Bitcoin dominance crumbles: Top 10 beginner friendly altcoins to watch

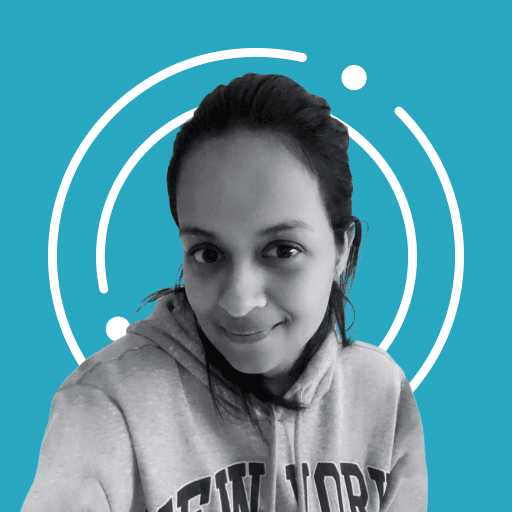

Bitcoin dominance dips to 55.81%, down from its November 2024 top of 61.53%. Declining BTC dominance has paved the way for the altcoin season, with over 75% of the top 100 altcoins consistently outperforming Bitcoin. Let’s deep-dive into the top 10 altcoins for beginners to buy in December 2024.

Table of Contents

Why Bitcoin dominance matters to altcoin traders

Bitcoin (BTC) dominance is a percentage measure of how much of the total crypto market value belongs to BTC. This is an important metric for traders as it helps identify how capital is distributed between Bitcoin and altcoins.

At 55.81%, over half of the total crypto market value belongs to Bitcoin and the rest of the capital is likely flowing into altcoins. Typically, a decline in Bitcoin dominance during bull markets is a sign of potentially higher returns on altcoins. Bitcoin dominance is therefore used to identify altcoin trading opportunities.

Bitcoin dominance suddenly drops, signalling the start of an altseason, a time period where over 75% of the top 100 altcoins consistently outperform BTC in a 90-day timeframe. The shift occurs in capital flow, and traders capitalize on the opportunity by minimizing exposure to BTC while investing in high-liquidity altcoins.

The Bitcoin dominance chart on TradingView shows a likelihood of a nearly 5% decline to the confluence of 100 and 200-day Exponential Moving Averages (EMAs) at 53%.

What makes an altcoin worth investing in

In order to make the most of the altseason, beginners need to consider these five points as a checklist when buying an altcoin.

Fundamental use case and utility

The purpose of the real-world use case of an altcoin is one of the most important points to consider before buying a token. Questions to consider are: what is the real-world use case? How do blockchain technology and the token simplify an existing problem? What is the unique value proposition of the altcoin?

Two altcoins that fit the criteria and rank within the top 100 cryptos by market capitalization are Polygon (MATIC) and Chainlink (LINK). MATIC is a layer-2 scaling solution that enables faster and cheaper transactions for users while capitalizing on Ethereum (ETH) as the underlying security layer.

Chainlink connects smart contracts with real-world data and finds utility in traditional and decentralized financial institutions, crypto exchanges and banks.

Tokens with no utility may enable short-term gains; however, once the hype surrounding the project dies, most token holders typically face unrealized losses.

Market capitalization and liquidity

An altcoin’s market capitalization is a measure of the size and relevance of the project among traders. Large market cap projects like Ethereum, Binance Coin (BNB) are typically considered safer than other altcoins, the potential of price gains is low to moderate in most cases. But mid to small-market cap projects, meme coins on Base, and Ripple (XRP) have a relatively higher potential for gains with higher risk.

Liquidity ensures traders have an out in the case of large price swings or corrections.

Litecoin (LTC) is a large market-cap altcoin known for its robust liquidity and has been considered “silver” to Bitcoin’s “gold” since its inception.

Aptos (APT) is a mid-market-cap token focused on scalability and security.

Development activity and team transparency

Evaluating the team behind the project and keeping track of ongoing developments are key steps in ensuring the token has a committed team.

Tracking roadmap progress, identifying whether the team is credible within the blockchain community, and following Discord or X commentary on the project are other effective ways.

Cardano (ADA) is popular within the crypto community for its rigorous academic approach and has one of the most active developer communities.

Optimism (OP), an Ethereum layer-2 scaling solution, has consistent updates and a transparent development team.

Community support and adoption

Most meme coins criticized for lack of utility compensate for the same with support from a strong community online. This is evident from address activity, trade volume, participation in burn/staking and airdrops announced by the project.

Altcoins with community support have a relatively higher number of supporters on forums like Reddit, X, or Telegram. Tracking project partnerships and integrations is another way to identify the token’s relevance and adoption among market participants.

