Bitcoin nears $100K while retail investors dominate market

Bitcoin trades at $99,340.23, approaching the $100K mark as retail investors retain market dominance.

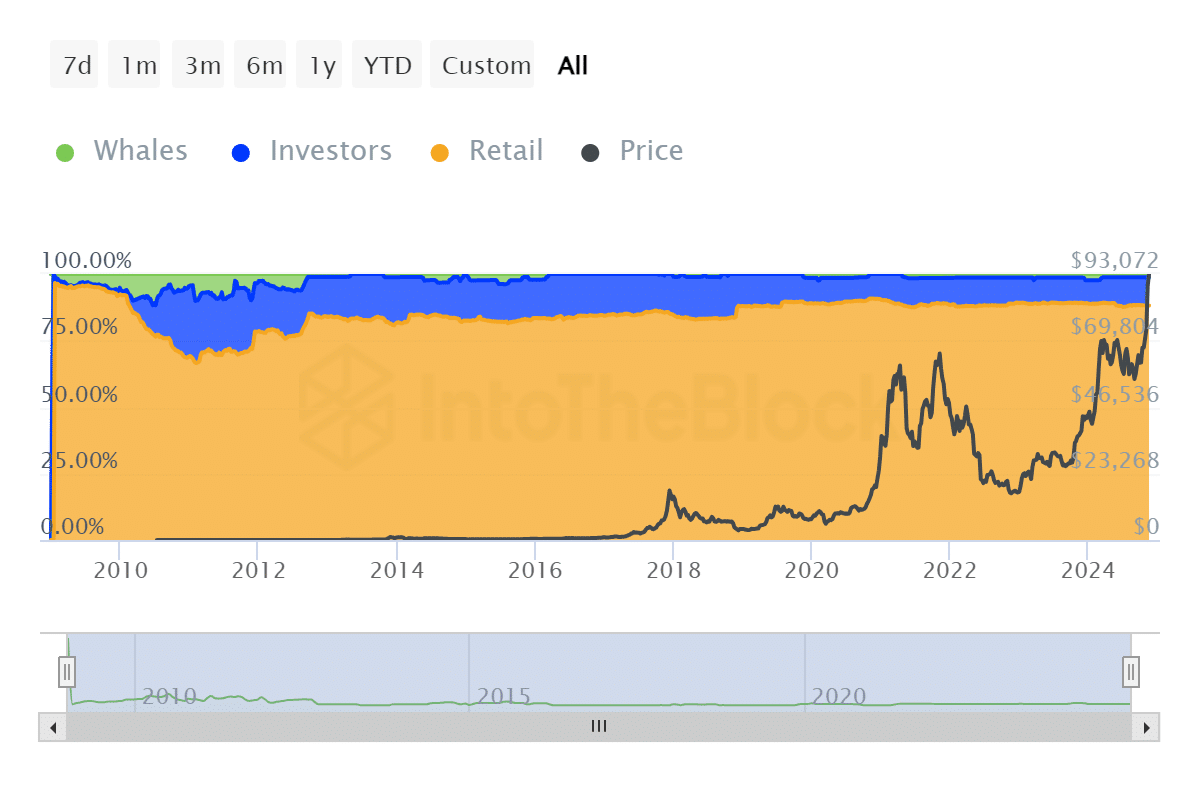

What is more interesting about this rally is the dominance of retail investors, who currently account for 88.07% of all Bitcoin (BTC) in circulation, according to The Block. Contrary to the recent claims that institutional investors are leaving retail investors behind in ownership of BTCs, the asset is still in the hands of retail investors, which underlines their stronghold in the market. This grassroots stronghold contrasts the much smaller shares held by whales at 1.26% and institutional investors at 10.68%.

Adding momentum to BTC, the historic debut of BlackRock’s BTC ETF options witnessed $1.9 billion in notional value traded on the first day. It is a landmark news because it signifies growing institutional interest in BTC, yet lowers entry barriers for everyday investors. But there’s still some way to go, says Jeff Park, Head of Alpha Strategies at Bitwise Invest, in his observations on X about the ETF’s potential to reshape access to BTC.

Bitcoin Breakdown:

BTC ownership distribution reflects the overall availability of the asset in the market. Companies such as Coinbase have substantial quantities of BTC, holding more than 2.25 million BTC. However, most of this is kept for their clients. Satoshi Nakamoto‘s wallet, which contains 96,8452 BTC, remains untouched as it played a role in creating the Genesis block.

Overall, funds and ETFs account for 1.09 million BTC, or about 5.2%, while governments such as the U.S. and China collectively hold around 2.5%.

Despite BTC witnessing price surges, the market is far from stable and often shows extreme volatility. For instance, on Nov. 21, the price of BTC dipped to $95,756.24, with trading volume reaching $98.40 billion. This volatility then reflects the vital role that retail investors play during price hikes, even as institutional investors become more active in the market.

Some argue that BTC is becoming more centralized, but the data does not back this claim. Financial products like ETFs are attractive to institutions, but they also make BTC more accessible to retail investors. BTC continues to align with Satoshi Nakamoto’s vision of a decentralized and democratized financial system. As BTC nears the $100,000 threshold, its open-and-shut conversation that BTC’s ownership remains essential.