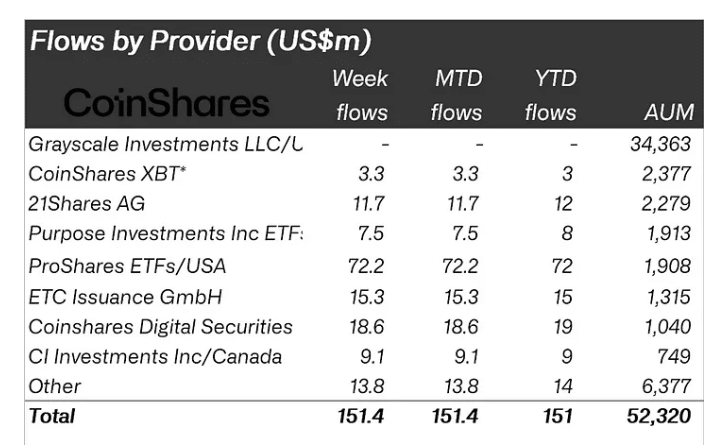

Crypto-based investment products saw $151m inflows in 2024’s first week

In the first week of 2024, digital assets investment products witnessed a significant surge in capital inflows, amounting to $151 million.

According to CoinShares analysis, since Grayscale’s victory over the SEC regarding their spot Bitcoin ETF application last year, the market cumulatively attracted $2.3 billion in inflows, equating to 4.4% of the total assets under management (AUM).

Despite Bitcoin ETF not being approved yet, American exchanges accounted for a substantial portion, 55%, of these inflows. European markets, specifically in Germany and Switzerland, also showed robust activity, contributing 21% and 17% of the inflows, respectively. The beginning of the year also marked a positive trend for blockchain equity investments, with a notable $24 million influx in the past week.

Bitcoin emerged as the frontrunner in this rally, attracting $113 million in capital. This figure represents 3.2% of Bitcoin’s total AUM over the past nine weeks. In contrast, the year’s first week saw a $1 million outflow from short-Bitcoin investments. This trend contradicts the anticipated ‘buy the rumor, sell the news’ reaction expected with the potential launch of a U.S. ETF, as evidenced by the $7 million outflow from short-Bitcoin ETPs over the last nine weeks.

Ethereum also experienced a positive shift in investor sentiment, garnering $29 million in inflows, which adds up to $215 million over the last nine weeks. On the other hand, Solana faced a less favorable start to the year, with outflows reaching $5.3 million. Cardano also caught investors’ attention, with inflows of $3.7 million.