Arbitrum (ARB) drops nearly 90% in value since its debut

Arbitrum, the largest layer-2 blockchain on Ethereum (ETH), has been making headlines since its token, ARB, made its market debut on March 23.

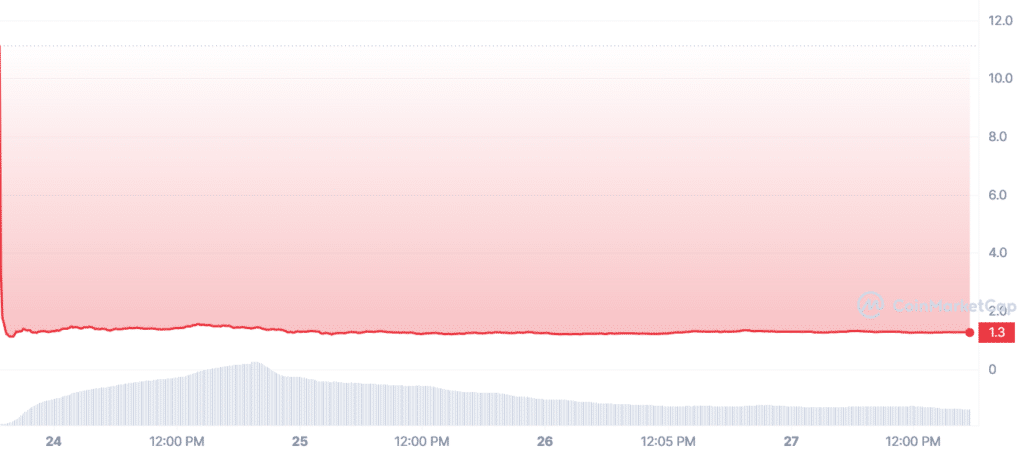

However, in just four days, ARB’s value has plummeted nearly 90% from its high, trading at just $1.26 as of Mar. 27.

In this article, we will look at the events surrounding ARB’s market debut and the subsequent decline in its value.

The launch of ARB

The launch was highly anticipated, and ARB’s total value locked (TVL) is currently at $2.19 billion, twice that of rival Layer 2 chain Optimism, according to DeFi LIama.

After the airdrop, ARB’s price across all exchanges varied significantly, with prices reaching as high as $11.8 on March 23.

Arbitrum-based decentralized exchange GMX became the largest single holder of ARB, receiving 8 million tokens in the airdrop, spurring discussion about using tokens on the GMX governance forum.

Meanwhile, TVL of all other decentralized apps (dapps) and decentralized exchanges (DEXs) have continued to soar over the past few days. This suggests that the market still has confidence in the potential of Arbitrum’s technology.

However, it is worth noting that ARB is not the only Layer 2 scaling solution facing a decline in daily transactions.

Layer-2 network Optimism has suffered a steep decline in daily transaction count since the conclusion of its Optimism Quests program on Jan. 17. Since the program ended, the number of daily transactions on Optimism has fallen by 67%.

Liquidity providers profit from ARB Launch

Entities providing liquidity to ARB made over $500,000 in profits in the first few hours of trading, according to data.

Over $180 million in volume was traded on the ARB/ETH liquidity pool, netting $542,000 in fees for liquidity providers. However, ARB’s value began to decline soon after it was made available for trading across exchanges.

What’s next for Arbitrum

Arbitrum’s token launch generated a lot of hype, but the subsequent decline in ARB’s value highlights the cryptocurrency market’s volatility.

Despite this, the rise in Arbitrum’s TVL suggests that investors still believe in the project’s potential.

However, with rival layer-2 networks facing similar declines in daily transactions, it remains to be seen how the market will respond to future developments in this space.