XRP price crashes as CME futures open interest surges: buy the dip?

XRP price crashed below the support at $3, coinciding with the ongoing crypto market crash.

- XRP price has crashed and moved into a bear market this month.

- CME futures open interest has soared to a record high.

- XRP has numerous catalysts, including the growth of RLUSD stablecoin.

Ripple (XRP) token was trading at $2.9380, down by 20% from its highest point this year, meaning it has moved into a bear market. Still, its chart patterns, soaring CME futures open interest, and the upcoming ETF approvals point to a strong comeback.

XRP price to benefit as CME futures open interest soars

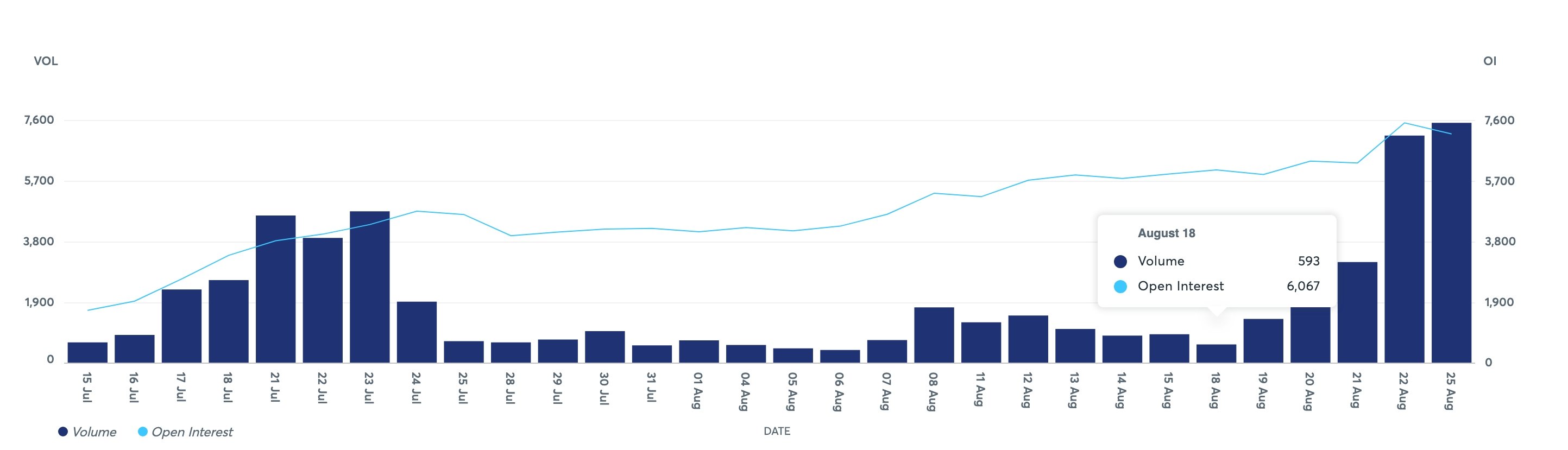

The Ripple token has numerous catalysts that will push it higher in the coming weeks. One of them is the soaring futures open interest on CME, a sign of high demand from American institutional investors.

CME data shows that the open interest hit a record high of 7,197 contracts, compared with the previous day’s 7,545. The figure has been in a strong uptrend after bottoming at 6,000 on Aug. 18.

More data from Wall Street shows that Teucrium and ProShares leveraged XRP ETFs have had substantial inflows since their recent launches. XXRP has over $400 million in assets, while UXRP has $100 million.

XRP price has more fundamental catalysts that may push it higher in the longer term. One of these came out on Monday when Gemini launched the first XRP rewards credit card that will ensure everyday purchases.

Ripple USD’s (RLUSD) assets have moved from zero in December last year to over $687 million today, making it one of the fastest-growing stablecoins in the industry.

Ripple price technical analysis

The daily timeframe shows that the XRP price has formed two highly bullish chart patterns. It is now in the process of forming a falling wedge, which comprises two descending and converging trendlines. These two lines are nearing their confluence, which is where breakouts happen.

Interestingly, the wedge is part of the formation of the handle section of the cup-and-handle pattern. In addition to this, the XRP price is above the 100-day Exponential Moving Average.

Therefore, the most likely scenario is that XRP will remain in the bear market for a while and then resume the uptrend. The most likely scenario is that it jumps initially to the year-to-date high of $3.6553, up by 25% from the current level. The C&H pattern’s target price is $5.2.