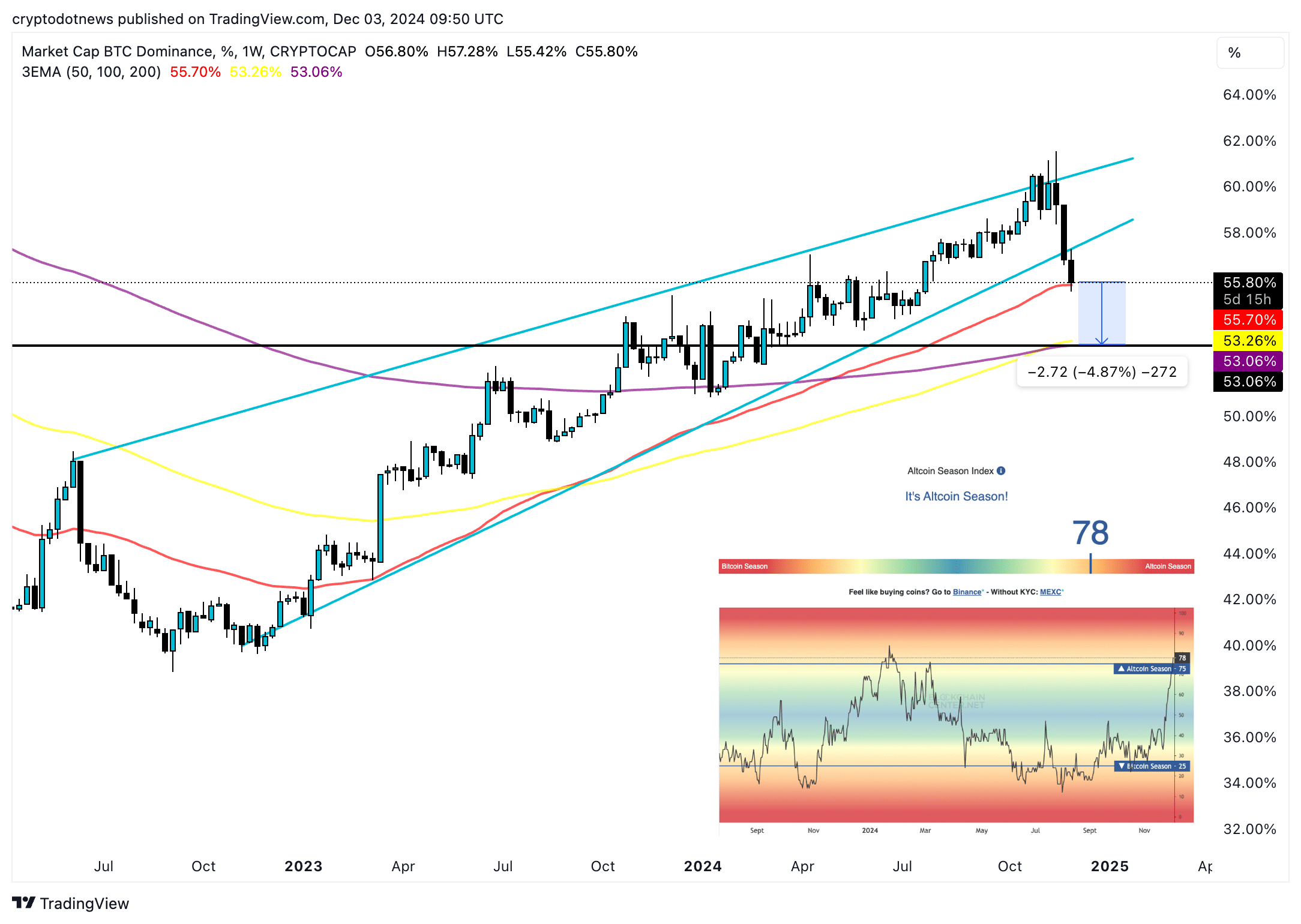

Solana (SOL) yielded double-digit gains for holders this market cycle, flipping Ethereum in transaction volume on decentralized exchanges and protocol revenue in October and November 2024.

Dogecoin (DOGE) started out as a meme coin, however strong community support contributed to the increasing adoption for microtransactions and tipping across the crypto ecosystem.

Risk management: Volatility and regulatory landscape

Altcoins are inherently considered riskier than Bitcoin, so beginners should assess the volatility through historical price movements, listing on exchange platforms with clear listing criteria, regulations and existing lawsuits in the U.S. and other economies.

XRP is rallying despite ongoing regulatory scrutiny, as it remains a popular altcoin for cross-border payments with a clear use case on the XRPLedger.

Stellar (XLM) is similar to XRP, Stellar focuses on cross-border payments and development of central bank digital currencies, with regulatory clarity.

Top 10 altcoins to buy in December 2024 to prepare for 2025

Solana (SOL)

Solana is a layer 1 token that competes with Ethereum and outperforms the latter in several metrics this cycle. From decentralized exchange volume to protocol revenue and daily active users, Solana has flipped Ether, fueling the narrative of a “flipping” where the SOL market cap exceeds that of ETH.

Between $200 and $210 is the ideal buy zone for sidelined traders, the resistance is the 2024 peak and the psychologically important $300 level. The target is $359 when SOL enters price discovery in this cycle.

Ethereum (ETH)

