Binance allegedly lifts limits for Russian users amid regulatory crackdown

Update: Binance reassured crypto.news that all sanctions are still in place and the withdrawal limits remain unchanged.

Binance has reportedly started informing Russian users about lifting part of the sanctions implied in April 2022 related to withdrawal and deposit policies.

In April 2022, two months after the Russo-Ukrainian war began, Binance imposed restrictions on Russian Federation citizens following the EU’s fifth package of restrictions.

Binance was required to limit services for Russian nationals and legal entities established in Russia that had crypto assets exceeding the value of 10,000 EUR. Those who had crypto account balances that exceeded the amount were given 90 days to close out their positions

However, on April 18, Russian finance outlet RBC revealed that Binance users in Russia are no longer subject to this limit. The media confirmed the information with the exchange’s tech support in the region.

A crypto-focused channel in Telegram, DeCenter, posted a screenshot of an alleged support chat with a Russian-speaking user. The purported Binance support team member writes in their message:

“Binance removed the limit of 10,000 euros for the balance of Russian users.”

Screenshot of an alleged support chat with Binance by DeCenter

Crypto.news has solicited comments from Binance. At the time of writing, there was no official confirmation for the news.

Despite this recent change, restrictions on peer-to-peer (P2P) transactions involving US dollars and euros for Russian users remain in place on the Binance platform. Citizens of Russia and individuals residing in the country, regardless of their citizenship, are still unable to buy and sell dollars and euros using Binance’s P2P service.

Binance’s recent regulatory issues

In other news, the Australian Securities and Investments Commission (ASIC) canceled Binance’s derivatives license, requiring the exchange to liquidate all existing positions by April 21. The decision comes from concerns over Binance’s classification of retail and wholesale clients, which has significant implications for consumer protection.

This action follows a lawsuit from the US Commodity Futures Trading Commission (CFTC) against Binance for operating derivatives illegally in America and regulatory challenges from agencies in the UK, Japan, and Singapore.

The revocation of Binance Australia’s license raises questions about cryptocurrency regulation in Australia and worldwide as regulatory bodies increasingly focus on crypto enterprises. The CFTC has launched legal proceedings against Binance, accusing the exchange of violating the Commodity Exchange Act by failing to register as a futures commission merchant and operating without required regulations.

The CFTC is seeking relief in the form of civil penalties, disgorgement, and a permanent injunction against future violations. Binance has been under investigation by various regulatory authorities, including the Department of Justice and multiple international regulators.

The lawsuit caused the bitcoin price to drop to $26,600 but quickly rebounded to $27,000. The ongoing regulatory scrutiny highlights the need for clear and compelling regulations in the rapidly evolving cryptocurrency market.

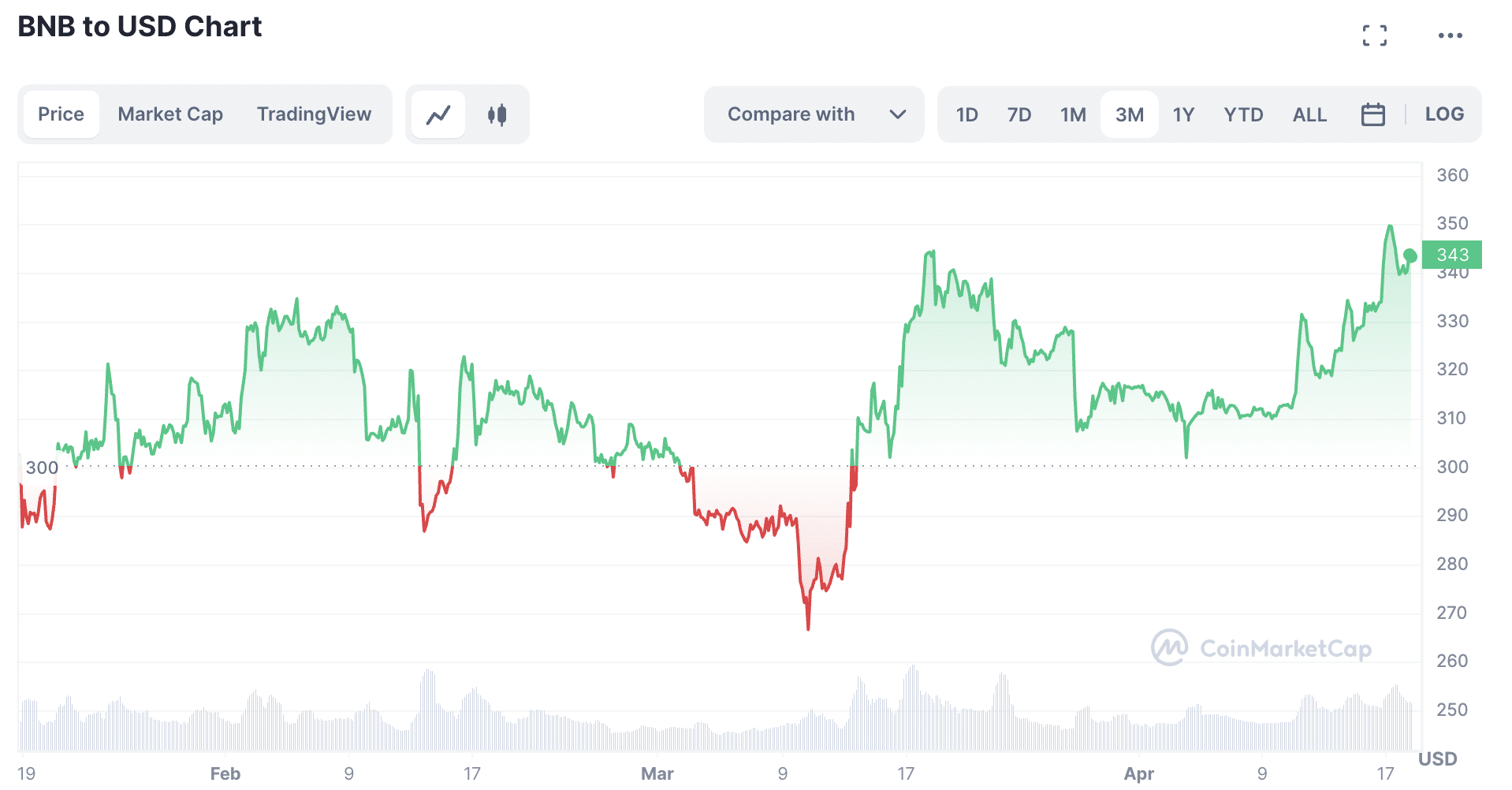

The cryptocurrency markets have recently experienced turbulence due to a significant regulatory push against Binance, which has sent shockwaves throughout the industry. The firm’s native token, BNB, has been significantly impacted by these developments.

The US Commodity Futures Trading Commission (CFTC) has announced its intention to file a lawsuit against Binance, one of the world’s most prominent cryptocurrency exchanges. This news has caused considerable concern across the cryptocurrency markets, with BUSD exchange reserves reportedly decreasing by $500 million, according to data from Cryptoquant. This substantial dip highlights the potential impact of regulatory action on the cryptocurrency market.