Biden administration is all eyes on the Silvergate saga

According to a White House representative, Joe Biden’s administration is “informed of the issue” at Silvergate. As the situation develops, it will continue to follow news on the problematic bank.

On March 6, at a press conference, White House’s spokesperson Karine Jean-Pierre said that she would not be commenting directly on Silvergate but that the administration would carefully follow the situation with the cryptocurrency bank.

Jean-Pierre added the White House had observed that Silvergate marked another large crypto business to “face serious challenges” in recent months. Nevertheless, she refused to go into additional details about the firm.

Biden is vigilant about the dangers of crypto

Jean-Pierre notably said that in recent weeks, banking authorities had guided how banks should safeguard themselves against crypto-related dangers.

She further asserts that the president has consistently called on Congress to take action to safeguard regular citizens from the danger presented by digital assets.

“This president will continue to call on Congress to take action. We will not communicate with this specific firm, just as we have not done so with other cryptocurrency companies, but we will keep an eye on the news.”

White House spokesperson Karine Jean-Pierce

Silvergate’s troubles

Silvergate, a financial institution often called a crypto bank, was an essential banking partner to several significant crypto firms and initiatives.

Nevertheless, when Silvergate delayed the submission of its annual 10-K report by two weeks at the beginning of March, concerns over the bank’s ability to remain solvent became more widespread. A 10-K report is a legally required document to be filed by a corporation and gives an in-depth review of the firm’s operations and financial status.

In response to this information, cryptocurrency exchange Coinbase revealed on March 2 that it had severed its partnership with Silvergate. The announcement also referred to concerns regarding an investigation by the Department of Justice (DoJ) into Silvergate regarding the company’s involvement in the failure of FTX.

Circle, Paxos, Bitstamp, Galaxy, MicroStrategy and Tether, to mention a few of the crypto industry’s biggest names, were among many who quickly severed connections with or distanced themselves from the bank.

Further questions were raised about Silvergate’s financial stability when the company stated on March 4 that it was shutting down its digital asset payment network Silvergate Exchange Network owing to “risk-based” issues.

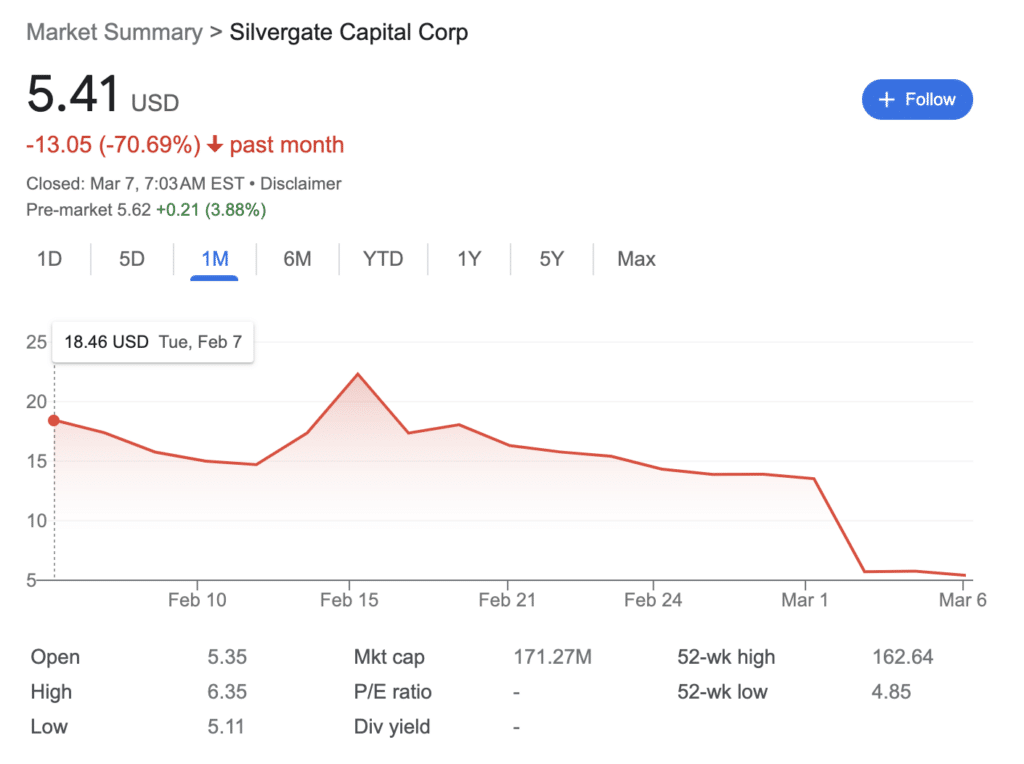

Since March 1, Silvergate’s stock price (SI) has fallen about 60%, while the whole market worth of cryptocurrencies has fallen around 5.5%, to $1.072 trillion.

Financial expert and publisher of the Crypto is Macro Now newsletter Noelle Acheson told CNBC on March 6 that the bank’s conventional economic links would offer authorities a better pretext to crack down on cryptocurrencies if Silverbank were to declare bankruptcy.

“Up until this point, we’ve been able to argue that the consequences of everything that transpired last year was confined inside the crypto business – unpleasant, but limited.”

Financial expert Noelle Acheson

Silvergate’s failure would allow authorities to declare, “We warned you so; systemic risk led to our prediction.” It gives them more reason to go after crypto and tighten the noose on crypto firms’ access to fiat currency.