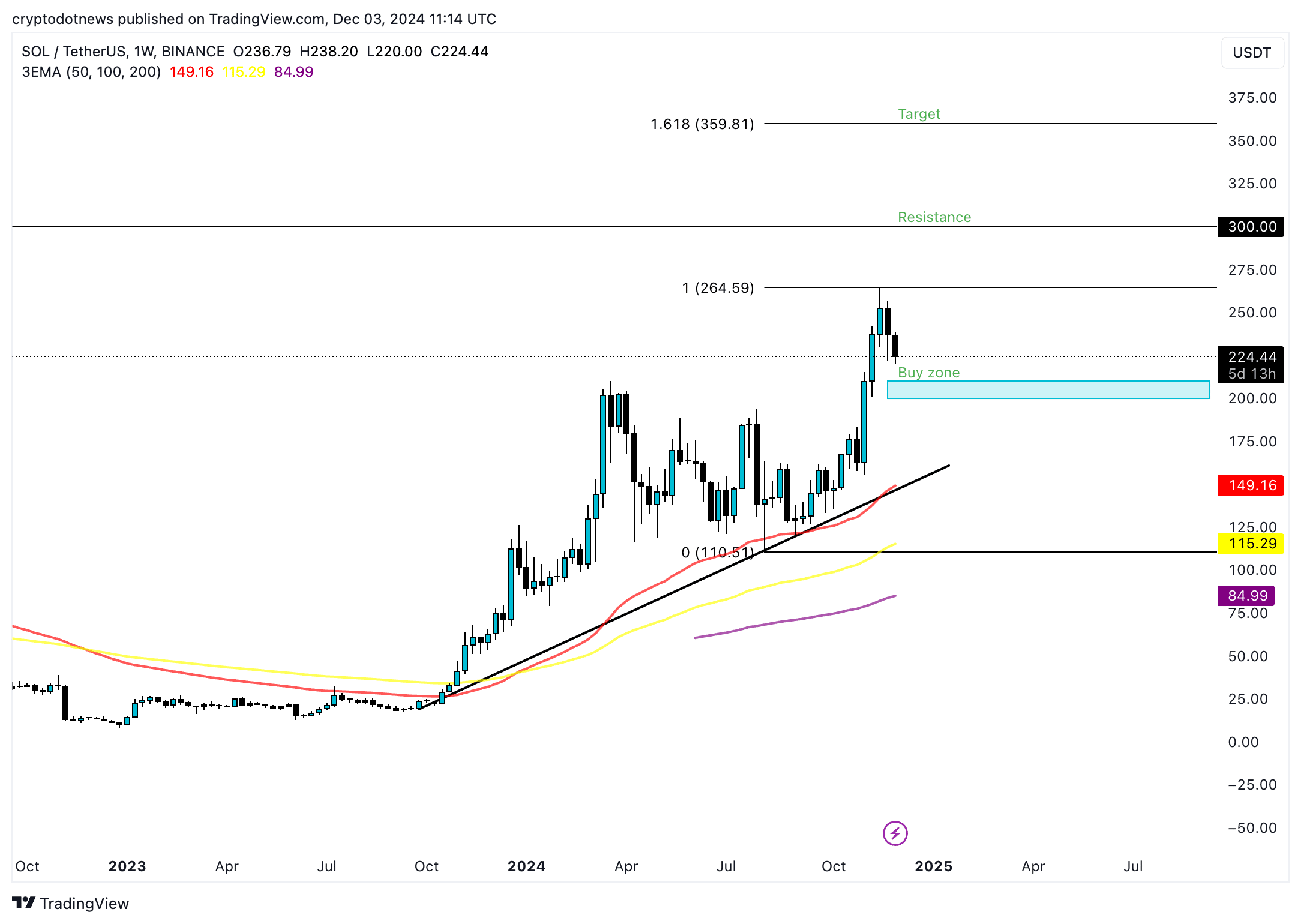

Ethereum is likely to outperform Solana, at least in the short term, based on on-chain metrics from derivatives trading platforms like Binance. ETH/USDT weekly price chart shows a cup and handle formation with a measured move target of $7,000.

The buy zone for Ether is between $3,200 and $3,600, and the all-time high and a key resistance level is $4,878.

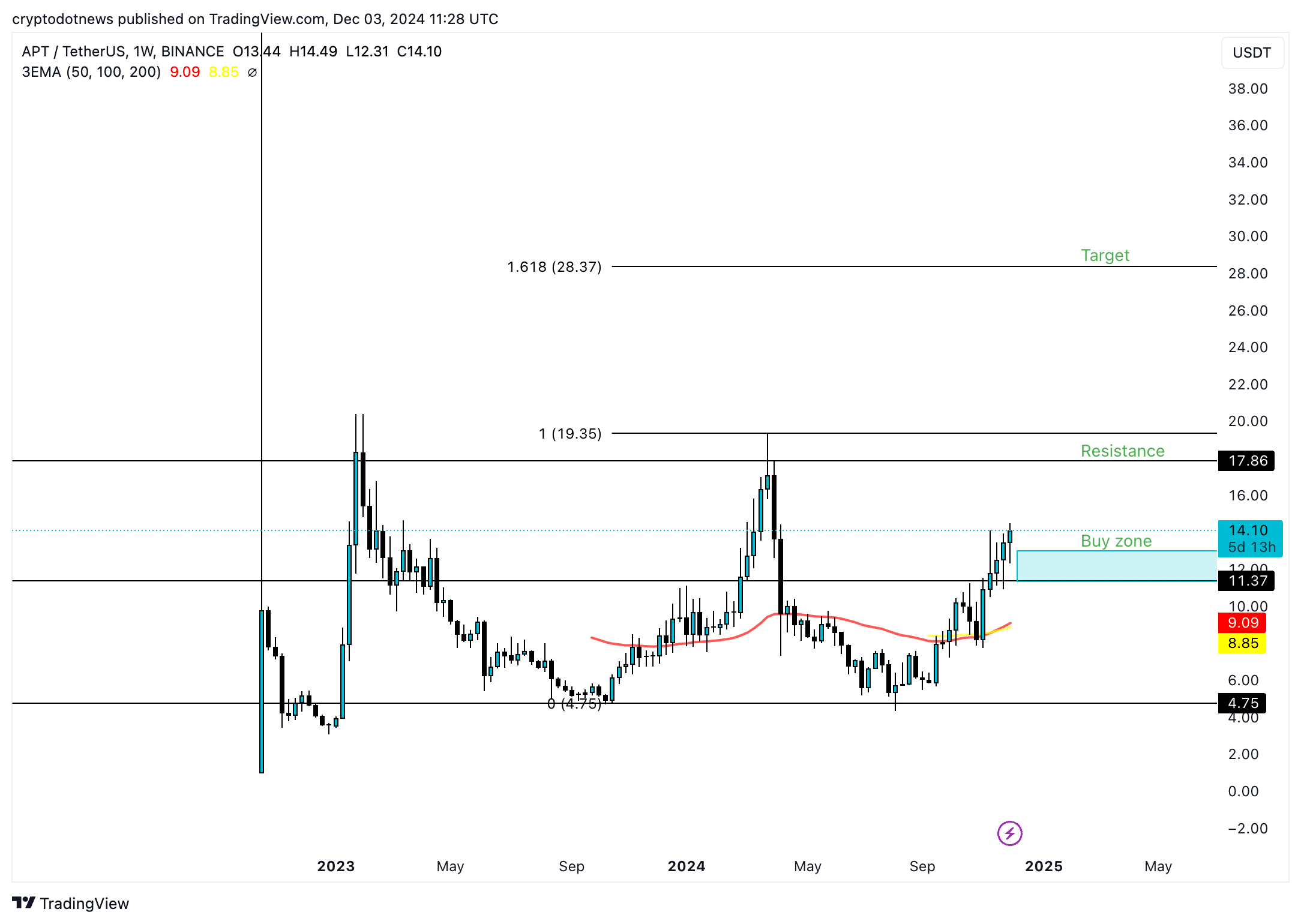

Aptos (APT)

Aptos is forming a cup and handle in its weekly price chart. The buy zone for sidelined traders and new entrants is between $11.37 and $13.50. The key resistance level is $17.86, and the target for the cycle is $28.37.

