XRP, SOL prices tank as over $2b wiped from crypto market after tariffs announced by Trump

The crypto market has plunged into the fear zone of the crypto fear and greed index, sliding to sentiment levels last seen in October 2024.

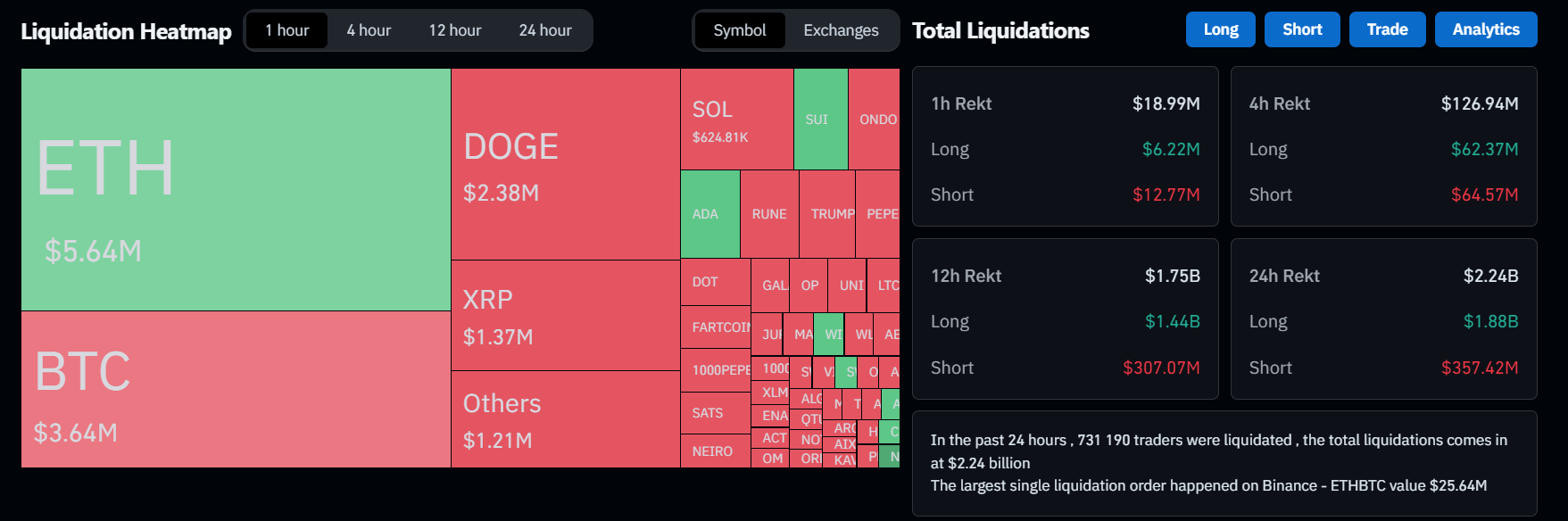

A mix of fresh U.S. tariffs, weak liquidity, and panic selling wiped over $2 billion from the market in the last 24 hours, according to data from Coinglass. Amid the chaos, Bitcoin (BTC) price dropped nearly 6% to around $91,200 before bouncing back slightly, but altcoins took an even harder hit.

Ethereum (ETH) tanked 18%, XRP (XRP) was the biggest loser with a 20% drop, and Solana (SOL) fell 8% as the total market cap sank nearly 12% to $3.15 trillion.

Matrixport co-founder Daniel Yan called it “another typical weak Monday,” blaming Asia markets for their knee-jerk reaction to bad news. He highlighted extreme volatility, with Coinbase’s ETH premium — a sign of strong U.S. buying demand — spiking to 6% while the top 100 tokens averaged a 22% loss.

An X user under alias @Coins_Kid noted in an X post on Feb. 3 that XRP’s price structure suggests an “expanded flat wave 4 correction” since December and that “we don’t quite see 5 waves down in C.” While some see this as a potential buy-the-dip moment, overall sentiment appears to be cautious.

Santiment data shows traders are stepping back. One user analyzing aggregated sentiment noted, “Talks of buying the dip have calmed down. Big targets like $110K-120K for Bitcoin are getting less attention.”

Despite the chaos, Bitwise’s head of alpha strategies Jeff Park believes tariffs are part of a much bigger game. He argues that the U.S. is looking for a way to weaken the dollar without crashing its ability to borrow cheaply — a kind of “Plaza Accord 2.0.”

And while tariffs may just be a tool in that playbook, the long-term impact on Bitcoin could be massive. With a weaker dollar, lower U.S. rates, and global economic uncertainty, Bitcoin could be heading “higher, violently faster,” Park wrote in a Feb. 3 post on X.