Inflation is cooling, but beware the yen carry trade: What could this mean for Bitcoin?

Will Bitcoin’s price hold above critical support levels as the market digests cooling inflation and yen trade risks?

Table of Contents

A brief look at inflation figures

Inflation is like the temperature in a room — too hot, and it’s uncomfortable; too cold, and it’s just as bad. For the past few months, the U.S. economy has been trying to find that ‘just right’ spot and all eyes are on the latest numbers to see where we’re headed next.

The Producer Price Index data for July 2024 just came in, showing inflation is cooling off. PPI inflation fell to 2.2%, slightly below expectations, marking the lowest level since March 2024.

Core PPI inflation also dropped to 2.4%, surprising many who expected it to be higher. With numbers like these, a rate cut in September seems almost certain.

But the story doesn’t end there. The bigger headline everyone’s waiting for is the Consumer Price Index (CPI) data, set to be released on August 14.

This data is crucial because it gives a clearer picture of how much everyday prices are rising or falling, affecting everyone from the average consumer to big investors.

Wall Street is predicting a 2.9% rise, but there’s still a 37% chance it could be higher than expected. If it goes above 3.0%, it could signal that inflation is back on the rise, which would be the third time in five months. That could change everything, from interest rates to market expectations.

But inflation isn’t the only concern. Just a few days ago, on August 5, the financial markets were rattled by the unwinding of the yen carry trade.

For those unfamiliar, the yen carry trade involves borrowing in Japan’s low-interest-rate environment and investing in higher-yielding assets elsewhere.

This strategy worked smoothly until Japan’s interest rates started rising, as they did recently for the second time since 2007 — the first being in March 2024. The result was a market shake-up, and the risk from this trade hasn’t fully dissipated.

As we await the CPI data and grapple with the ongoing risks from the yen carry trade, the question remains: could these global financial uncertainties pull the rug out from under crypto? Let’s find out.

Yen carry trade uncertainty continues to cloud the market

While recent inflation data suggests cooling in the U.S., the risks associated with the yen carry trade remain a looming threat that could heavily impact global markets, including the crypto space.