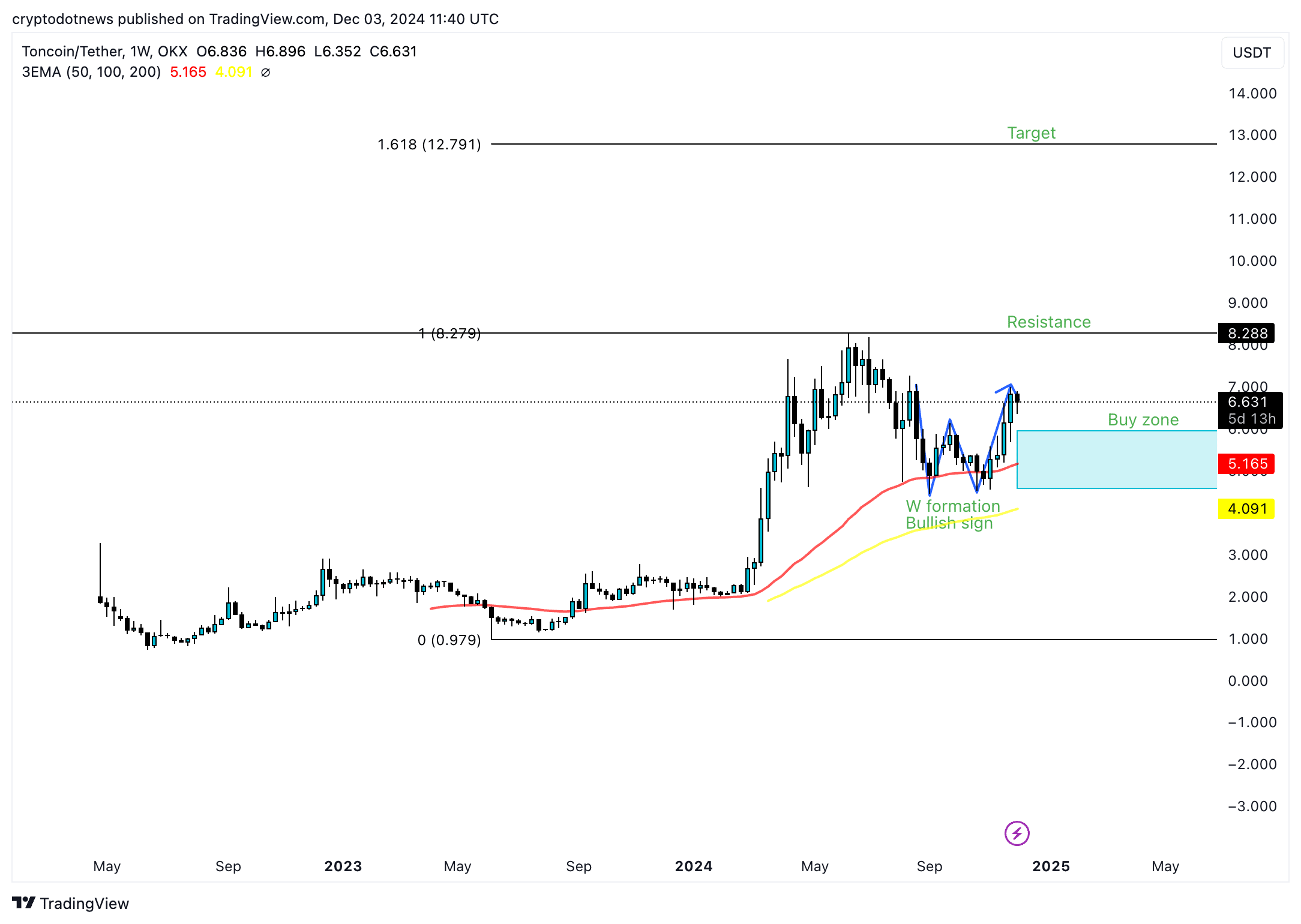

Toncoin (TON)

Toncoin observed a W formation on its weekly price chart, and the buy zone is between $4.091 and $6. TON faces resistance at $8.288, and the target for the cycle is the 1.618 Fibonacci retracement of the rally from May 2023 low to the 2024 peak at $12.791.

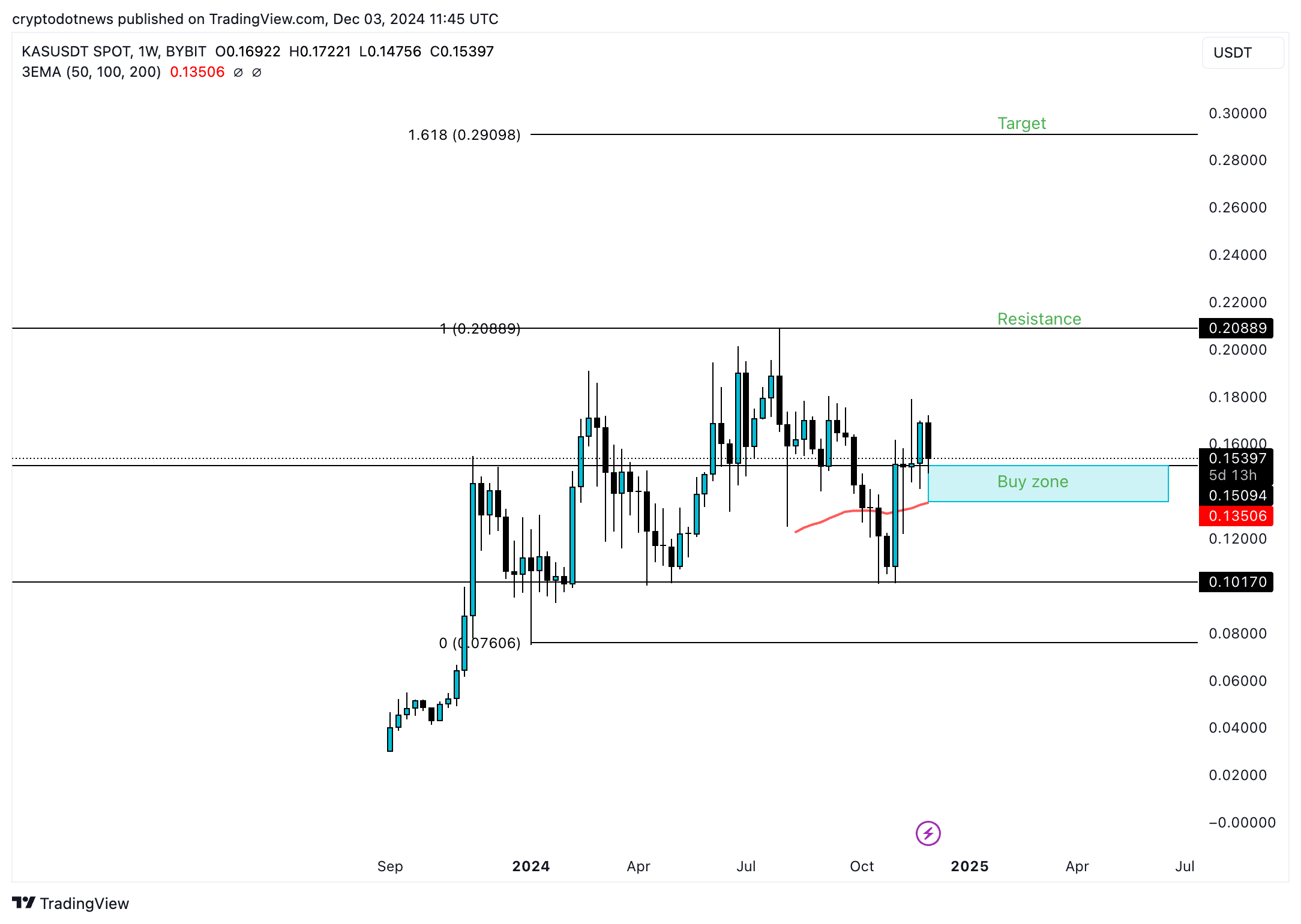

Kaspa (KAS)

Kaspa’s buy zone is between the 50-day Exponential moving average at $0.13506 and $0.15397. KAS could climb to its resistance at $0.20009 and the target at $0.29098. The layer 1 token could extend its gains this cycle alongside Bitcoin and other altcoins.

