Bitcoin back at $43k, BlackRock’s BTC ETF volume closes in on GBTC

Nearly three weeks after the SEC approved spot BTC ETFs, an expert says BlackRock’s fund may outpace Grayscale in trades.

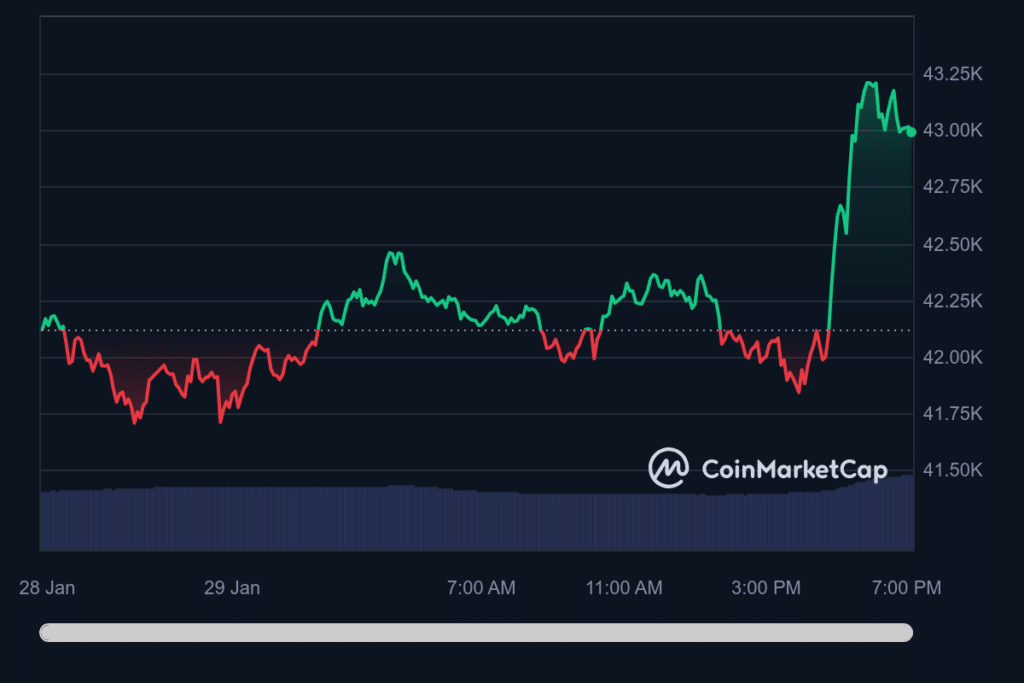

Bitcoin (BTC) retook the $43,000 mark and grew over 2% in a single day shortly after trading hours opened in the U.S. on Jan. 29. BTC’s trading volume also surged nearly 20% in 24 hours as crypto’s largest token aimed to erase losses suffered following a 10% drop on Jan. 22 when Bitcoin fell under $40,000.

At the time, the sharp decline was attributed to selling pressure from GBTC outflows, the converted BTC exchange-traded fund (ETF) issued by crypto asset manager Grayscale. GBTC outpaced other ETFs from BlackRock and Fidelity in trading volume for the first two weeks, recording roughly $4 billion in outflows.

However, Bloomberg’s James Seyffart said this pattern may be on the cusp of changing. Data showed that BlackRock’s iShares Bitcoin Trust (IBIT) boasted $2 million more than Grayscale’s GBTC in trades nearly two hours after trading opened.

According to an Arkham Intelligence dashboard tracking issuer wallets, BlackRock also owns over 52,000 Bitcoins worth over $2.1 billion at current prices.

While Grayscale had regained its trading lead at press time, BlackRock’s fund may be the first spot BTC ETF to outclass GBTC’s volume since the United States Securities and Exchange Commission (SEC) approved such crypto-based investment product on Jan. 10.

Another precursor to Bitcoin’s price action may be the Federal Reserve’s Federal Open Market Committee meeting. There is a 97.9% chance that the Fed will maintain its 5.25%-5.5% range and pause rates, per the CME FedWatch tool.