Xinbi emerges as a $17.9B hub for illicit crypto flows despite crackdowns

The Chinese-language guarantee marketplace Xinbi has continued to operate at scale despite sustained enforcement efforts targeting illicit crypto infrastructure, recording approximately $17.9 billion in total transaction volume since mid-2025, according to on-chain analysis from TRM Labs.

- The Chinese-language guarantee marketplace Xinbi has processed roughly $17.9 billion in total transaction volume since mid-2025, according to on-chain analysis by TRM Labs.

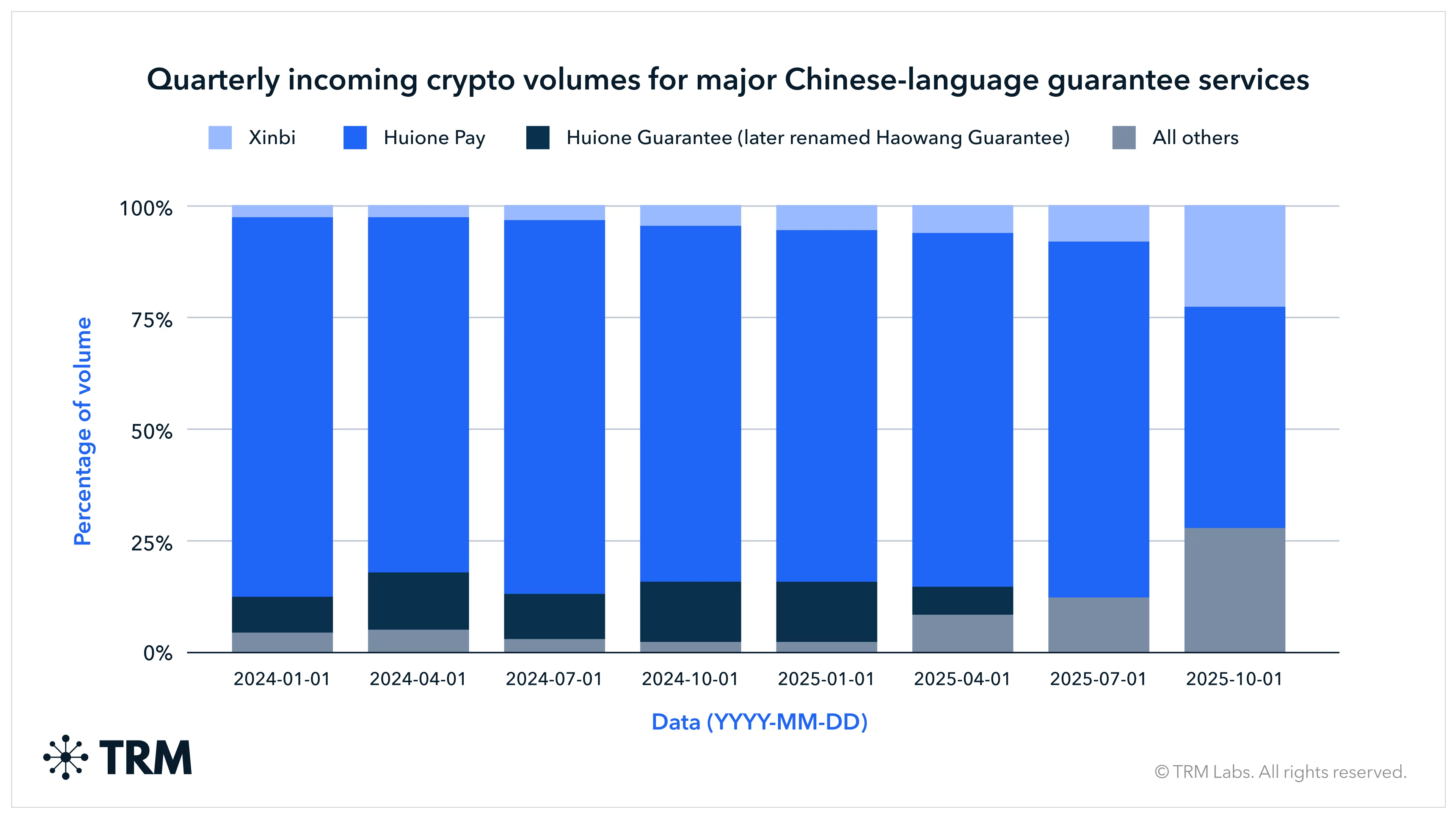

- Xinbi’s activity continued to grow even as enforcement actions sharply reduced volumes at rival platforms such as Haowang and Tudou.

- Analysts say Xinbi adapted by migrating across messaging platforms and launching its own wallet service, allowing illicit flows to persist despite crackdowns.

Data shows Xinbi has received nearly $8.9 billion in inflows, showing its resilience at a time when similar platforms have seen activity collapse following regulatory and law enforcement action.

Xinbi grows as rival platforms falter

Guarantee marketplaces function as informal escrow services, often facilitating scams, money mule operations, and other illicit activity by enabling rapid movement of funds with limited oversight.

Xinbi’s continued growth comes amid broader crackdowns that significantly disrupted competing services. In spring 2025, enforcement actions, including U.S. Treasury findings and coordinated takedowns of messaging channels, led to sharp declines in activity at platforms such as Haowang and Tudou.

