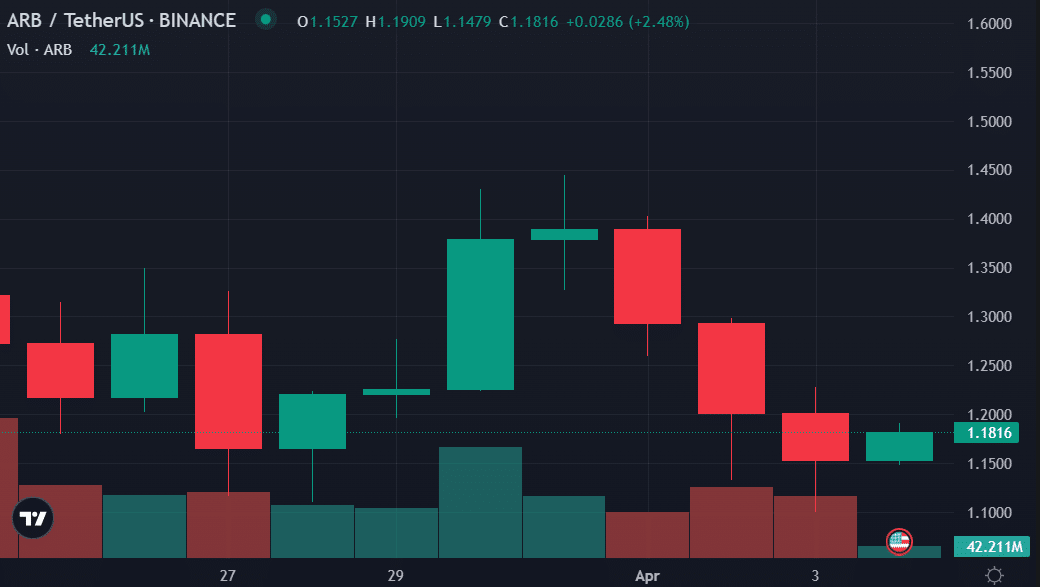

Arbitrum’s price is still down despite bullish sentiment

Arbitrum made headlines with the launch and airdrop of its native utility token, ARB, last month. Since then, ARB has been on a downward spiral, with its price plunging by 90% from the $11.8 mark on March 23.

According to data from Santiment, whales could shift ARB’s price “dramatically” since the asset has no “history of trading.” Per the analytics platform, the majority of arbitrum’s transactions, over 70%, were processed on the popular decentralized exchange (DEX), Uniswap.

Moreover, the largest centralized exchange, Binance, had an almost 20% share of ARB transactions, per Santiment. Data shows that over the past week, the positive sentiment around arbitrum disappeared with the rise of “a confused crowd of recipients.”

According to the market intelligence platform, most crypto community believes that the $1 mark “is already the bottom and talk[s] about it loudly because large transactions hold the price up.”

Per Santiment, ARB is ranked 39 among the top cryptocurrencies. The asset is trading at $1.8 when writing, slipped by 3.25% in the past 24 hours per crypto.news data. Arbitrum’s market cap is closing to the $1.5 billion mark, up by 0.7% over the last seven days.

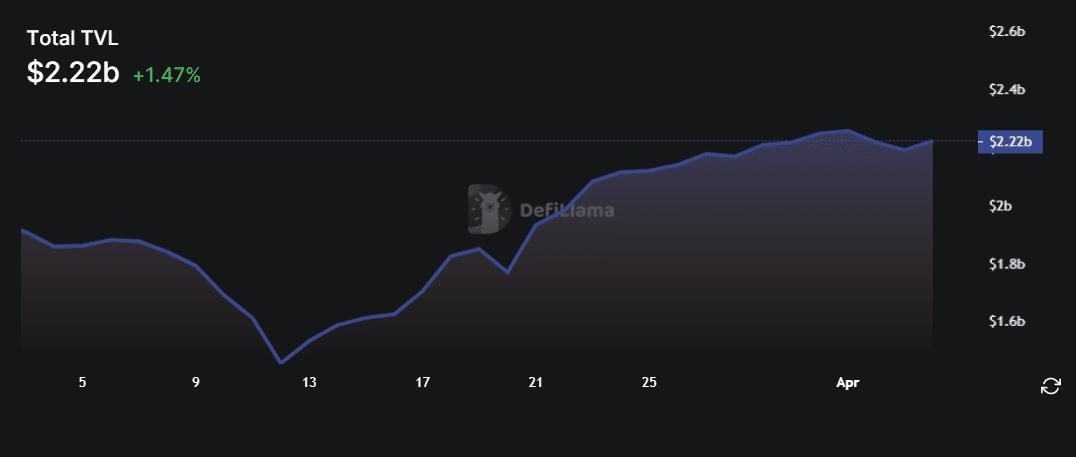

While Arbitrum’s native token is caught in the bear zone, its total value locked (TVL) has been growing since March 13, according to data provided by DeFi Llama. The TVL on the side-chain sits at $2.2 billion at the time of writing, up by 1.47% in the past 24 hours.