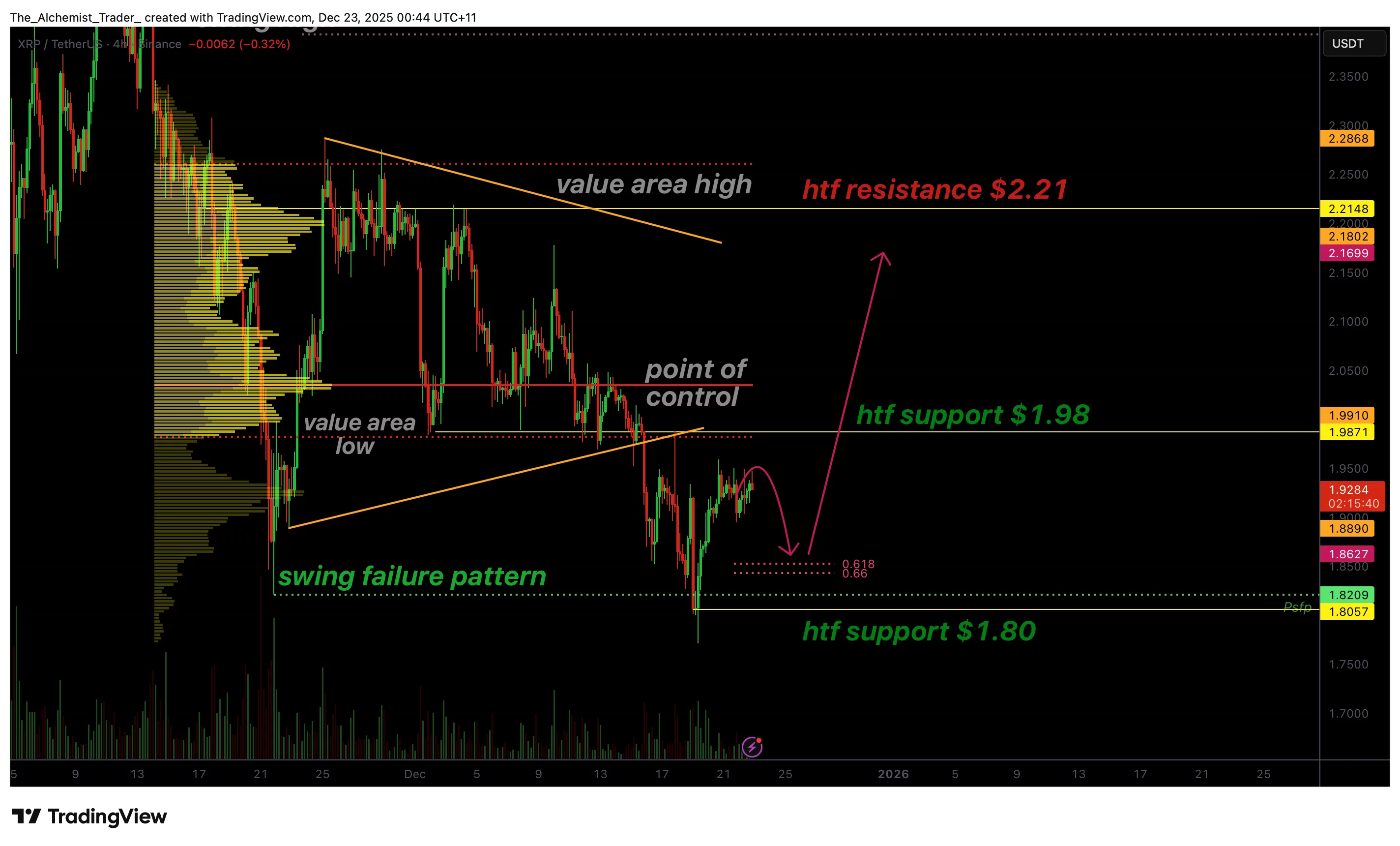

XRP price forms a swing failure, signaling a potential bottom

XRP price prints a swing failure pattern at $1.80 and reclaims support, suggesting downside exhaustion as traders watch the $1.98 level for bullish confirmation.

- The swing failure pattern forms at $1.80, suggesting a local bottom.

- Price remains below the $1.98 Point of Control resistance.

- Reclaiming $1.98 could open a move toward $2.20.

XRP (XRP) price is showing early signs of a potential bottom after forming a swing failure pattern (SFP) around the $1.80 level. This pattern, often associated with downside exhaustion, has emerged as the price reclaimed the $1.80 region after briefly trading below it.

While confirmation is still pending, the structure suggests that selling pressure may be weakening, opening the door for a short-term bullish recovery if key resistance levels are reclaimed.

XRP price key technical points

- Swing failure pattern forms at $1.80, signaling possible downside exhaustion.

- Price trades below the Point of Control at $1.98, which remains the key resistance to reclaim.

- Holding the 0.618 Fibonacci retracement could confirm the bullish setup.

The swing failure pattern at $1.80 is technically significant because it reflects a failed attempt by sellers to sustain price below a key support level. In an SFP, price briefly breaks below support, triggers liquidity, and then quickly reclaims the level, trapping late sellers. This behavior often marks local bottoms, especially when it occurs after an extended decline.

In XRP’s case, the reclaim of $1.80 suggests that buyers are actively defending this region. However, price has since moved lower after rejecting from the Point of Control (POC) near $1.98, a level that represents the highest traded volume within the current range. This rejection indicates that while downside pressure may be easing, bulls have not yet regained control, even as XRP-linked ETF assets climb past $60 million despite ongoing weakness in the token’s spot price.

The current pullback toward the 0.618 Fibonacci retracement is a critical test for the bullish thesis. This level often serves as a key support during corrective phases in the development of reversals. If price holds this region and forms higher lows, it would add further confirmation to the swing failure pattern and strengthen the probability of continuation higher.

From a market-structure perspective, XRP remains in a transitional phase. While the swing failure pattern suggests a potential shift in momentum, the broader structure has not yet flipped decisively bullish. Price is still trading below the POC and below the Value Area Low, which means acceptance back into higher value has not been achieved.

One level to watch remains $1.98. This region serves as both the POC and a high-time-frame resistance. A clean reclaim of $1.98 on a closing basis would signal acceptance of value and confirm the swing failure pattern as a valid bottoming structure. Such a move would likely open the path for a rally toward the $2.20 resistance, where prior selling pressure has previously emerged.

Until that reclaim occurs, caution is warranted. Failed swing failure patterns can lead to renewed downside if buyers fail to follow through. This is why holding above $1.80 and defending the 0.618 Fibonacci level is essential for maintaining bullish momentum.

Volume behavior will also be a key confirmation factor. A successful breakout above $1.98 should be accompanied by increased volume, signaling genuine demand rather than a short-lived relief bounce. Without this, any upside movement risks being corrective rather than impulsive.

In summary, XRP’s price action reflects a market at an inflection point. The swing failure pattern at $1.80 offers a constructive signal, but confirmation remains dependent on how price behaves around key volume and resistance levels.

What to expect in the coming price action

If XRP holds above the 0.618 Fibonacci level and reclaims the $1.98 Point of Control, the probability of a bullish continuation toward $2.20 increases. Failure to reclaim this region would keep price rotational and warrant continued caution.