Bitcoin ETFs on the horizon: SEC meetings could mean listings on major exchanges in Q2 2024

The U.S. Securities and Exchange Commission (SEC) may begin notifying the public of results of the spot Bitcoin (BTC) ETFs shortly.

According to a Jan. 3 report in Fox Business, sources familiar with the matter say the first announcement of the approval of spot Bitcoin ETFs could come on Jan. 5, with trading beginning as early as next week.

The news comes after an earlier Matrix report published on Jan. 2 predicted the SEC would deny applications. In their opinion, approvals will not happen until — at the earliest — Q2 of 2024.

According to the Fox Business report, however, analysts and ETF issuers remain confident that a favorable SEC decision will be made by Jan. 10, as the SEC continues to meet with key players on the issue.

Fox Business notes that the imminent approval of the ETF is also indicated by the fact that SEC lawyers from the Division of Trading and Markets met with representatives of the major exchanges – the New York Stock Exchange, Nasdaq, and the Chicago Board Options Exchange – on which the ETFs will be traded.

The meetings are seen as a positive sign that the SEC is moving closer to approving some or all of a dozen product applications from large money managers and crypto firms, anonymous sources at the firms said.

However, the fate of applications for spot Bitcoin ETFs is still unknown. For the past several weeks, speculation has been rampant that a spot Bitcoin ETF is imminent.

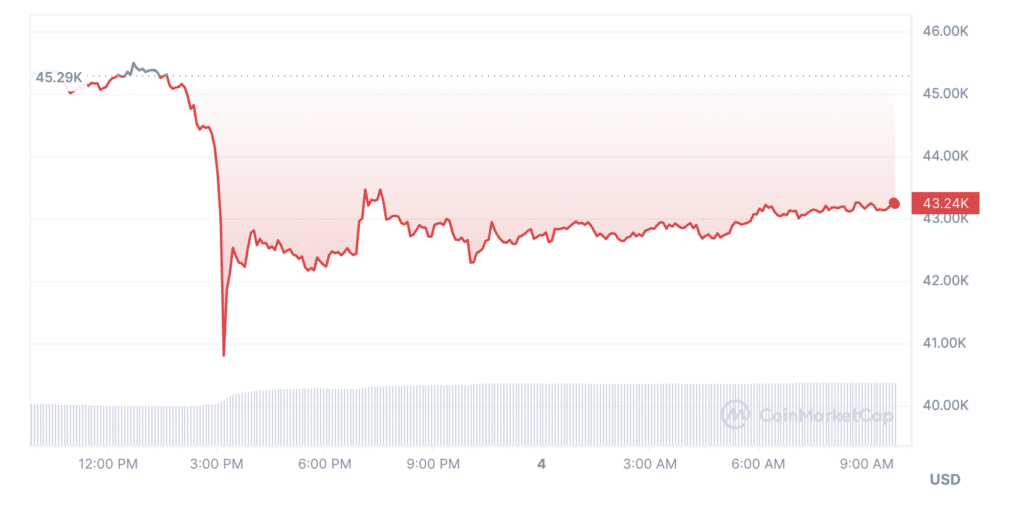

Against the backdrop of the Matrix report, the price of BTC fell by 4.5% to $43,240 at the time of writing. This happened shortly after Bitcoin broke through the $45,000 level, its highest since April 2022.

The entire crypto market also crashed 7% and lost nearly $1.7 trillion on the heels of the news that a spot Bitcoin ETF may be in doubt.