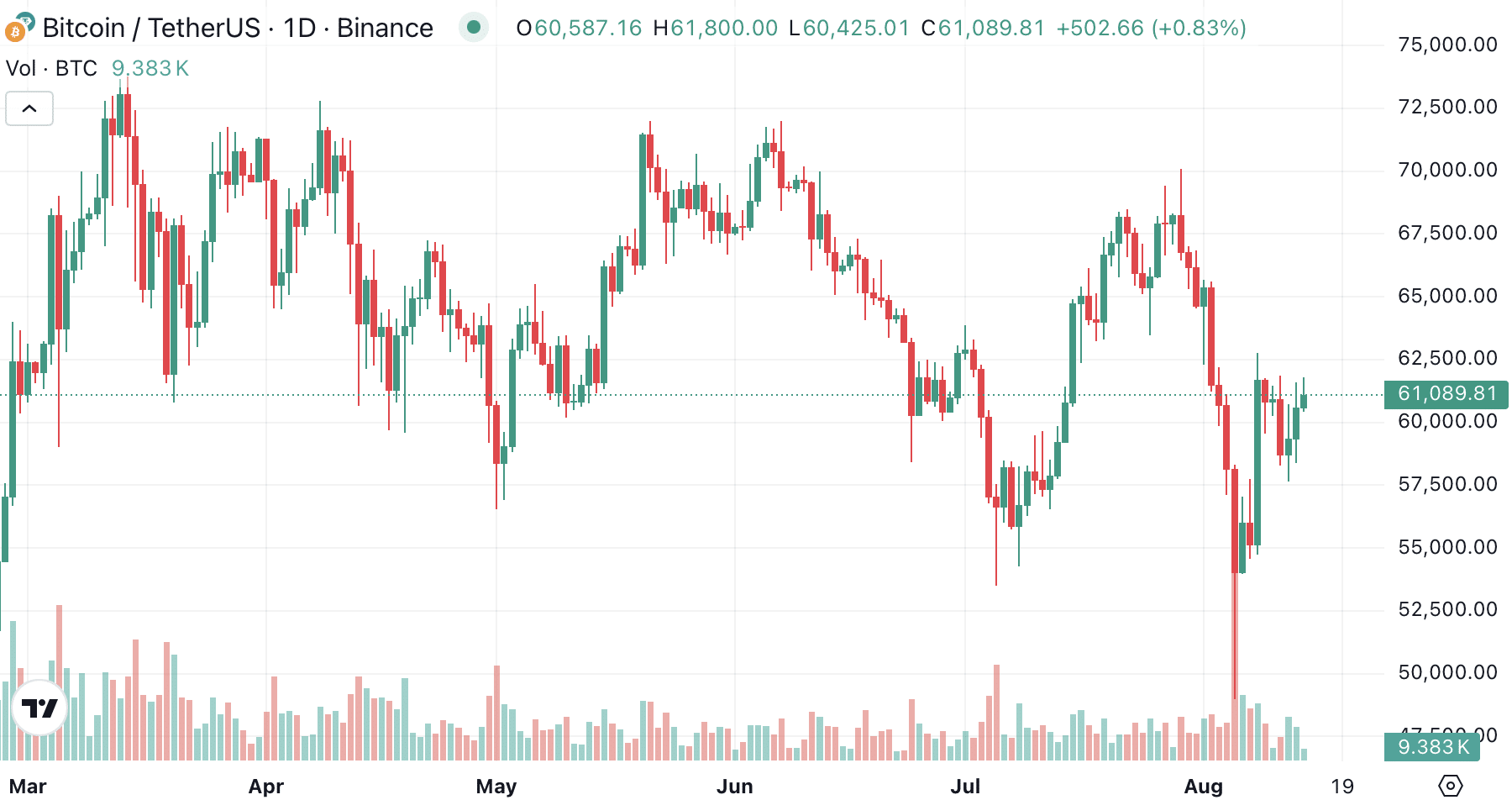

The unraveling of this massive trade, estimated by Reuters to involve up to $4 trillion, has already sent shockwaves through global financial markets, triggering a sharp sell-off in risk assets like Bitcoin (BTC), which plummeted to as low as $49,000 on August 5.

Since then, BTC has regained its footing and is trading at around $61,000 as of August 13, marking a rise of about 24%.

Richard Kelly, head of global strategy at TD Securities, told CNBC that he would be ‘very hesitant’ to declare the end of the carry trade unwind.

He believes that the undervaluation of the yen and potential changes in interest rate differentials could lead to further market disruptions over the next one to two years.

Moreover, as Barclays analysts have indicated, the selling pressure from the carry trade unwind does not appear to have been fully exhausted. They warn that it’s ‘too early’ to call an all-clear on the unwinding and that volatility is likely to remain elevated.

For the crypto market, these lingering risks pose twofold challenges: a strong yen could drive investors away from high-yielding but risky assets, while at the same time, a sharp market correction could erode the confidence of crypto investors.

What’s happening in the market?

As the crypto market faces turbulent times, Bitcoin is encountering its own set of challenges. According to Copper Research’s “Opening Bell” report, Bitcoin’s recent performance has been lackluster.

Despite showing resilience against the German government’s sale of 40,000 coins, Bitcoin has struggled to regain the momentum it had in March when it reached its all-time high.

The report highlights that overall market conditions have been tough, largely due to a series of global events, including the U.S. election, UK riots, Middle East tensions, and shifts in Japanese central bank policy.

What’s particularly noteworthy is the lack of buying activity in Bitcoin. Initially, when the German sell-off occurred, some market participants bought the dip, seeing it as an opportunity.

However, recent market volatility has scared off many investors, resulting in minimal buying activity for Bitcoin.

Yet, there is a silver lining. Recent data shows a noticeable uptick in inflows into Bitcoin and Ethereum ETFs (ETH) over the last two days.

On August 13, the 12 spot Bitcoin ETFs recorded total inflows of $38.94 million, a nearly 40% increase from the $27.87 million recorded the previous day.

Leading the charge was BlackRock’s IBIT fund, which saw $34.6 million in inflows, bringing its total to a staggering $20.36 billion since its launch.

Ethereum also saw a surge in interest. The nine spot Ethereum ETFs recorded net inflows of $24.3 million on August 13, a jump from the modest $5 million recorded the previous day. BlackRock’s ETHA fund was at the forefront, with $49.1 million in inflows following a day of no activity.

What to expect next?

The current data suggests that the market is at a critical juncture, raising the question: where do we go from here? One thing is certain: Bitcoin’s next move could define the direction of the entire crypto market in the coming weeks.

Michaël van de Poppe, a well-known crypto analyst, recently noted that Bitcoin is in a choppy phase, with its immediate future hinging on whether it can hold above the $56,000 to $57,500 range.

He suggests that if Bitcoin manages to stay within this zone, there’s potential for a rally toward the upper end of the range, possibly leading to a new all-time high.

Meanwhile, the increase in inflows to Bitcoin and Ethereum ETFs indicates that institutional investors are still interested, albeit cautiously. However, if volatility continues, we might see more sideways movement or, worse, another dip.

For now, it’s a waiting game. If the macroeconomic environment stabilizes, Bitcoin could break out of its current range and make a run for new highs. Therefore, stay cautious, trade wisely, and never invest more than you can afford to lose.