AI tokens market tanks 14.6% as Nvidia faces anti-trust probe in China

Artificial Intelligence-related cryptocurrencies saw significant declines, with the AI coins market cap dropping 14.6% in a day following reports of China’s anti-trust probe into AI chip-making giant Nvidia.

Near Protocol (NEAR), the largest AI coin by market cap, fell over 8.6% over the past day, trading at $6.65 per coin at press time. Render (RENDER), Akash Network (AKT), FET, and The Graph (GRT) suffered losses of 9.7%, 9.6%, 8.6%, and 8% respectively in the same period.

Meanwhile, other AI tokens such as Bittensor (TAO), Arkham (ARKM), Livepeer (LPT), and Flux (FLUX) suffered much higher losses, between 12-16,% respectively. The losses across AI-related cryptocurrencies led to a 14.6% slump in the market cap of AI coins, bringing it down to $40.56 billion at the time of writing.

The AI sector fell after China launched an investigation into Nvidia for suspected violations of the country’s anti-monopoly law. The State Administration for Market Regulation also accused the U.S. chipmaker of breaching commitments tied to its 2020 acquisition of Israeli chip designer Mellanox Technologies.

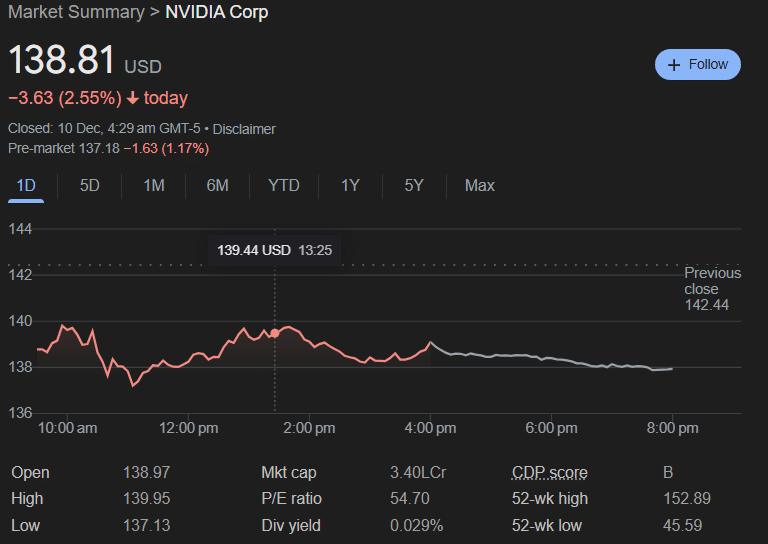

The report had a significant impact on Nvidia, which derives approximately 15% of its revenue from customers in China, according to its most recent financial report. Nvidia’s shares fell by 2.55%, closing at $138.81 on Tuesday in the New York markets.

AI-related cryptocurrencies often respond to news involving Nvidia. As previously reported by Crypto.news, several of these tokens experienced double-digit losses after Nvidia faced its largest one-day market value drop on Sept. 4 following an antitrust subpoena from the U.S. Department of Justice.

This time, AI-related coins also faced setbacks as Bitcoin (BTC), the bellwether crypto asset, experienced a flash crash on Dec. 10, briefly falling below $95,000 from an intraday high of $100,200 recorded the previous day.

The crash triggered a ripple effect across the broader crypto market, which fell by 6.8% in the past day, leading to a massive $1.7 billion in liquidations.