Are Telegram trading bots really safe? A user’s guide to best practices

Explore the critical security insights and essential safety practices for navigating the risks of Telegram crypto trading bots in our comprehensive guide.

Telegram crypto trading bots have recently emerged as an innovative tool promising to change how complex trades are executed. These bots, operating within the familiar interface of the Telegram messaging app, offer the convenience of swift and efficient trading, enabling users to respond to market changes in real time. However, beneath the surface of this technological convenience lies a web of security concerns that users often disregard.

The incidents involving Unibot and Maestro, two of the most popular Telegram trading bots, are a stark reminder of the vulnerabilities inherent in these platforms. In late October, these bots were compromised in a sophisticated exploit, culminating in a staggering loss of $1.1 million.

These breaches highlighted the potential financial risks for individual traders using such tools and also underscored the broader implications for the security of automated trading tools at large. It has become clear that the convenience such tools offer may come at a high price if the associated security risks are not navigated with caution.

In this article, we will explore the critical security concerns behind the seductive appeal of Telegram trading bots and provide pragmatic recommendations from security professionals to help users safeguard their digital assets against such vulnerabilities.

Understanding the risks of Telegram bots

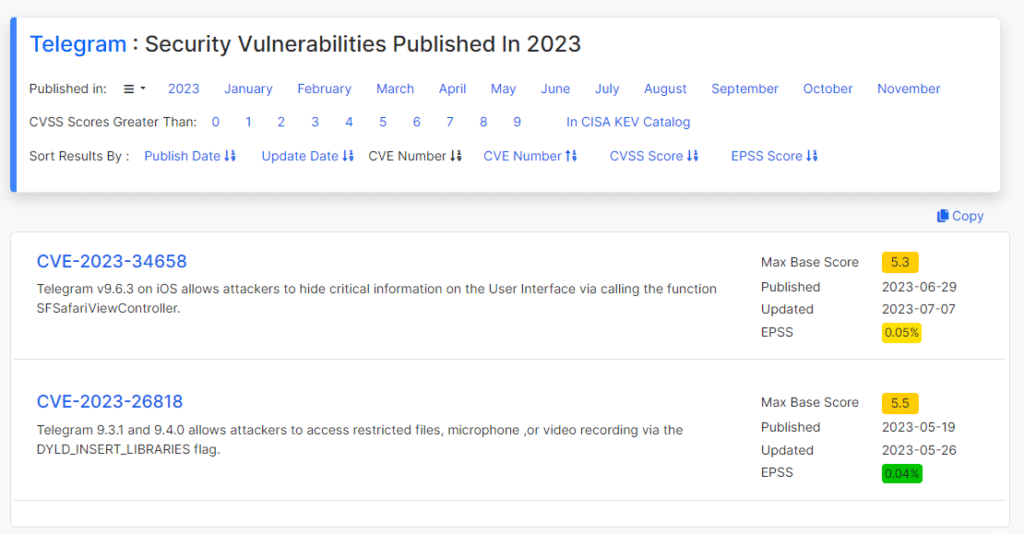

The very features that make Telegram bots accessible and efficient also open the door to potential security threats. The bots operate on a platform that isn’t inherently designed for secure financial transactions, which can leave sensitive data like private keys vulnerable to interception.

Several tech experts have criticized Telegram’s encryption method, as most interactions on the app don’t use end-to-end encryption (E2EE) like WhatsApp. Also, the trading bots require a level of access to user accounts that could potentially be exploited by cybercriminals, turning a tool of convenience into a liability.

Moreover, the incidents that led to significant financial losses for users have revealed that these platforms may not have adequate measures in place to prevent unauthorized access or to secure user assets. The reliance on Telegram’s infrastructure, which is not optimized for financial services, introduces additional layers of risk. Users’ private keys, once imported into the bot for trading purposes, are at risk of being extracted by malicious software or individuals with nefarious intentions.

The centralization of control within these bots also presents a significant vulnerability. Unlike decentralized platforms where control is distributed, many Telegram bots require users to input their private keys or API tokens, effectively relinquishing control over their assets. This central point of failure becomes an attractive target for attackers, as gaining access to the bot’s infrastructure can lead to control over all connected accounts.

Transparency and auditability are often lacking in the development and deployment of these bots. Without open-source code or independent security audits, it is challenging for users to verify the security and integrity of the bot they are entrusting with their assets. This opacity can conceal backdoors or other security flaws that could be exploited by attackers or even by the bot developers themselves.

What caused the Unibot and Maestro exploits?

The case studies of Unibot and Maestro provide a clear picture of vulnerabilities present in Telegram trading bots and the dire consequences that can ensue when they are left unaddressed.

Unibot, one of the leading bots in this space, experienced a surge in market value earlier this year, only to be compromised by a sophisticated attack. Hackers exploited a vulnerability in the bot’s system, leading to a loss of $640,000. The attack was a result of what is known as a “Call Injection” vulnerability, where the attackers injected unauthorized commands into the bot, diverting funds to their own accounts. The aftermath was swift and brutal, with the associated token’s value plummeting by 35% within a single day.

On the other hand, Maestro suffered a contract breach that allowed threat actors to trigger unauthorized transfer of over 280 ETH. These cases illustrate the technical flaws of these tools and the operational risks that users face when engaging with such bots.

In analyzing these breaches, it becomes evident that the security infrastructure of many Telegram trading bots is not robust enough to withstand the advanced tactics employed by hackers today. The lack of rigorous security protocols, such as third-party code audits and real-time monitoring systems, means that vulnerabilities can go undetected until it is too late.

Best practices for users

For users who are keen to leverage Telegram bots to enhance their crypto trading experience, it’s imperative to adopt a set of best practices to enhance their security posture.

Vigilance in bot selection

Before engaging with any trading bot, thorough due diligence is essential. Users should research the bot’s track record, developer reputation, and any history of security incidents. Seeking out community feedback and looking for evidence of regular security audits can provide insight into the bot’s reliability.

Securing personal accounts

It is crucial to secure personal Telegram accounts against unauthorized access. Enabling two-factor authentication adds an extra layer of security, making it more challenging for attackers to gain control of a user’s account and, by extension, the trading bot.

Wallet hygiene

Users should never share their primary wallet’s private keys with a trading bot. Instead, creating a new wallet specifically for trading activities can limit exposure. This wallet should only contain funds that the user is prepared to risk, separate from their main holdings.

Regular monitoring and withdrawals

Active monitoring of wallet activity is a necessary habit. Users should regularly review transactions initiated by the bot to detect any unauthorized actions promptly. Additionally, profits should be withdrawn to a secure wallet at regular intervals to prevent the accumulation of funds in a potentially vulnerable environment.

Understanding the tech

A fundamental understanding of the technology behind Telegram bots and the associated risks is beneficial. Users should educate themselves on how the bots operate, the nature of the transactions they perform, and the security measures in place to protect their funds.

In the event of noticing unusual bot behavior or suspecting a security breach, users must act swiftly. This includes stopping all bot activities, transferring funds to a secure wallet, and alerting the bot’s support team or the broader community.

To sum it up

Overall, the innovative promise and allure of Telegram bots can’t be denied, as such tools allow greater opportunities for smart trading. However, users must take proper caution and understand its risks. By implementing these best practices, users can significantly reduce the risk of falling victim to the security pitfalls of Telegram trading bots. While no system is infallible, informed and cautious participation in using these bots is the key to safeguarding one’s digital assets.