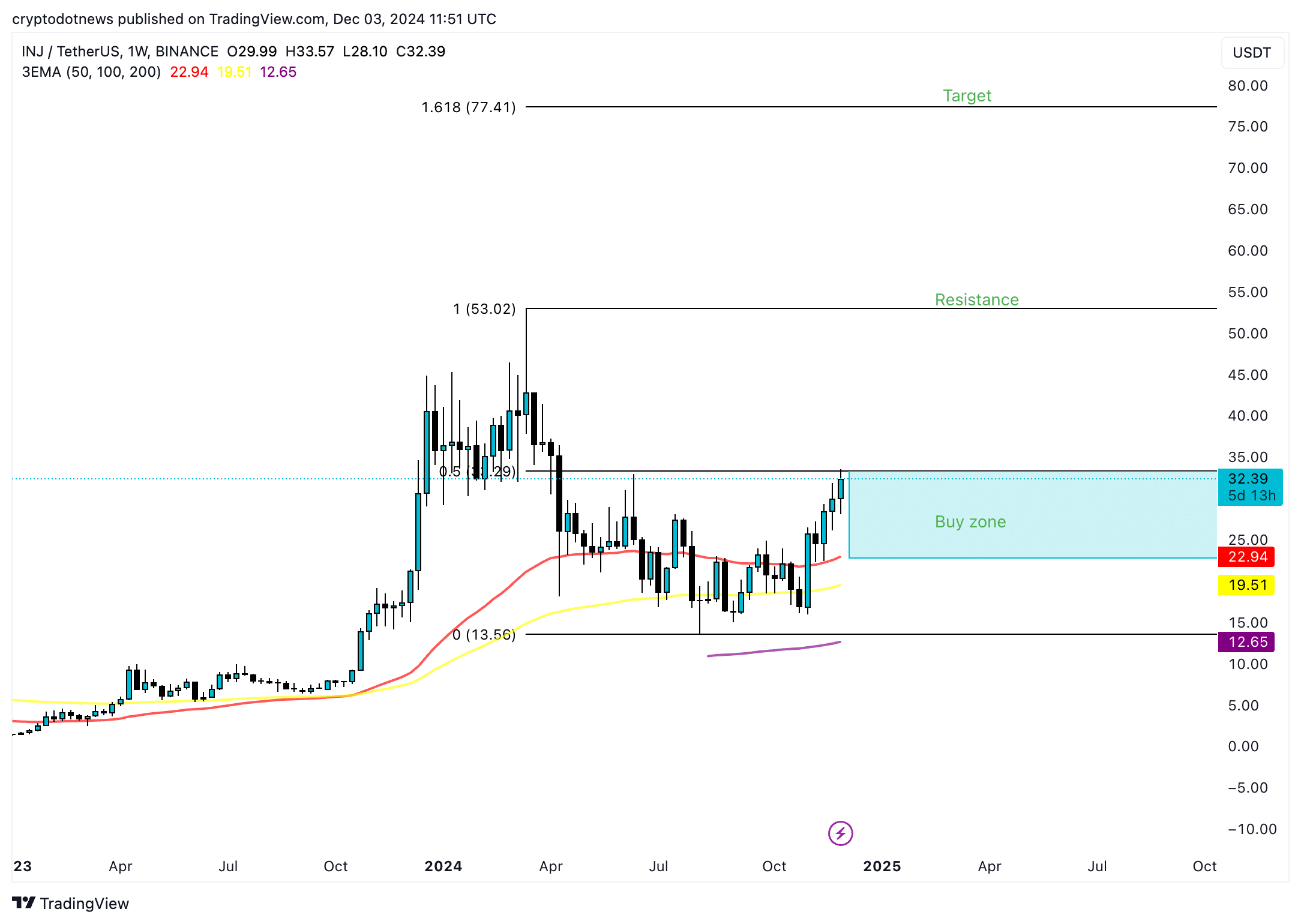

Injective (INJ)

Among artificial intelligence tokens, Injective is within the buy zone that extends from a 50-day EMA at $22.94 to $32.39. INJ faces resistance at the 2024 peak of $53.02, the cycle target is $77.41, and the 161.80% Fib retracement of the rally is $53.02.

