Will Mt. Gox payouts spark Bitcoin crash?

Given some of those who owed money for 10 years were among BTC’s earliest adopters, fears of a mass-selling event may have been exaggerated.

There’s a black cloud looming over the crypto markets — the ghost of a crypto exchange that collapsed over 10 years ago.

Mt. Gox once handled over 70% of the world’s Bitcoin transactions, but went under after up to 850,000 BTC was stolen in audacious hacks.

The doomed Japanese trading platform went bankrupt in 2014, and its users — many of whom were early Bitcoin adopters — haven’t been paid since.

This, in part, is due to painstaking efforts to recover some of the stolen crypto. About 142,000 BTC has now been recovered, and is set to be distributed to creditors.

While this means that victims won’t be made whole, they can take some comfort in the fact that Bitcoin’s worth substantially more than it was a decade ago. In dollar terms, they’ll still be up on their investment — albeit not as rich as they would have been.

What’s more, the BTC hard fork in 2017 also means they’ll be entitled to a chunk of Bitcoin Cash.

Compensation is due to be paid to creditors by October, ending a long-running saga after repeated delays. But how is the process going, and why is it making some analysts nervous?

‘Beware of Mt. Gox’

Mt. Gox customers have been sharing updates on how their claims are progressing through a specially created subreddit.

And there was frenzied excitement on April 22 when some accounts were updated. Some have already received an early lump-sum repayment in cash — and others have been told how much BTC and BCH they can expect to receive.

In a recent report, K33 Research argued that this 142,000 BTC haul — worth about $9 billion at current market rates — could become a “negative price contributor” in the weeks to come.

This is based on fears that those who are finally reunited with their crypto will immediately swap it for fiat, ramping up selling pressure in the markets.

But there are a few things worth bearing in mind here.

The Mt. Gox Investment Fund — the creditor that’s owed the most — has confirmed it’s got no plans to offload the Bitcoin it receives.

Given the sheer amount of admin involved, transactions are unlikely to happen in one go. Customers in some regions have already received the initial cash payments they were entitled to faster than others.

Bitcoin’s daily trading volumes are rarely below $10 billion, meaning there’s a decent chance that the market would be able to withstand selling pressure. That being said, confirmation of payouts alone might be enough to spook traders.

And another factor worth considering is this: many of those set to receive a payout believed in Bitcoin long before it reached mainstream consciousness.

Hold or sell?

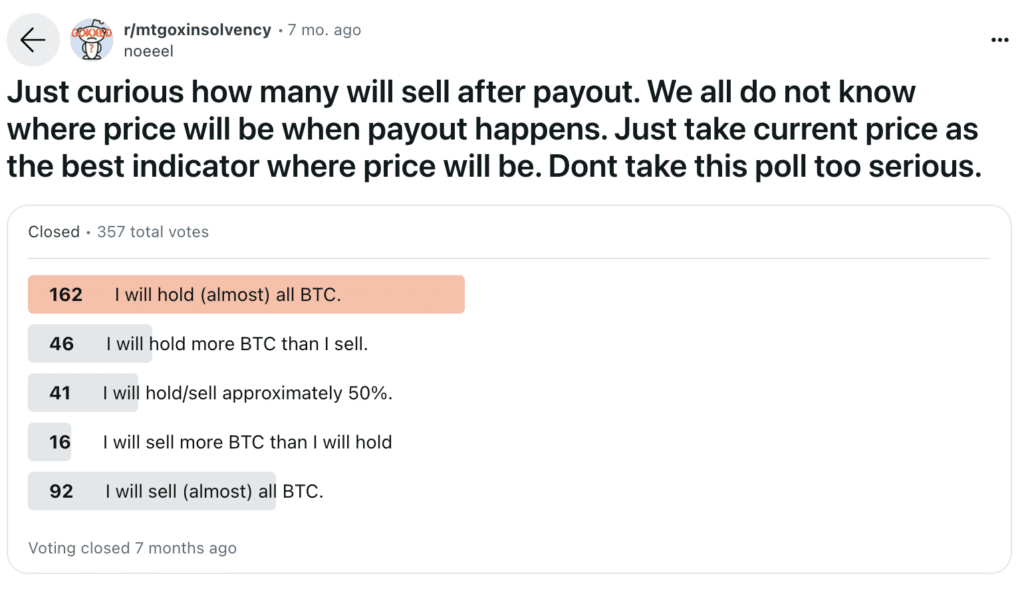

Late last year, a fascinating poll on the Mt. Gox subreddit offered an insight into what everyday creditors are thinking.

Of the 357 who voted, just 25% said they intended to sell almost all of their Bitcoin. About 11% revealed plans to swap half of the crypto they receive for fiat.

But by far, the biggest bloc of voters — 45% — vowed to hold on to their digital assets.

“I held for 10 years. I don’t mind holding for another 10,” one quipped.

“Already made all the profits I need. In it for the heck of it, so why sell? I want to see where Bitcoin goes and be a part of it,” another added.

Some did express a desire to bow out of the market — and spend their newfound cash on vacations and other investment opportunities… including rival cryptocurrencies.

End of an era

In dollar terms at least, Mt. Gox remains the biggest crypto heist in the industry’s history.

While the U.S. has charged two Russian nationals in connection with laundering stolen Bitcoin, the identities of others who were involved in the audacious attack remain unknown.

And while the market today is unrecognizable compared with when the exchange went bankrupt in February 2014 — when Bitcoin was worth a mere $550 — you could argue that history keeps on repeating itself.

Why? Because a long line of creditors has now formed at other trading platforms that suddenly halted withdrawals and went under.

More than 100,000 are awaiting compensation after FTX imploded — that said, the recent rise in crypto valuations meant they could receive more than their initial claim amount.