XRP shows signs of rebound but declining on-chain activity signals more risk ahead

XRP is recovering from recent lows but weakening XRP Ledger metrics may indicate further challenges.

Trading at $2.25 as of press time, XRP (XRP) is up 3.8% over the last day. The price is near the upper end of its weekly range between $2.09 and $2.29. With 24-hour volume reaching $2.65 billion, trading volume is up almost 180% from the day before, reflecting growing trader interest. Rising volume alongside price gains often hints at stronger conviction among market participants.

Coinglass data also reveals a spike in derivatives activity. XRP’s futures volume has increased 201.98% to $4.82 billion, while open interest has increased 11.48% to $4.09 billion. This can support short-term price movements in either direction since it indicates that more traders are opening positions and placing bets on ongoing volatility.

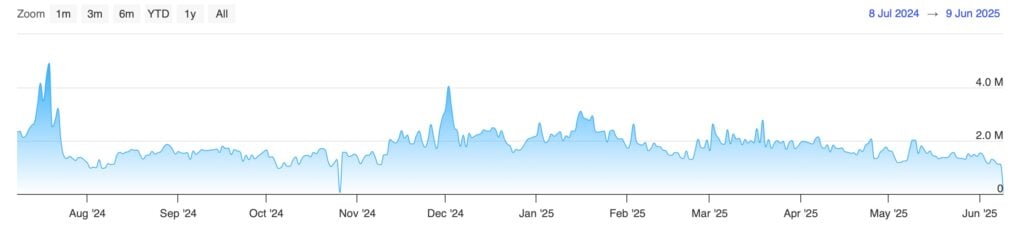

However, not all signals are positive. According to data from XRP scan, on-chain activity is slipping, raising concerns about the sustainability of this rally. By June 8, there were only about 600,000 payments between accounts, down from almost 900,000 at the beginning of the month.

Likewise, the number of transactions has decreased from roughly 1.5 million at the start of June to just over 1.1 million in the last few days.

The number of active addresses has also declined, now sitting below 20,000. These metrics often show user engagement and utility on the XRP Ledger, and their decline may indicate that network demand is waning despite the price increase.

From a technical perspective, XRP has been able to maintain its position above a crucial support level close to $2.08. After recently recovering from this area, the price is now pressing against the middle band of the Bollinger Bands near $2.25. A break above this level could open the way toward the upper band at $2.42.

Although it is trending upward after recovering from oversold levels, the relative strength index is still neutral near 50. If momentum builds, bulls could target a move back to the $2.60–$2.65 resistance area seen in late May.

However, if $2.25 is not broken, a retest of $2.08 may occur, and a breakdown there might reveal the $2.05–$2.00 range. Until on-chain metrics reverse course, price gains may remain fragile even as short-term momentum builds.