Aave fork on Blast mistakenly liquidated $26m

An Aave fork on Blast network liquidated user positions worth over $26 million due to an erroneous threshold change.

Pac Finance, an iteration of decentralized finance (defi) lender Aave on Coinbase’s layer-2 chain Blast, attempted to adjust its loan-to-value (LTV) parameters on April 11. Instead, the Aave fork unknowingly reduced its liquidation threshold.

The result was a sweeping wipeout of Ether-collateralized (ETH) positions on the platform. According to Will Sheehan, Founder of block explorer Parsec, one user lost up to $24 million due to the Aave fork incident on Blast. On-chain analytics also showed participants thousands of dollars in losses denominated in ezETH.

Aave fork Pac Finance admits error

Hours after the issue was highlighted, Pac Finance acknowledged the mistake and disclosed that affected users were contacted. The team also said a plan to mitigate the error was in the works.

“In our effort to adjust the LTV, we tasked a smart contract engineer to make the necessary changes. However, it was discovered that the liquidation threshold was altered unexpectedly without prior notification to our team, leading to the current issue.”

Pac Finance team

To avoid further mishaps, Aave promised to set up a community forum to discuss future upgrades and changes to its defi lending protocol. Pac Finance added that it intends to deploy a governance contract to reaffirm transparency and repair user trust.

Stani Kulechov, Founder of blockchain developer Avara and the parent company behind Aave’s project, tweeted that the matter highlighted a root issue with protocol spin-offs.

A fundamental problem with forking code is the lack of in-depth knowledge of the software and the parameters.

Stani Kulechov, Avara Founder

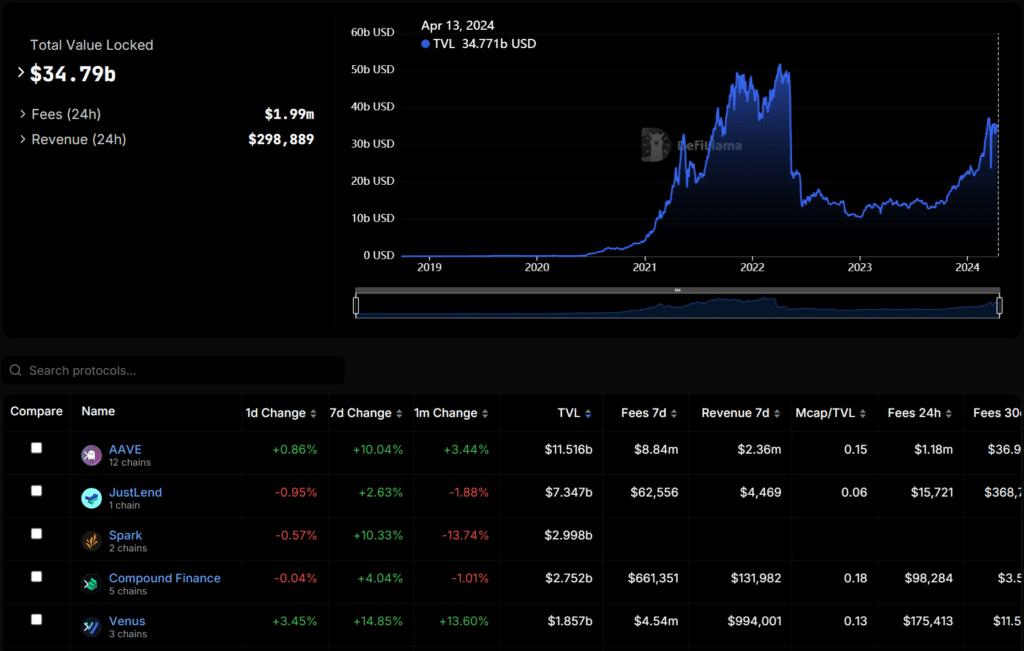

The lending market is one of defi’s largest sectors, allowing users to borrow and provide liquidity to crypto’s burgeoning ecosystem. According to DefiLlama, lending protocols hold nearly $35 billion in total value locked (TVL).

Aave is the most significant player in the market with $11.5 billion in TVL and availability across 12 chains, including Ethereum, Arbitrum, Polygon, Optimism, Avalanche, Gnosis, Base, Metis, Binance Smart Chain, Scroll, Fantom, and Harmony. It has also deployed its stablecoin GHO to compete with Maker’s DAI token on Ethereum’s blockchain.