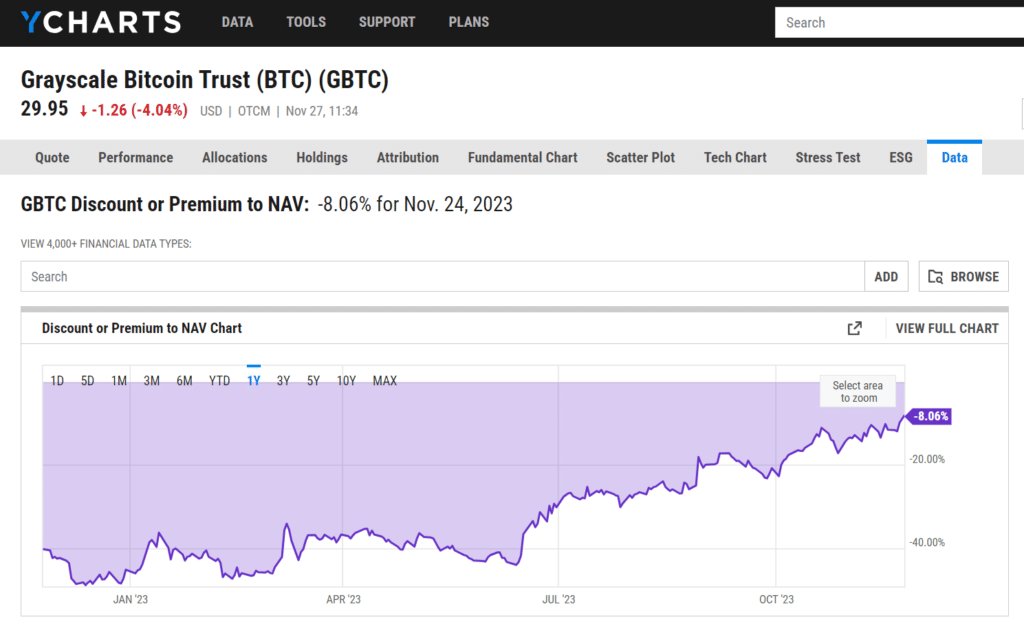

Bitcoin ETF desire narrows Grayscale GBTC discount to 8%

The discount on Grayscale’s Bitcoin Trust known as GBTC continued to shrink as of Nov. 27, likely due to mounting anticipation for a regulatory nod toward spot Bitcoin ETFs.

GBTC’s discount to net asset value (NAV) gradually fell to 8%, seemingly fueled by industry hype surrounding a raft of spot Bitcoin ETF filings from issuers like BlackRock and conviction from crypto proponents that the Securities and Exchange Commission (SEC) would soon approve such crypto-based financial products for the first time.

Discount to NAV is regarded as an important metric for determining the difference between a fund’s trading price and the value of its underlying asset, in this case, Bitcoin (BTC) which traded around $36,800 at press time, per CoinMarketCap.

The descent to these levels formed a new two-year low not seen since late 2021 when BTC and the broader crypto market raced to all-time highs at the time. Previously, the discount on Grayscale’s BTC fund had dropped to 15.8% by mid-October 2023.

Eric Balchunas, a Bloomberg ETF expert, said GBTC’s shrinking discount signals an accumulating narrative in favor of the SEC’s acceptance of a spot Bitcoin ETF.

$GBTC discount down to 8% in what is quickly becoming a Top 5 ETF chart of the year, not only is it visually stunning but it is a graphical representation of the slow-growing level of optimism over the past six months that a spot ETF will finally be approved.

Eric Balchunas via X

Although word from the SEC only disclosed a review of applications, issuers like Grayscale, ARK Invest, and WisdomTree to name a few, have filed amendments to their initial bids for a spot Bitcoin ETF.

Crypto proponents and ETF experts alike opined that the updated filings indicate constructive talks with the securities watchdog toward greenlighting products that could inject billions into Bitcoin.