Spot Bitcoin ETFs’ net outflow: what investors need to know

The BTC ETF market saw its first net total outflow of $158 million on Jan. 24, with GBTC experiencing a significant dip in investor interest. What’s next?

The recent launch of U.S.-listed Bitcoin (BTC) exchange-traded funds (ETFs) represents a big milestone in the crypto’s journey toward mainstream financial acceptance.

On the first day of trading, Jan. 11, these ETFs, a collection of 11 including notable names like BlackRock’s iShares Bitcoin Trust, Grayscale Bitcoin Trust, and ARK 21Shares Bitcoin ETF, saw a remarkable $4.6 billion in trading volume.

Amid this, firms like BlackRock and Fidelity are leading the charge with dominant trading volumes, and others like Vanguard have chosen to remain on the sidelines despite SEC’s approvals for their spot BTC ETF, citing the high-risk nature of Bitcoin as an investment.

Moreover, this enthusiasm is also tempered by a note of caution from the U.S. Securities and Exchange Commission (SEC). The SEC, despite approving these ETFs, was clear in stating that this approval does not constitute an endorsement of Bitcoin, and it still considered it a speculative and volatile asset.

Meanwhile, financial experts, including those from Goldman Sachs, have expressed skepticism about the intrinsic value of crypto assets like Bitcoin.

As these ETFs continue to trade, let’s better understand who is leading the ETF race and what is happening in the BTC ETF market.

Who is leading the spot BTC ETF race?

As of Jan. 29, leading the pack among all spot BTC ETFs is the Grayscale Bitcoin Trust (GBTC). Despite GBTC’s premium fee of 1.50%, the highest among its peers, Grayscale boasts a market cap of almost $26 billion and assets under management (AUM) of over $20 billion.

Comparatively, BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Trust (FBTC) are vying for their share of the spotlight.

With a more investor-friendly fee of 0.25% each, both have made significant strides. IBIT has garnered an AUM of nearly $2 billion, while FBTC trails closely with $1.75 billion, placing second and third respectively as of Jan. 29.

Ranking behind the top three ETFs are funds like Ark/21 Shares’ Bitcoin Trust (ARKB) and Bitwise’s Bitcoin ETP (BITB). ARKB is making noticeable waves with an AUM of $529 million and a competitive fee of 0.21%.

Bitwise, slightly behind with an AUM of $511 million and a fee of 0.20%, is also fighting to make strides.

Meanwhile, Coinbase’s role as a common custodian for many of these ETFs brings an intriguing twist to the narrative. Despite its integral role, Coinbase’s stock price has surprisingly dipped by around 7% since the launch of these ETFs and is trading at $125 as of Jan. 29.

What is happening in the BTC ETF market

Recent developments surrounding the launch of spot Bitcoin ETFs have yielded some unexpected results.

A notable observation comes from James Seyffart, a Bloomberg Intelligence analyst, who reported that the 10 spot Bitcoin ETFs witnessed a net total outflow of $158 million on Jan. 24, marking the first occurrence of such an event since their inception on Jan. 11.

BlackRock’s IBIT absorbed a substantial chunk of this outflow, amounting to $66 million. However, GBTC, which had been leading the pack, experienced a notable dip in investor interest. The total number of Bitcoins in the trust fell sharply to 502,712 as of Jan. 29 from over 590,000 BTCs at the beginning.

In contrast, BlackRock’s IBIT and Fidelity’s FBTC have shown decent growth. Both funds have doubled their Bitcoin holdings, with IBIT holding nearly 50,000 BTC and FBTC holding over 40,000 BTC as of Jan.26.

Yet, despite the recent mixed results, the cumulative inflows into these spot ETFs since their launch remain significant.

Eric Balchunas of Bloomberg calculates the total dollar inflows at around $824 million, translating into a net Bitcoin addition of approximately 17,000-20,000 tokens.

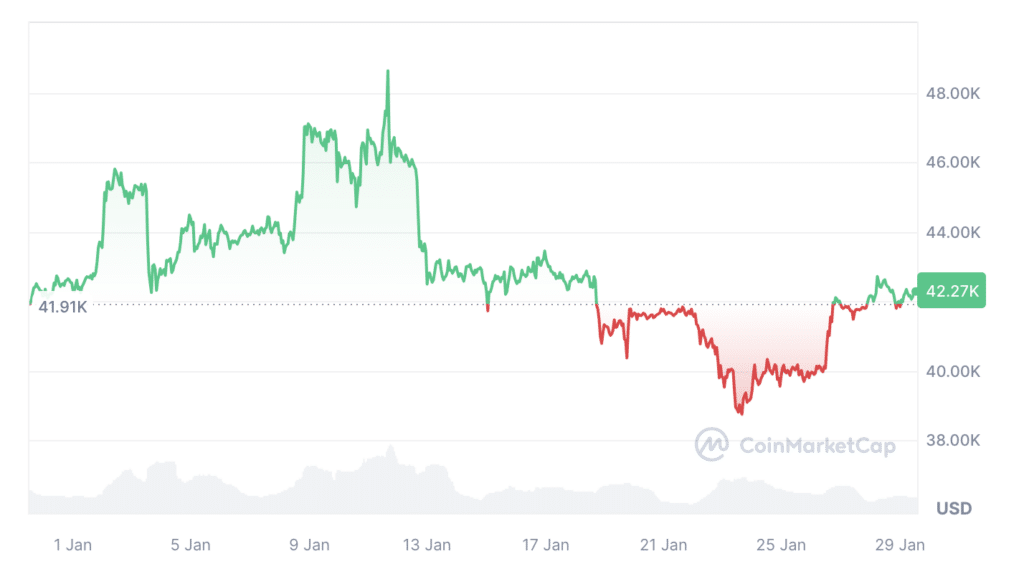

The Bitcoin price action has been a crucial factor influencing these trends. The approval of these ETFs initially pushed Bitcoin to a 52-week high of $48,969 on Jan. 11.

However, following this peak, the market entered a bearish phase, with the price dropping to around $38,500 by Jan. 23.

There has been a rebound since, with Bitcoin crossing the $40,000 resistance it faced in the preceding days, trading around $42,000 as of Jan. 29.

What to expect next

A potential U.S. recession in 2024, U.S. presidential elections, and the fourth Bitcoin halving scheduled for Apr. 2024 could potentially boost Bitcoin’s price.

Moreover, the trend of countries adopting Bitcoin, as seen with El Salvador and the Central African Republic, could continue this year. This broader adoption could lead to an increased demand for BTC and BTC-related products such as spot and futures ETFs.

The combination of all these factors makes the future of Bitcoin and Bitcoin ETFs both exciting and unpredictable.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.