed Index has dropped to the extreme fear zone of 15, its lowest level since April this year.

The Crypto Fear and Greed Index is calculated by looking at several data points, including price momentum of Bitcoin and other altcoins, volatility, derivatives market, and the relative value of Bitcoin in the market.

More data shows that the CNN Money Fear and Greed Index has slumped to 12, its lowest level since April. All sub-indices in the index, such as market volatility, put and call options, safe-haven demand, junk-bond demand, and stock price strength, have plunged into the extreme fear zone.

In most cases, Bitcoin typically starts its bull run when there is fear in the market. A good example of this is what happened in July last year, when the Fear and Greed Index dropped to 26 and Bitcoin moved to $54,000. A few months later, Bitcoin jumped to a new record high.

Similarly, the Crypto Fear and Greed Index dropped to the extreme fear zone of 19, and BTC moved to $79,000. A month later, it reached a new record high of nearly $109,000. Similarly, most Bitcoin bear markets start when the coin moves to extreme greed.

Bitcoin price technical analysis

Bitcoin’s technicals suggest it has some upside left. For one, the Relative Strength Index has moved into the oversold territory at 30. The Percentage Price Oscillator has also fallen to the lowest level this year.

The coin has also dropped to the double-bottom target of $92,000. It is also forming a hammer candlestick pattern. Therefore, the most likely scenario is where it rebounds to the psychological point at $100,000. A move below this week’s low of $88,790 will invalidate the bullish outlook.