Worldcoin hits $1b market cap as OpenAI, NVIDIA unleash bullish catalysts

Worldcoin’s price soared to an all-time high of $9 on Feb. 22, up by a staggering 336% in the last 10 days as OpenAI’s SORA launch and NVIDIA earnings emerge as key drivers.

On Feb. 22, Worldcoin (WLD) achieved unicorn status, crossing the $1 billion market capitalization milestone.

WLD’s emergence on the crypto top-gainers chart is largely attributed to bullish headwinds from NVIDIA’s stock performance and OpenAI’s recently shipped SORA generative AI video rendition model.

It remains to be seen if Worldcoin’s underlying ecosystem’s growth can sustain the momentum or if the rally will peter out as the media hype cools.

Worldcoin adds $840 million market cap in 10 days

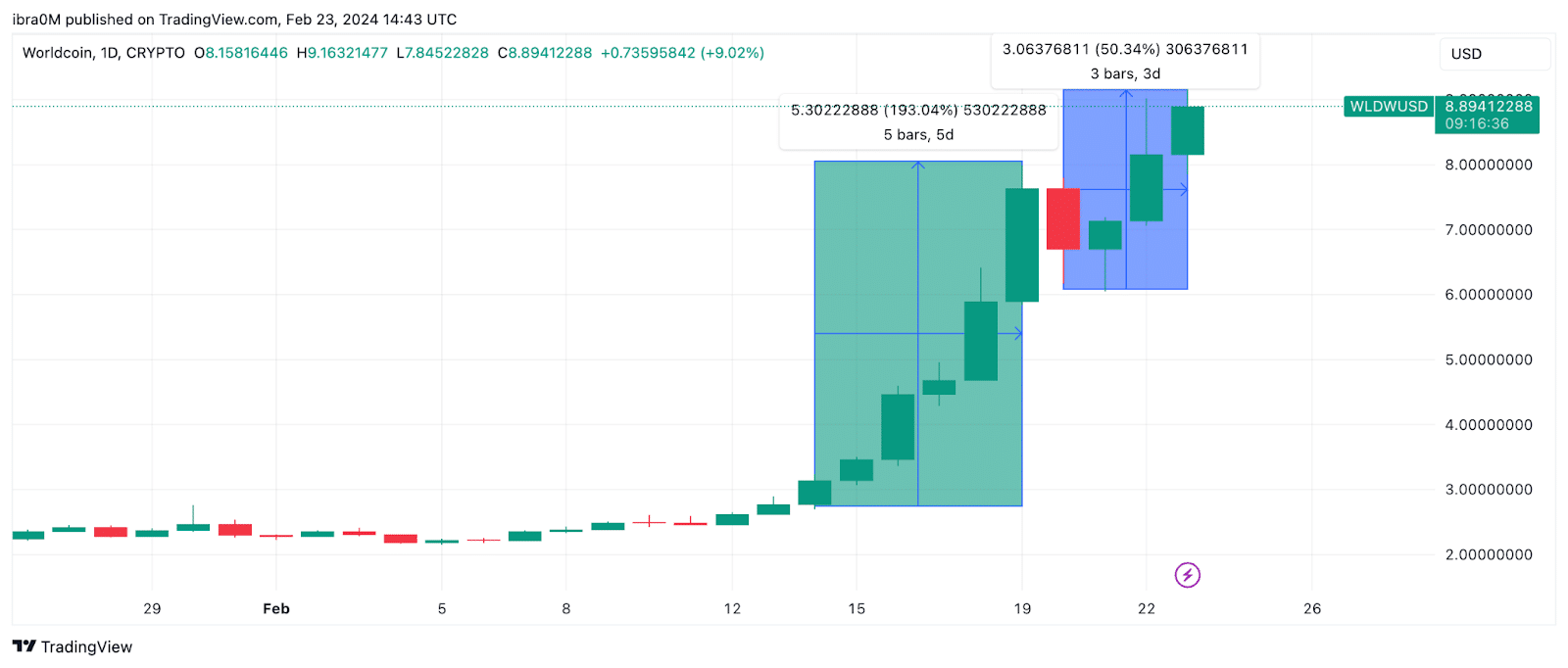

On Feb. 22, Worldcoin’s native WLD token stretched its remarkable price rally in February 2024 to a staggering 320%, adding $840 million to its market capitalization within a frenetic 10-day period.

After a tepid start to the month, Worldcoin’s price trend flipped bullish on Feb. 15 when OpenAI soft-launched its latest text-to-video AI model, Sora.

Between Feb. 15 and Feb. 19, WDL price soared 160%, rising from $3 to a global peak of $8.

At the $8 territory, a rapid profit-taking wave saw WLD price retrace toward $6 on Feb. 21, as investors grew hawkish on NVIDIA’s Q4 earnings.

