As Bitcoin Rebounds, Crypto Stocks Emerge from Doldrums

Since entering into a bear run in January 2018, crypto stocks have suffered, leading some investors to dump them, but bitcoin’s unexpected recovery in July 2018 is giving the asset class a much-needed second wind. Even though crypto is nowhere near the celebrated highs of 2017 and early 2018, there is now a palpable sense of relief and optimism in the market, and companies which are operating in the space are experiencing stock price rebounds.

Crypto-Stocks and Bitcoin Joined at the Hip

At the height of the crypto investment boom of 2017, crypto companies were the darling of many an investor, driven by the bull movement of bitcoin as it touched $20,000. Many companies rebranded furiously as”blockchain-based,” hoping to take ride the wave of publicity and take advantage of freely flowing investment.

In the space of a few days in February 2018, Bitcoin halved in value, and the cryptocurrency market went into a panic. Investor funds dried up as everyone waited to see whether the cryptocurrency champion would stage another bull run and carry the industry along. Days turned into weeks, and weeks into months with bitcoin doing nothing more than declining slowly.

In June 2018, the bitcoin price dipped below the psychologically important $6,000 mark to $5,900, sparking a serious conversation about the viability of bitcoin mining. For the majority of the bitcoin network’s hashrate, $6,000 was the price needed to break even, so there was a real possibility that the miners would only switch off their equipment, grinding bitcoin to a halt and potentially deal a fatal blow to the fledgling cryptocurrency industry.

As crypto-stocks languished, bitcoin started making a noticeable but unspectacular upward movement. $5,900 turned into $6,300. This soon turned into $6,900 before retracing to $6,700. The consensus was that while this was a relief, it was hardly great news. It was not significant enough to cause any significant reaction. Then without warning in the middle of July 2018, bitcoin suddenly broke $7,000, famously shooting up to $600 in just 35 minutes of trading.

Suddenly everyone sat up and took note – the cryptocurrency market, ICOs waiting for favorable market conditions, blockchain-branded companies, and anyone with a stake in the success of the cryptosphere.

For better or for worse, after all, Bitcoin continues to be the lodestar of the cryptosphere, responsible for 46 percent of the crypto market’s total capitalization and used by traders as a proxy for investment decisions.

Bull Market for Crypto Startups Once Again

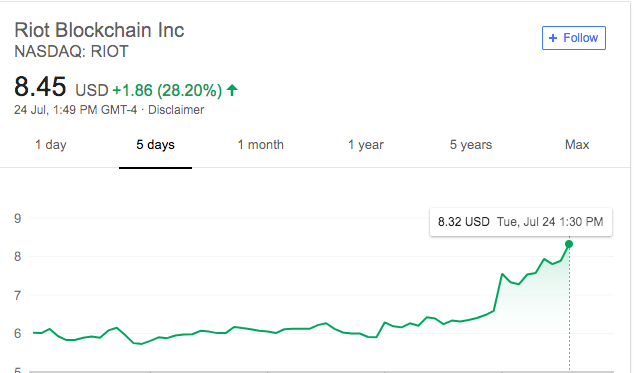

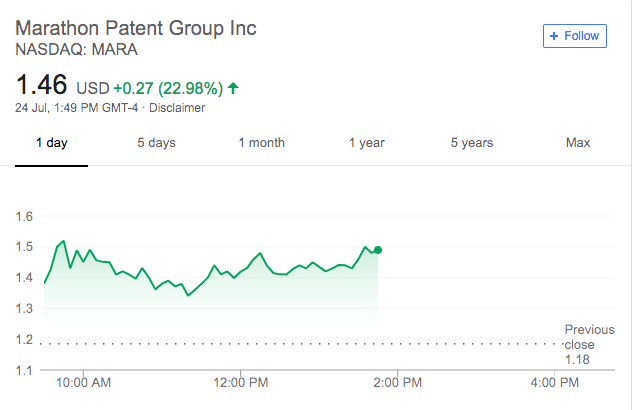

Since the start of July 2018, bitcoin has gained more than 30 percent despite regulatory ambiguity and security concerns. Companies with bitcoin mining interests such as Marathon Patent Group of Quebec, Canada, are witnessing a strong stock resurgence. Riot Blockchain Inc., one of the newly rebranded blockchain companies (once a biotechnology machinery maker) saw its stock jump by nearly 40 percent on July 17 alone.

Riot Blockchain Stock Price

(Source: NASDAQ)

Marathon Patent Stock Price

(Source: NASDAQ)

Shares of NXT-ID Inc. went up 5.1 percent on news that the company is entering the crypto payments space by marketing a device in partnership with hip-hop musician Lil’ Flip.