Binance-backed Bitcoin restaking startup BounceBit unveils roadmap

BounceBit has announced its roadmap to democratize high-yield opportunities in Bitcoin investing by merging centralized and decentralized finance.

BounceBit, a new Bitcoin restaking startup backed by Binance, has unveiled its roadmap for 2024, outlining key aspects the project is planning to implement this year.

In a Medium blog post on May 20, BounceBit announced its intention to combine the structure and liquidity of centralized exchanges like Coinbase while building decentralized infrastructure for Bitcoin “as an asset, without altering its core technology.” The startup explicitly stated it will not launch a sidechain or layer-2 solution, saying “recent trends, like runes and BRC-20 tokens, seem to capitalize on temporary hype rather than addressing long-term needs.”

“You might not agree, the market might not agree, and that’s fine, we are venturing this road anyway.”

BounceBit

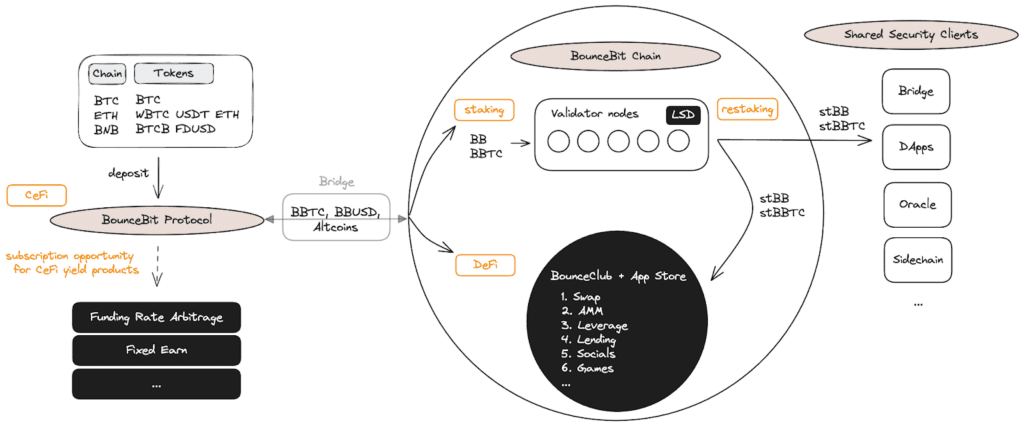

Although BounceBit’s roadmap for 2024 mentions no dates, the document focuses on several key developments this year. The startup aims to enhance the BounceBit Chain — a proof-of-stake layer-1 chain secured by validators staking both Bitcoin and BounceBit’s native token BB — by optimizing the Ethereum Virtual Machine (EVM) execution layer to improve node performance.

Other planned improvements include developing a shared security client module to allow other projects to utilize the liquidity of the BounceBit BTC restaking chain, constructing a new mempool module to achieve higher transaction throughput, and refactoring the communication layer between EVM and Cosmos SDK, a framework for developing blockchain networks.

In addition to infrastructure enhancements, BounceBit plans to introduce the Fixed Earn product, offering fixed income for Bitcoin and dollar assets, similar to traditional crypto lending. The company will also launch BounceClub, a service enabling users to create their own centralized-decentralized-finance (cedefi) products using BounceBit’s widget. For contract deployment, it’s understood that BounceBit will maintain a special whitelist, though the method of verification is yet to be known.

Earlier in April, Binance Labs, the venture arm of Binance, announced its investment in BounceBit. While the size of the deal has not been disclosed, Binance Labs’ Yi He stated that the startup “unlocks new avenues for Bitcoin’s utilization with the fusion of cefi and defi.”