However, the leading chip manufacturer posted record-breaking earnings on Feb. 21, sending its share price to all-time highs. Along with other AI-related risk assets, WDL price also rocketed further, hitting an all-time high of $9, adding another 50% to its February gains.

Beyond the media hype, the Worldcoin project has witnessed increased global adoption since the turn of the year.

Worldcoin-funded addresses were on the rise before the rally

WLD’s over 300% price breakout in the last 10 days has been credited to the developments surrounding NVIDIA and OpenAI and for a good reason.

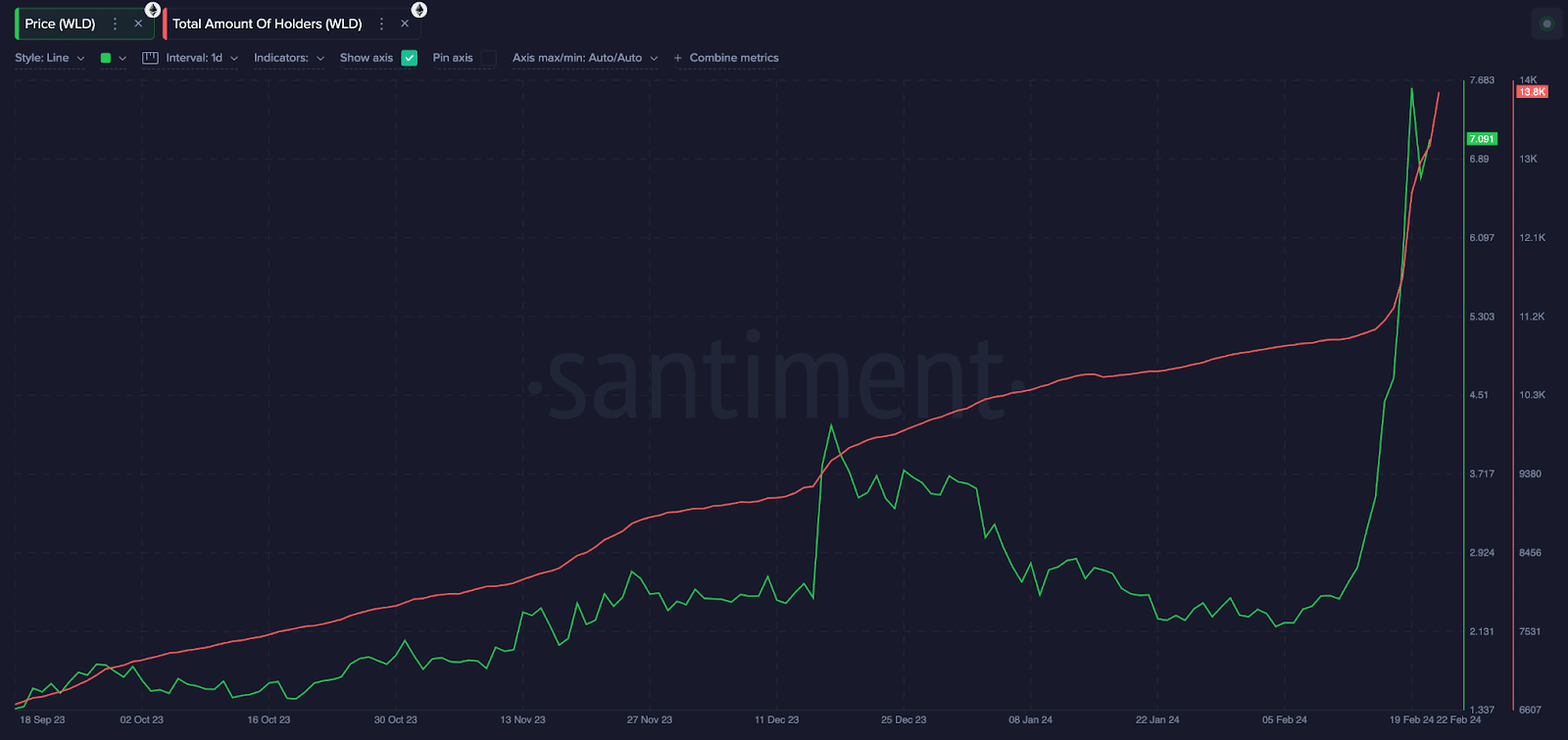

However, looking past positive headlines, on-chain data trends show that Worldcoin has attracted a steady growth in user base, even before the latest frenzy.

The Santiment chart tracks the number of unique addresses holding units of a specific cryptocurrency. It shows that Worldcoin has attracted 3,608 new funded addresses since the turn of the year, bringing the total to 13,800 at press time on Feb. 23.

A closer look at the red trendline shows that while WDL price dipped 50% from $4.21 to $2.20 between Dec. 17 and Feb. 5, it continued to attract steady growth in new investor addresses.

