Wormhole unveils new governance staking feature, W token rises 12%

Wormhole’s governance token, W, has experienced a significant surge of 12% following the introduction of a new staking feature.

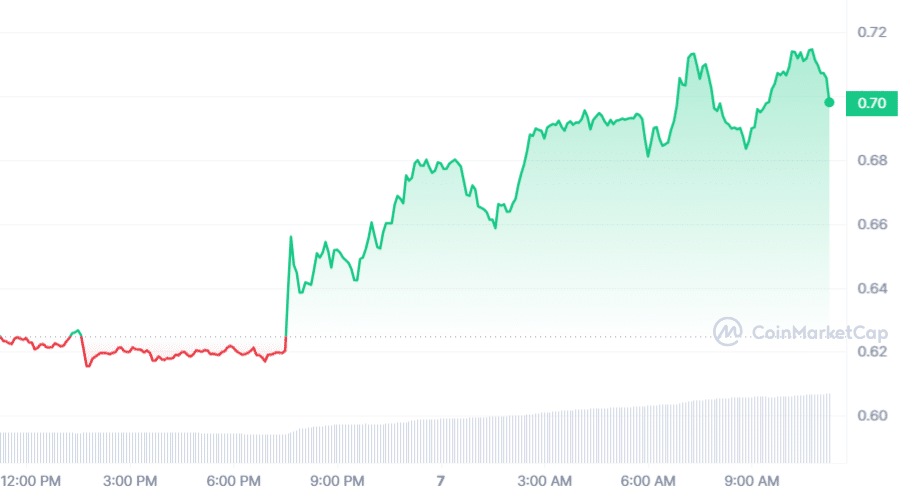

At the time of writing, the W token was exchanging hands at $0.7113, up 12% in the last 24 hours. In the same timeframe, the crypto asset also witnessed a trading volume of $225 million, per data from CoinMarketCap. Its market cap stood at $1.25 billion.

Wormhole (W) is a cross-chain messaging protocol that facilitates the transfer of assets and data across different blockchain networks.

In a June 6 X post, the Wormhole team revealed the launch of the “Stake for Governance” feature for W token holders. The new functionality allows W token holders to stake their tokens to participate in governance decisions. This helps in promoting a more decentralized and community-driven management structure.

Dan Reecer, co-founder of Wormhole Foundation, also took to X on the same day to provide additional details on the significance of this launch. He explained that of the staking feature marks the first step in the W staking roadmap, introducing the industry’s first multichain governance system, MultiGov.

W token holders can now delegate their tokens either to themselves or to a chosen delegate, enabling a seamless multichain experience for voting and delegating in any DAO.

Reecer also noted that MultiGov, developed in collaboration with Tally and ScopeLift, allows users to delegate and vote from any connected Layer 2 network and, soon, Solana.

Tally is a governance platform that helps DAOs manage their proposals and voting. On the other hand, ScopeLift is a development team that focuses on building tools for decentralized governance.

Unlike other protocols, such as Uniswap, which hosts its governance on the Ethereum mainnet, MultiGov offers a more convenient and cost-effective solution for users across different chains. The innovation aims to provide a truly multichain experience and chain abstraction.

For those looking to stake for governance, users can head to the Tally Governance Portal. There, they can transfer their W tokens from Solana to a supported EVM chain, such as Ethereum, Arbitrum, Optimism, or Base.

Once transferred, users can choose a delegate and stake their W tokens for governance.

Additionally, Wormhole has implemented a daily transfer limit of 100 million W tokens from Solana (SOL) to EVM chains to ensure security.

The next steps for Wormhole governance include completing and auditing the Solana integration into MultiGov. After that, the acceptance of proposals and the beginning of voting will follow.

Wormhole’s efforts to expand the reach of the W token are evident in its recent listing on Robinhood, a major cryptocurrency exchange. The W token is now available to trade with European customers on the platform. Additionally, investment firm Multicoin Capital revealed in an April 3 blog post that it had co-led a $225 million funding round in Wormhole last year.

According to analysts at Invezz, the Wormhole token has surged from $0.513 on May 14 to over $0.718, breaking past key resistance at $0.70.

Despite trading above the 50-period and 25-period moving averages, it has formed a rising broadening wedge, a bearish pattern. This puts the token at risk of a reversal down to $0.60, the analysts noted.

Meanwhile, a trader known as Degen_Maximum sees the potential for the W token to double in value in the short term, adding an optimistic twist to its recent performance.