Bitcoin, Ethereum price gaps narrow on U.S. crypto exchanges post-spot ETF approvals

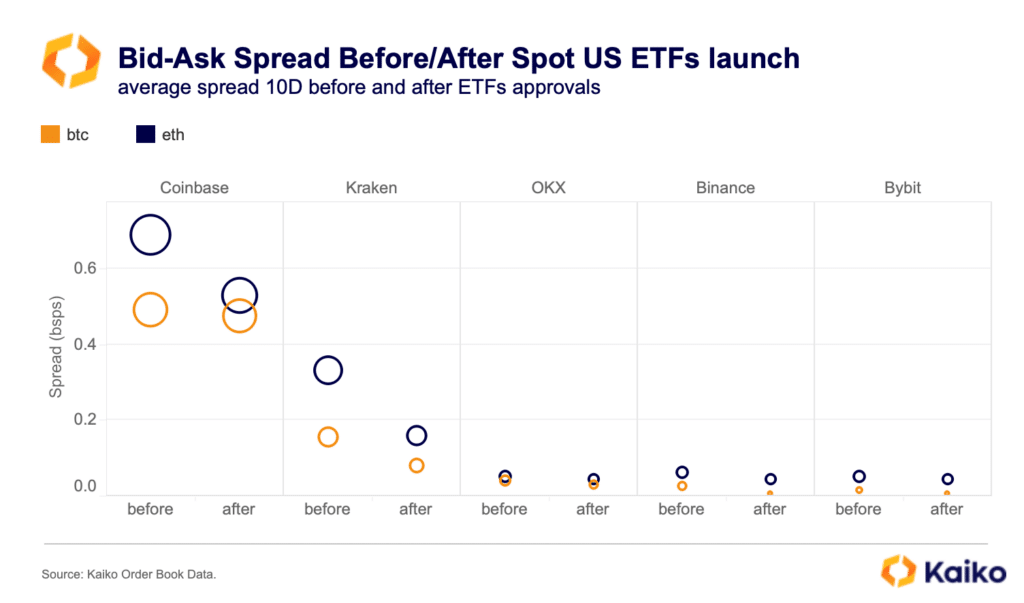

Bid-ask spreads on major U.S. exchanges like Coinbase and Kraken have tightened post-spot ETF approvals, signaling enhanced market liquidity and depth, analysts at Kaiko say.

Bid-ask spreads for Bitcoin (BTC), which represent the difference between the highest bid and lowest ask prices, have decreased significantly post-approval, indicating an improvement in market liquidity and deeper trading activity.

In a recent research report, analysts at Kaiko revealed that U.S.-based crypto exchange Kraken experienced the highest volatility in spreads during January, reaching a peak of 10 basis points on Jan. 20. Similarly, spreads on Bitstamp and Coinbase also peaked between Jan. 8 and Jan 13 at 6.7 and 1.7 basis points respectively, before plummeting to below 1 basis point in recent weeks.

Kaiko pointed out that the trend extends beyond U.S. markets and Bitcoin, as the average bid-ask spread for the most liquid BTC and Ethereum (ETH) trading pairs has also declined across various crypto exchanges.

“Coinbase and Kraken saw the strongest decline while the drop was less pronounced on Binance and OKX, which already offer very low spreads.”

Kaiko

Analysts say the approval of spot exchange-traded funds (ETFs) will eventually fuel a new wave of competition among exchanges, as Coinbase has already announced fee waivers for large traders, which is expected to further drive down spreads.

As crypto.news earlier reported, the U.S. Securities and Exchange Commission (SEC) has greenlit all spot Bitcoin ETF applications. Nonetheless, Gary Gensler, who has maintained a critical stance on cryptocurrencies since assuming leadership of the U.S. financial regulator, reiterated in a statement that the SEC “did not approve or endorse Bitcoin,” despite approving spot ETFs.