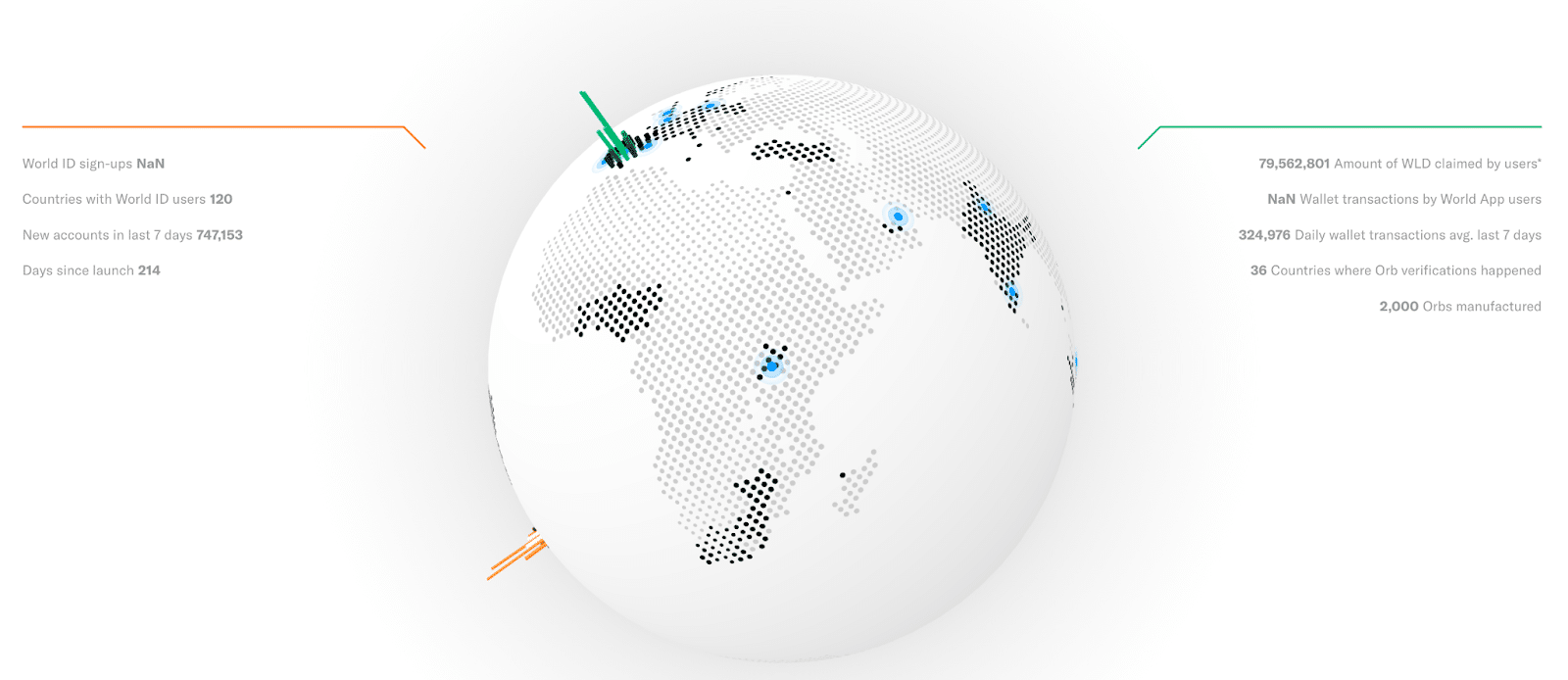

More data from the Worldcoin official website shows that 3.5 million people from 120 countries have now signed up for unique World IDs.

This remarkable growth within the on-chain WLD ecosystem came after initial pushback surrounding its IRIS scanning and data harvesting concerns from critics.

It, however, remains to be seen if this growth translates into steady on-chain transactions and network activity sufficient to keep WLD on its current upward trajectory.

Worldcoin price prediction: $10 is the next major resistance

In terms of short-term price action, without another comparable bullish catalyst, Worldcoin’s price will likely enter a pullback below $8 in the coming days.

With prices trending at all-time highs, virtually every existing holder sits on unrealized profits. As media fanfare surrounding SORA and NVIDIA wanes, some strategic investors could look to take some profits.

The upper and lower Bollinger bands are stretched to extremes, pointing in opposite directions. This rare market alignment happens when an asset has reached overbought conditions and is primed for a pullback.

If this scenario plays out as predicted, losing the $8 support could trigger a free fall toward the 20-day SMA price at $4.20, the previous peak recorded before the blistering rally set in 10 days ago.

On the other hand, there’s a chance bullish investors could hold out for more gains, especially with the official launch of SORA still to come. In this case, the bulls must first scale the $10 psychological resistance.

This week’s price trends show that WLD witnessed a momentary pullback each time the price approached nominal milestones at $8 and $9, respectively. A repeat of this pattern could see the WLD price rejected from $10 during the next rally.