Young investors see crypto as better alternative to US stocks, personal brands: BofA

A new study shows young investors are increasingly favoring crypto over traditional U.S. stocks, reflecting a generational divide in investment strategies.

As the first members of Generation X approach their 60th birthdays, a significant transfer of wealth is reshaping American investment preferences, with crypto emerging as a favored alternative among younger investors, according to Bank of America‘s latest study.

The findings reveal stark generational divides in attitudes toward investment opportunities, with younger affluent Americans increasingly leaning toward alternatives like crypto and private equity, while older generations remain committed to traditional equities.

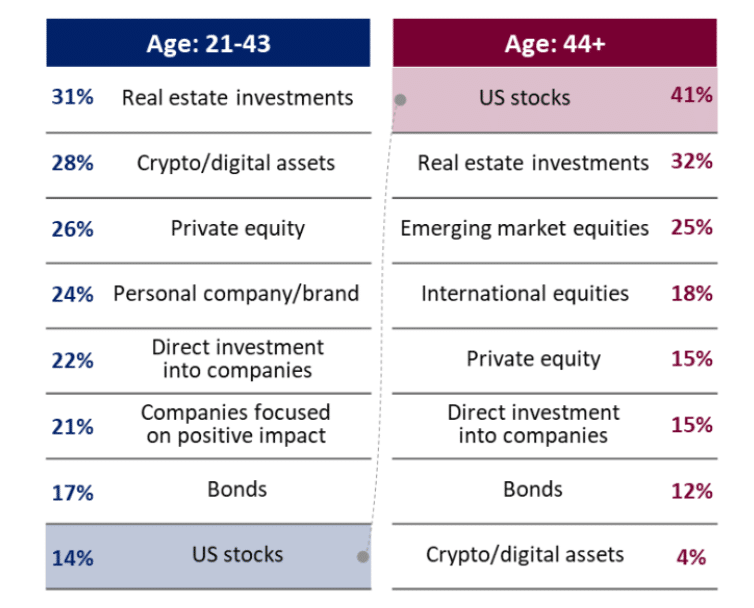

In the 2024 Study of Wealthy Americans, BofA highlights that younger investors — primarily Gen Z and millennials — are prioritizing real estate (31%), cryptocurrencies (28%), and private equity (26%) as more promising avenues for growth than personal company/brand (24%) or direct investment into companies (22%).

In contrast, older generations — those aged 44+ — predominantly favor U.S. stocks (41%) and real estate (32%).

Bank of America Private Bank president Katy Knox says the market is going through a period of “great social, economic and technological change alongside the greatest generational transfer of wealth in history.”

While older generations believe their children share their philanthropic values, younger respondents appear to express a clear disconnect, advocating for more impactful giving strategies.

As wealth transitions to a younger demographic, these divergent perspectives may lead to new investment trends, the report reads, prompting advisors to adapt their strategies to meet the evolving needs of this emerging investor class. The study surveyed U.S. adults with at least $3 million in investable assets.