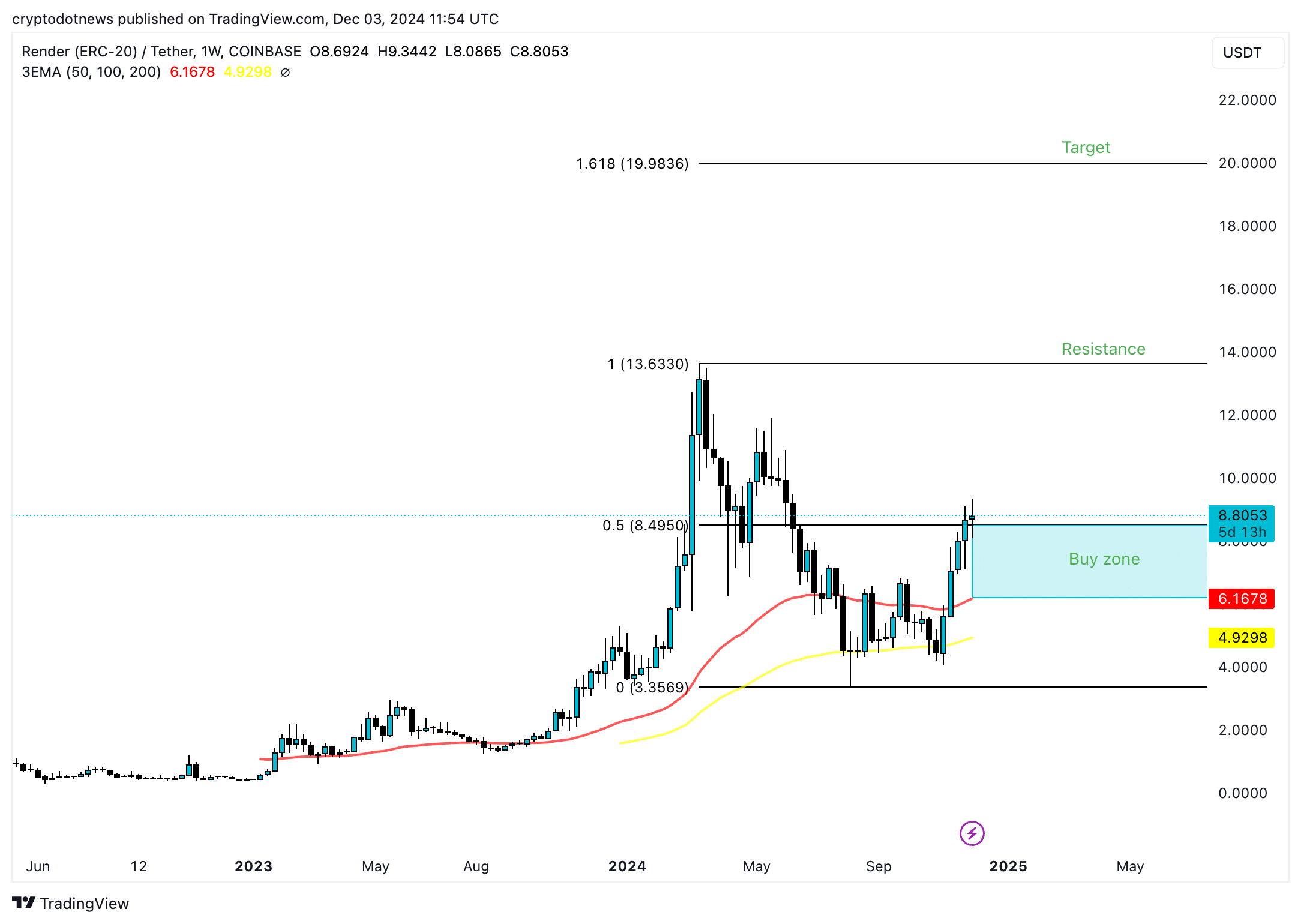

Render (RNDR)

Render is within the buy zone between $6.6178 and $8.4950, the 50% Fibonacci retracement of 2024 decline in RNDR. The token’s target for the cycle is projected at $19.9836, and INJ faces resistance at $13.6330.

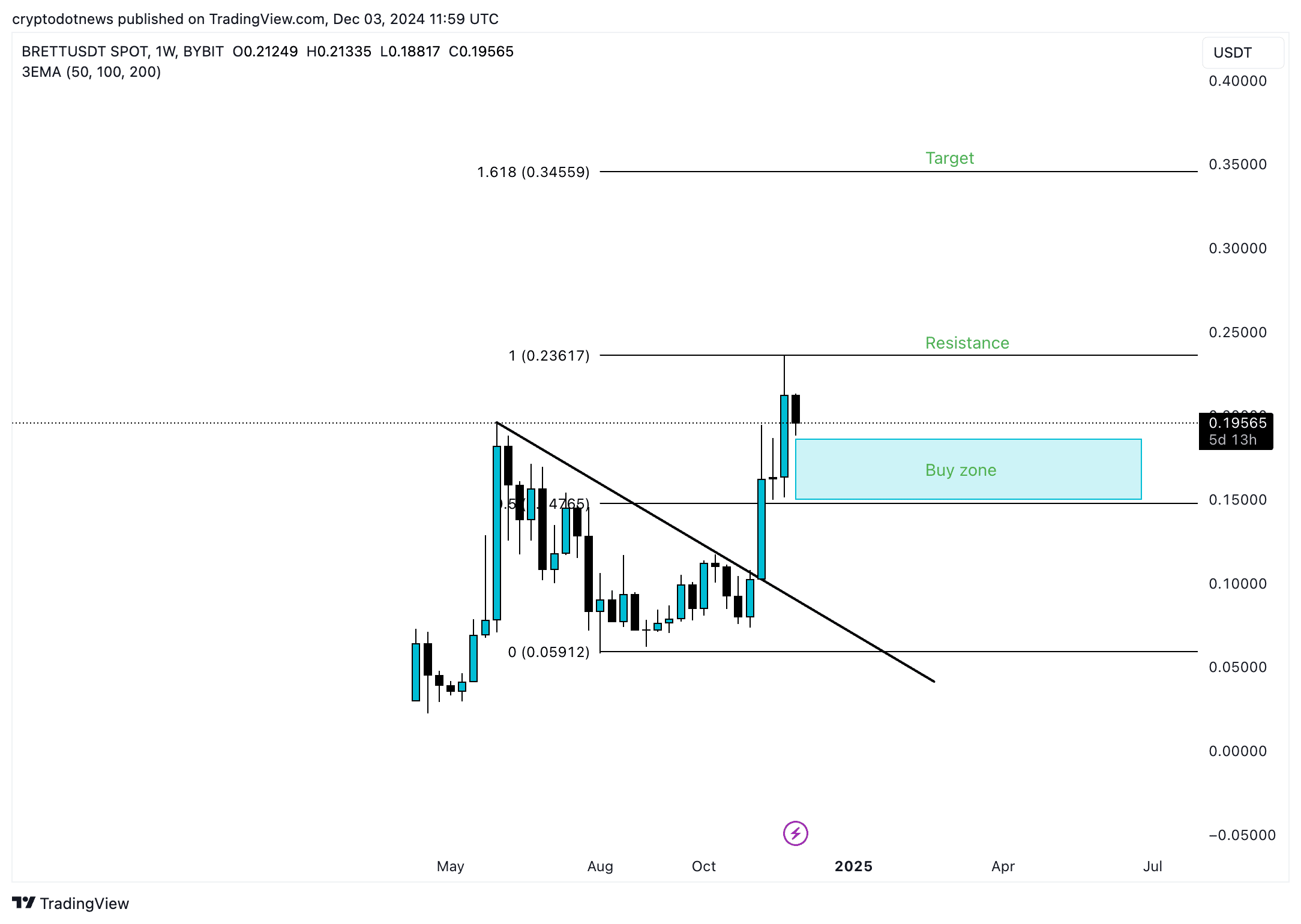

Brett (BRETT)

Among meme coins, Base-based Brett is a token that could extend its gains this cycle. BRETT could break past resistance at $0.23617 to climb towards the target at $0.34559. The buy zone is between $0.15 and $0.18.

