ApeCoin gains 6% as staked volume exceeds 90m

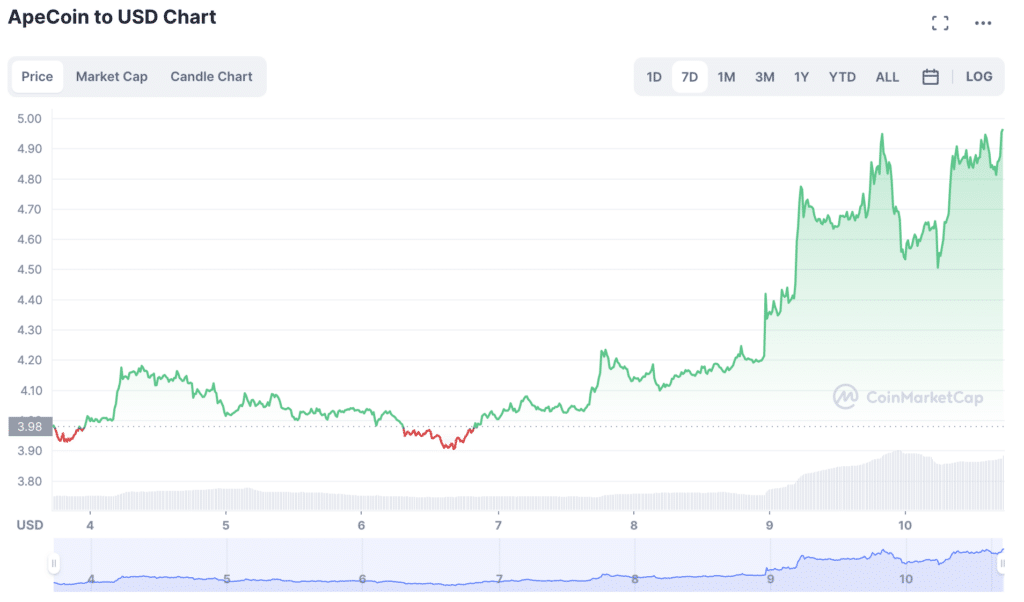

ApeCoin (APE) has gained by over 6% in the past 24 hours as the volume of staked tokens surged above the 90 million mark less than two months after the launch of ApeCoin Staking. The asset rallied to a 2-month high of $4.98 yesterday amid a sharp increase in the total holding amount.

ApeCoin staking balance breaks above 90 million

Leading multi-chain explorer OKLink recently called attention to the surge at a time when volume hit the 92.1 million level. Despite a recently-introduced resistance to the asset’s price rally as of press time, the staked volume has remained fairly stable above 90 million, currently sitting at 92.3 million APE valued at $450.4 million against prevailing rates.

Data from DappRadar also reveals a 4% increase in ApeCoin staking volume in the past 24 hours, with a massive 11% surge in the balance of staked APE. The number of unique active wallets (UAW) on the protocol has also increased by 8.58% to a current value of 1.99K

The increase in holding amount persists despite a recent withdrawal trend noticed among large stakers. Blockchain surveillance system Lookonchain highlighted these withdrawal requests that have resulted in $4.24 million worth of APE.

Top investment firm Arca was reported to have unstaked all its 424K APE ($2.04M) yesterday when the asset’s price rallied above $4.5. The firm had previously unstaked 125 APE on Jan. 6. Arca sent all those tokens to Coinbase. Amid the recent market-wide rejection, another staker took out 451,167 APE worth $2.2M today. The assets were transferred to a Binance address.

APE surges by 6.38% amid a flat market

Meanwhile, ApeCoin has capitalized on the recent altcoin rally as it broke above $4.9 yesterday for the first time since the FTX-induced collapse of early November. Despite resistance, the asset has held up quite well, finding support at the $4.3 level.

APE is currently changing hands at $4.97 at the time of reporting, up 6% in the past 24 hours when most assets are trading flat. ApeCoin appears to have generally been immune to the recent swings of the bears, being the biggest-gaining asset among the top 28 assets in the past day.

ApeCoin’s persistent rally marks the second time the asset has been bucking the trend in the past three months. Similarly, the asset gained by 25% in one week of November 2022, despite the prevalent market-wide selloffs triggered by the FTX collapse.