While those services struggled to recover, Xinbi’s inflows nearly doubled between May and December 2025, suggesting displaced users migrated to its ecosystem.

TRM Labs notes that Xinbi adapted quickly by shifting its operations across platforms. While initially centered on Telegram, the marketplace expanded to alternative messaging apps such as SafeW and introduced its own wallet service, XinbiPay.

These changes allowed Xinbi to preserve continuity even as messaging channels were removed or restricted, reducing the impact of platform-specific enforcement actions.

Wallet integration complicates fund tracing

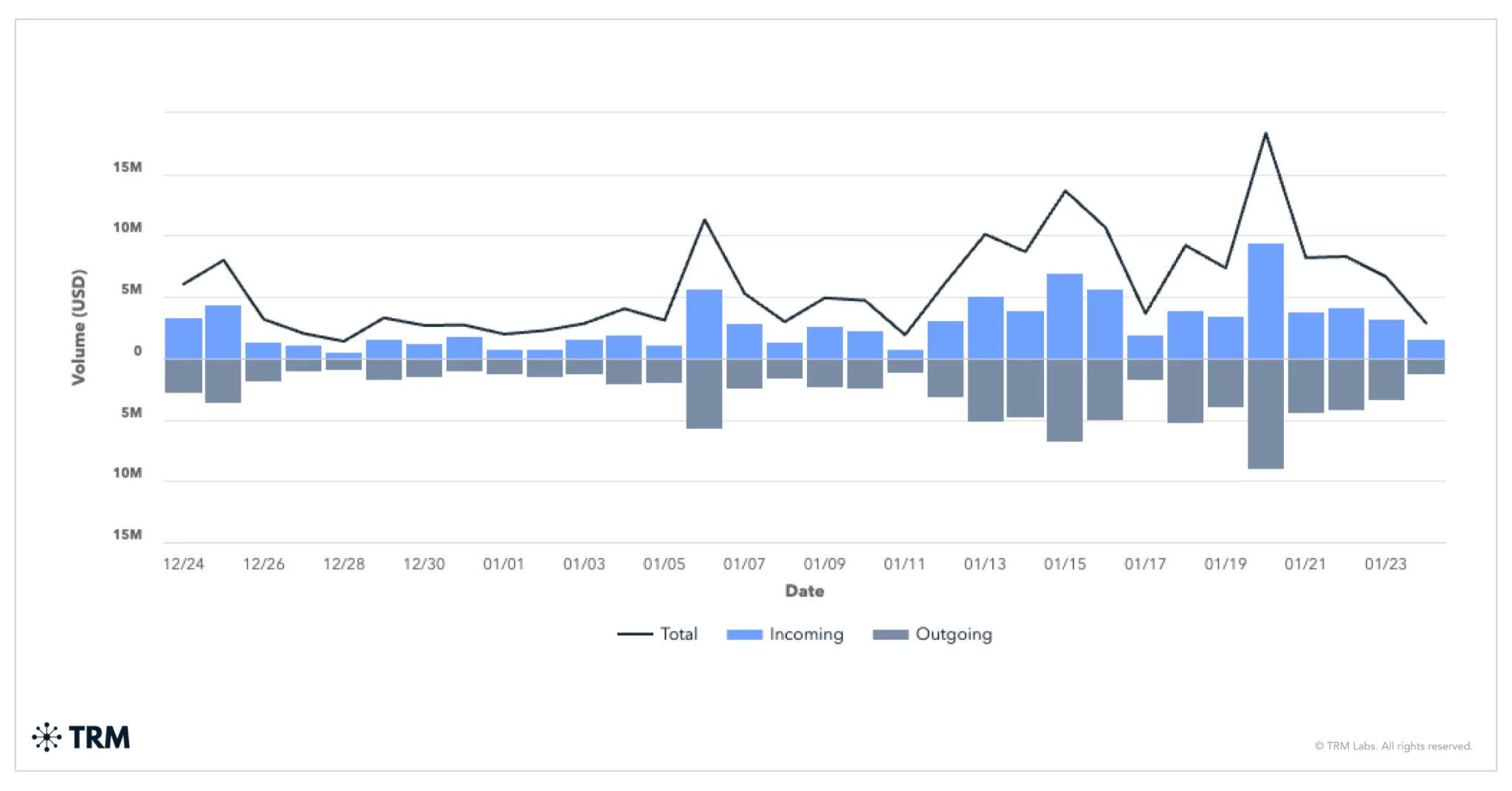

On-chain patterns show a brief slowdown in activity during December 2025, followed by a sharp rebound in early 2026 as users transitioned to the new infrastructure.

The integration of wallet services has enabled funds to circulate internally, complicating tracing efforts and reducing reliance on external exchanges.

Guarantee marketplaces like Xinbi play a critical role in crypto-enabled financial crime by providing escrow, dispute resolution, and payment coordination services without meaningful Know Your Customer controls.

This positioning allows them to serve as central hubs in laundering chains, often bridging scam proceeds to broader crypto markets.

TRM Labs warns that while enforcement actions have disrupted individual platforms, Xinbi’s continued growth highlights the challenges authorities face in dismantling decentralized and adaptive networks. Targeting these facilitators remains a priority, as disrupting guarantee services can expose illicit funds earlier in the laundering process and limit their ability to re-enter the financial system