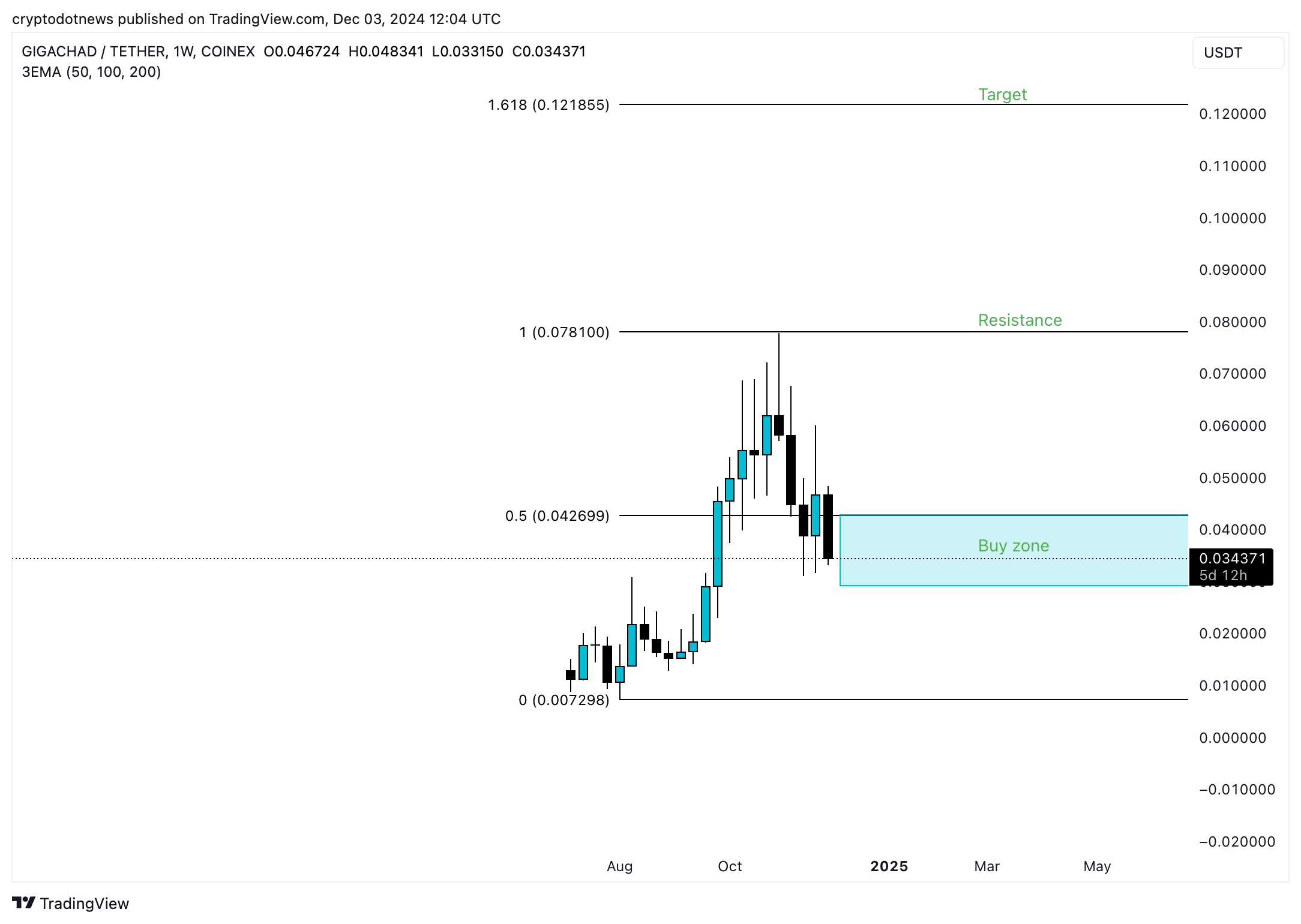

Gigachad (GIGA)

Gigachad is another memecoin, while it ranks closer to 250 by market capitalization the token could extend its gains this cycle. GIGA is currently within the buy zone, under the 50% fib retracement at $0.042699.

GIGA’s cycle target is $0.121855 and resistance is $0.078100.

