XRP price reclaims $2.40 as Open Interest signals renewed bullish strength

XRP’s price reclaims the $2.40 level, with rising open interest indicating renewed market confidence and the potential for continued bullish momentum after a volatile week.

- XRP reclaims $2.40 Point of Control with strong demand.

- Rising open interest suggests renewed accumulation.

- Sustained closes above $2.40 could lead to rallies toward $2.70–$3.00.

XRP’s (XRP) price has reclaimed the $2.40 level, showing early signs of renewed strength following a volatile week of trading. The current price region coincides with the Point of Control (POC), making it a key technical area that could determine the next directional move.

Adding to this, Ripple-backed Evernorth Holdings plans a $1B Nasdaq debut to boost institutional XRP use, potentially strengthening market confidence. As price stabilizes above this level $2.40 level, on-chain and derivatives data suggest that sentiment is shifting back toward accumulation, supported by a rise in open interest.

XRP price key technical points

- Key Resistance Reclaimed: XRP has moved back above the $2.40 Point of Control, a major volume-based resistance.

- Open Interest Rising: Derivatives data show open interest rebounding to historical levels, signaling renewed confidence among traders.

- Bullish Structure: Sustained closes above $2.40 could open the path toward a continuation rally.

Over the past week, XRP has experienced high volatility, with sharp movements both to the upside and downside. Despite this, the $2.40 region has emerged as a critical inflection point where the market is currently showing resilience. This area represents a high-volume node on the chart, serving as the Point of Control for the ongoing range.

The recent retest of the value area low confirmed strong underlying demand. Buyers stepped in early, preventing a deeper retracement and reinforcing $2.40 as a structural support level.

As long as daily candles continue closing above this level, it suggests that market participants are defending it aggressively and preparing for the next potential leg higher.

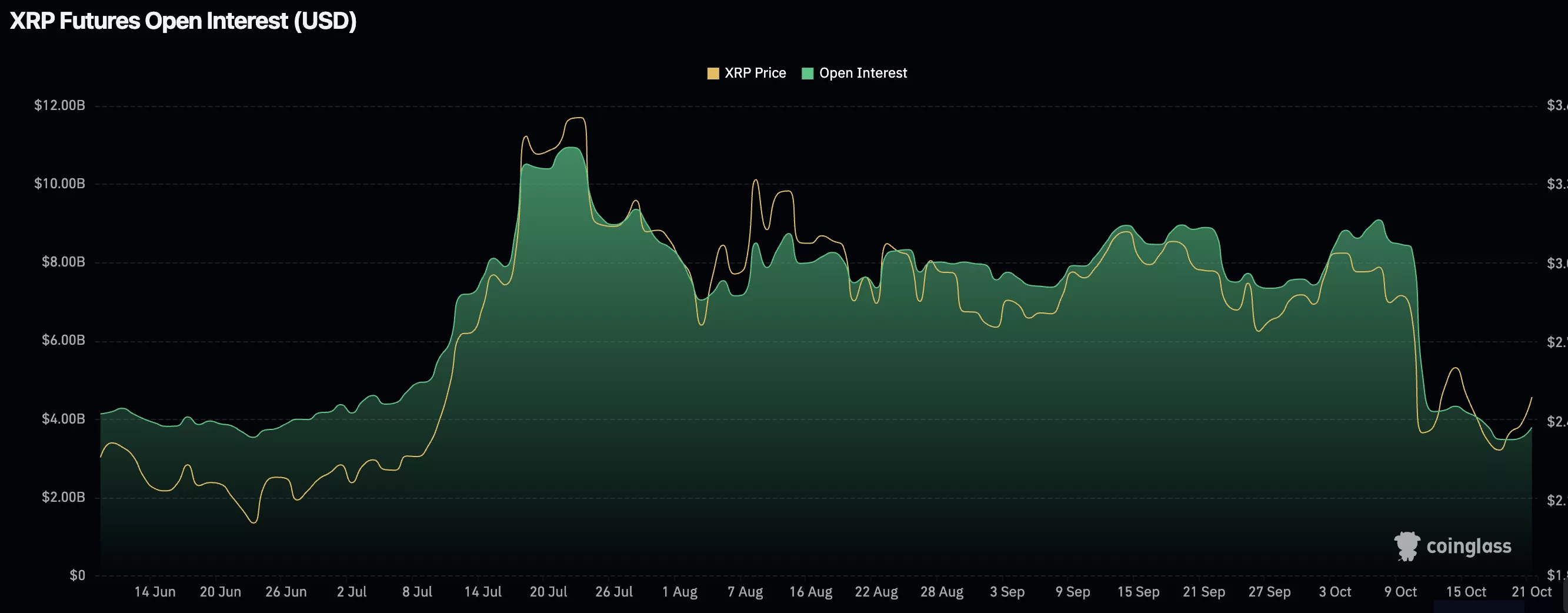

Another key factor supporting the bullish case is the rebound in open interest across major futures exchanges. Following a sharp reset earlier in July, when liquidation events wiped out excessive leverage, open interest has now begun to rise again alongside price. This combination indicates that traders are re-entering the market with renewed confidence, rather than speculative overexposure.

If open interest continues to climb while the price consolidates above $2.40, it will confirm that new long positions are being established rather than short-term profit-taking. This behavior historically precedes continuation rallies, especially when supported by stable funding rates and rising spot volume.

What to expect in the coming price action

As long as XRP maintains daily closes above $2.40, the structure remains bullish. Continued increases in open interest would validate the strength of this reclaim, supporting the potential for further upside momentum.

However, traders should watch for volume confirmation; without strong participation, the move risks becoming another short-term spike.