Bitcoin and crypto markets firm ahead of US Fed interest rate decision

Ahead of the highly anticipated Federal Reserve (Fed) announcement, trader sentiment is bullish, and the total crypto market capitalization is over $1.18t.

Bitcoin, ethereum bullish but gains are low

Statistics indicate that crypto markets have recorded slow gains recently in anticipation of the impending announcement from FOMC. Data suggests that the total market cap rose 1.47% to $1.18t primarily because some coins have been firm, reversing recent losses.

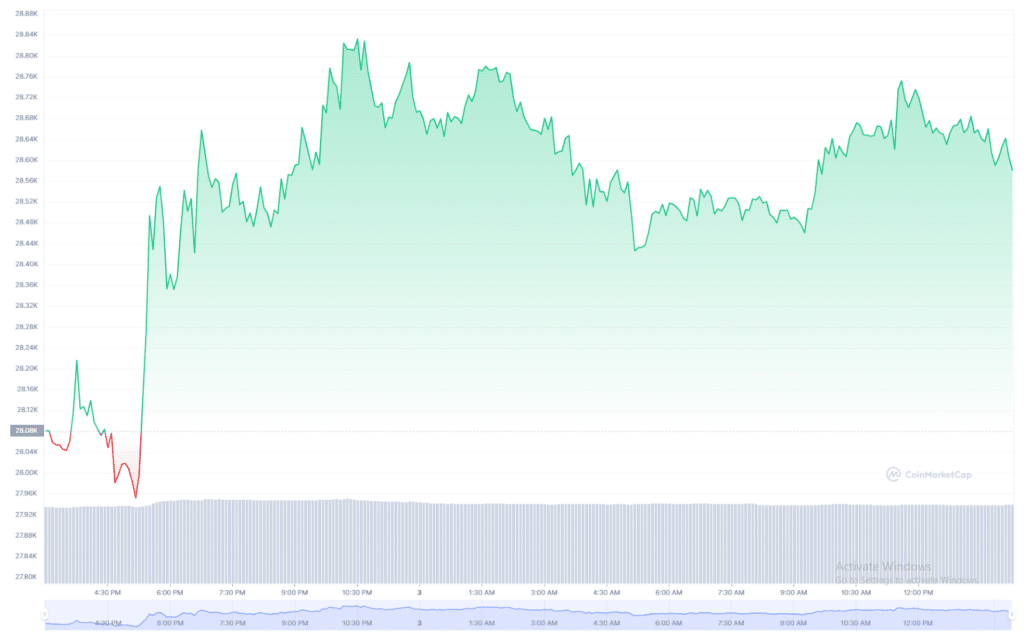

Bitcoin, for instance, is firm, up 2.29% in the past 24 hours and trading at about $28.7k when writing.

Bitcoin price actions | Source: CoinMarketCap

Reports indicate that the coin’s resistance and support currently stand at $29.1k and $27.5k, respectively.

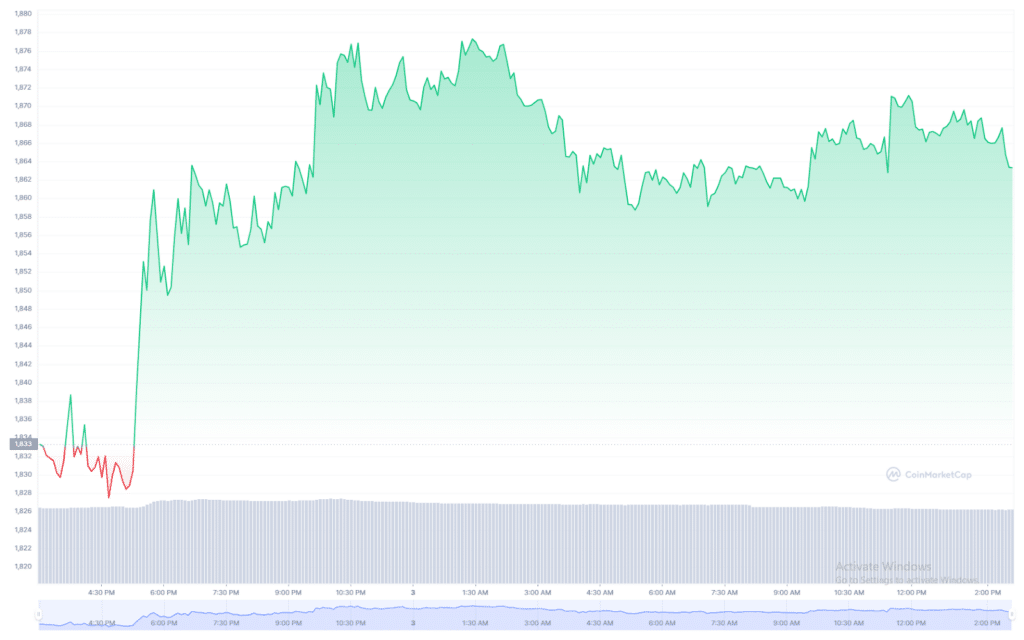

Ethereum price action | Source: CoinMarketCap

Meanwhile, ethereum (ETH), the second largest coin, is stable, adding 1.97% on the last day. It is currently trading at $1.8k. ETH is one of the top performers in 2023.

While ETH prices posted minor gains, polygon (MATIC), tron (TRX), and other top coins are relatively stable when writing. Meanwhile, BNB, ripple (XRP), cardano (ADA), litecoin (LTC), and solana (SOL) are in red, looking at their performance on the last day.

The performance of crypto assets paints to shifting sentiment and outflow of capital from banking stocks. Stocks of regional banks are mostly bearish, losing double digits.

Fed expected to raise rates

The Federal Reserve (Fed) will announce new interest rates today. Based on reports, economists’ consensus is for a 25 basis points (bps) rate hike, pushing fund rates to 5.25%, the highest in over 15 years.

A minority of analysts and investors believe that the Fed might increase rates by 50 basis points to 5.5%.

Some feel like the rate hike cycle will continue until the interest hits the 6% mark before the Fed decides to take a different action.

How the Fed acts now will indicate where their priorities lie: To tame inflation or rescue banks facing a liquidity crisis made worse by record-high interest rates..