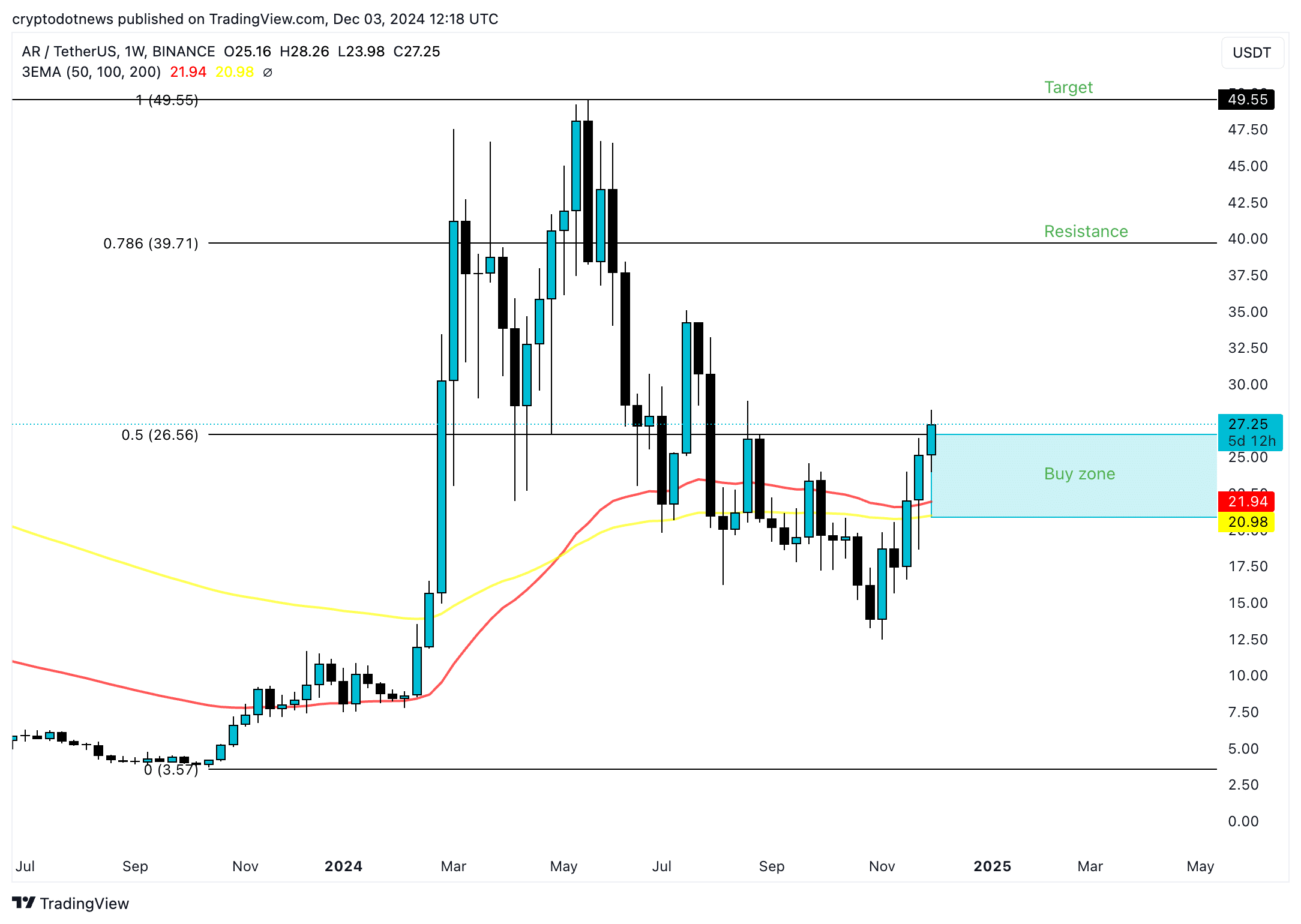

Arweave (AR)

Native token of a decentralized data storage protocol, related to both AI and DeFi narrative, AR’s buy zone is between 100-day EMA at $20.98 and 50% fib retracement of the rally to 2024 peak, at $49.55.

Strategic considerations and risk

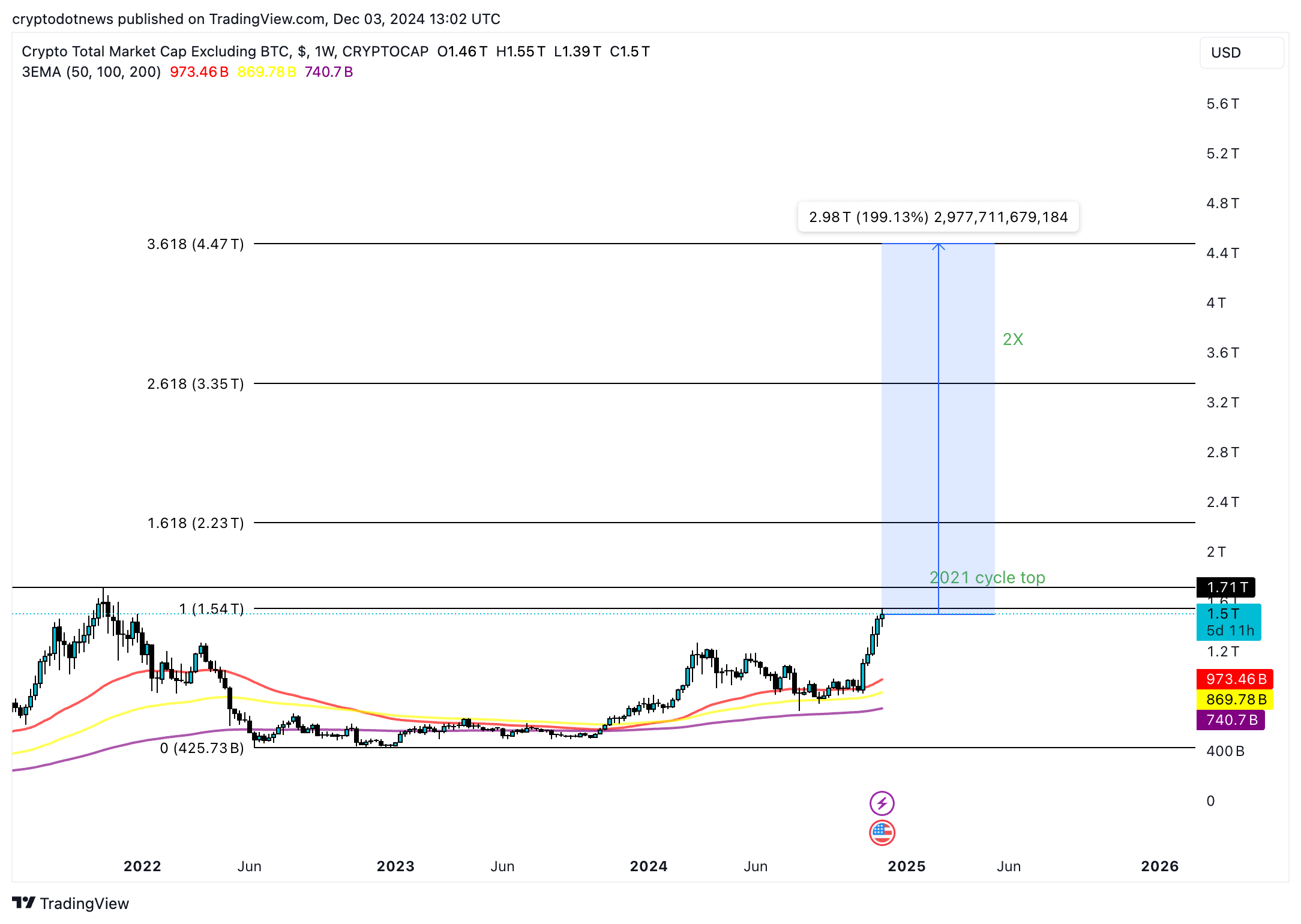

The total crypto market capitalization is a key metric used to determine what to expect from a portfolio that consists of the above 10 altcoins. Based on projections, the total market capitalization of crypto excluding Bitcoin could surge to $4.47 trillion.

An increase to the projected levels implies a likelihood of 2X gains in the portfolio with the top 10 altcoins listed above. Factors like duration of the altseason, Bitcoin’s performance, institutional investor interest and inflow of capital could influence the market cap.

Traders can expect between 2X and 3X gains this cycle, at the entry points marked in the weekly charts above.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.