Aave community mulls new proposal to increase liquidity for GHO stablecoin

Aave Labs has published a new governance proposal for integrating the GHO stablecoin across multiple blockchain networks.

In a forum post on Jan. 17, Aave Labs, a firm behind the Aave protocol, revealed a new governance proposal to integrate the GHO stablecoin across multiple blockchains. The initiative, as outlined by Aave Labs, is geared towards “enhancing GHO liquidity, accessibility, and interoperability while maintaining security and stability.”

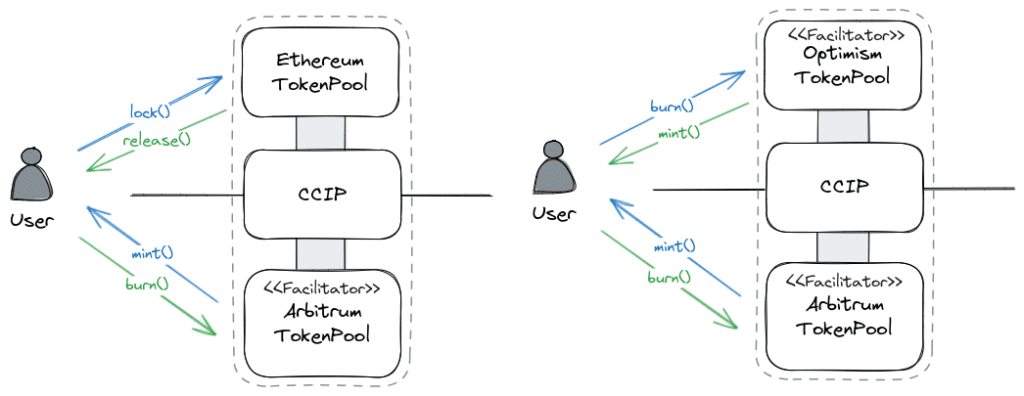

Aave Labs particularly proposes utilizing Chainlink‘s Cross-Chain Interoperability Protocol (CCIP), a solution for both communication and interaction between different blockchain networks, noting that GHO is currently limited for wide use as it is primarily accessible only via minting on the Ethereum mainnet, representing a “significant constraint in its potential reach and utility across defi.”

“We believe the future of GHO is to become a multichain asset where users can interact across various networks using GHO.”

Aave Labs

Upon approval by the Aave community, the proposal outlines that each selected network, picked by Aave DAO, will host a “canonical version of GHO” alongside a facilitator, an entity responsible for minting and burning GHO tokens controlled by Aave Governance. These facilitators will manage facilitator buckets and facilitate the onboarding of GHO liquidity from Ethereum. The total liquidity across chains will be constrained by the amount of GHO tokens locked on Ethereum. However, the proposal does not provide a clear timeframe for its implementation.

The initiative comes at a time when GHO has struggled to regain its peg to $1, a value it lost since its launch in July 2023. GHO is described as a decentralized multi-collateral stablecoin, predominantly backed by Ethereum (ETH), ETH-staking derivatives, and Wrapped Bitcoin (WBTC). As of press time, GHO is priced below the $0.98 mark, according to data from CoinGecko.